By the time the June issue of Cannabis Business Times hits mailboxes, Minnesota will likely be the 23rd state to legalize adult-use cannabis after both the state’s House and Senate approved the legislation. Gov. Tim Walz is expected to sign.

And at the end of April, a group of U.S. House lawmakers introduced the Secure and Fair Enforcement (SAFE) Banking Act of 2023—the eighth attempt to get the legislation passed.

These were two recent pieces of good news in what, so far, has been another very up and down year in the cannabis industry.

There was some excitement that voters in Oklahoma would approve cannabis for adults 21 and older, but that failed in March. So did a medical legalization attempt in Kansas.

But Delaware Gov. John Carney, who had previously vetoed an adult-use cannabis bill, said he would not block new legislation approved by the state’s general assembly. Missouri’s adult-use cannabis sales, which launched in February, were much stronger than anticipated, and the state is well on its way to hit $1 billion in sales this year. Maryland’s program is on schedule to roll out this July. There are 22 more licenses that will be awarded in Florida, which you can read more about in State Spotlight. The cannabis industry is growing. But perspectives on the health of the industry vary depending on who you ask, where they operate and what their business model is.

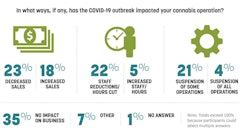

Anecdotally, during our conversations with teams at cannabis companies, many describe the industry like a roller coaster, especially since 2020. Demand was high during peak pandemic years, but wholesale and retail prices have fallen in many places. Price compression, oversupply, complicated regulations, competition from the illicit market, tax burdens and higher costs to produce due to inflation are just some of the challenges cannabis companies are wrestling with.

That reality is reflected in the feedback CBT received in this year’s “State of the Cannabis Cultivation Industry Report,” our annual opportunity to take a pulse of state-legal and Canadian cannabis markets, disparate as they may be. The results from the 2023 study were different from any other in the report’s seven-year history. Price compression was named the top business challenge for cultivators for the first time, and by 61% of participants, far more than the next top business hurdle noted, competition from the illicit market (28%). For the first time, more cultivators reported revenue decreases (34%) than increases (20%).

However, there were many positive takeaways, as well, illustrating how innovative the industry can be, even during the toughest times. In every category listed, the adoption of automation technology increased year over year. Median (the middle number in a data set) yearly cannabis sales were $477,000, up $240,000 from 2021. And the industry continues to grow—participants without businesses now indicated they have plans for retail (52%), cultivation (46%) or processing (35%) in the next 18 months. Anecdotally, we’re hearing that demand in many places is still strong.

During a conversation with Senior Digital Editor Melissa Schiller, founder and CEO of vertically integrated Giving Tree Dispensary Lilach Mazor Power said her Arizona-based business is not immune to price compression and regulatory challenges affecting other cannabis companies. But there are many things that give her hope.

“We are growing year over year. Our adult-use market is still in its infancy—we are seeing more adults being open to [trying] cannabis,” she says. “There’s enormous potential here!”