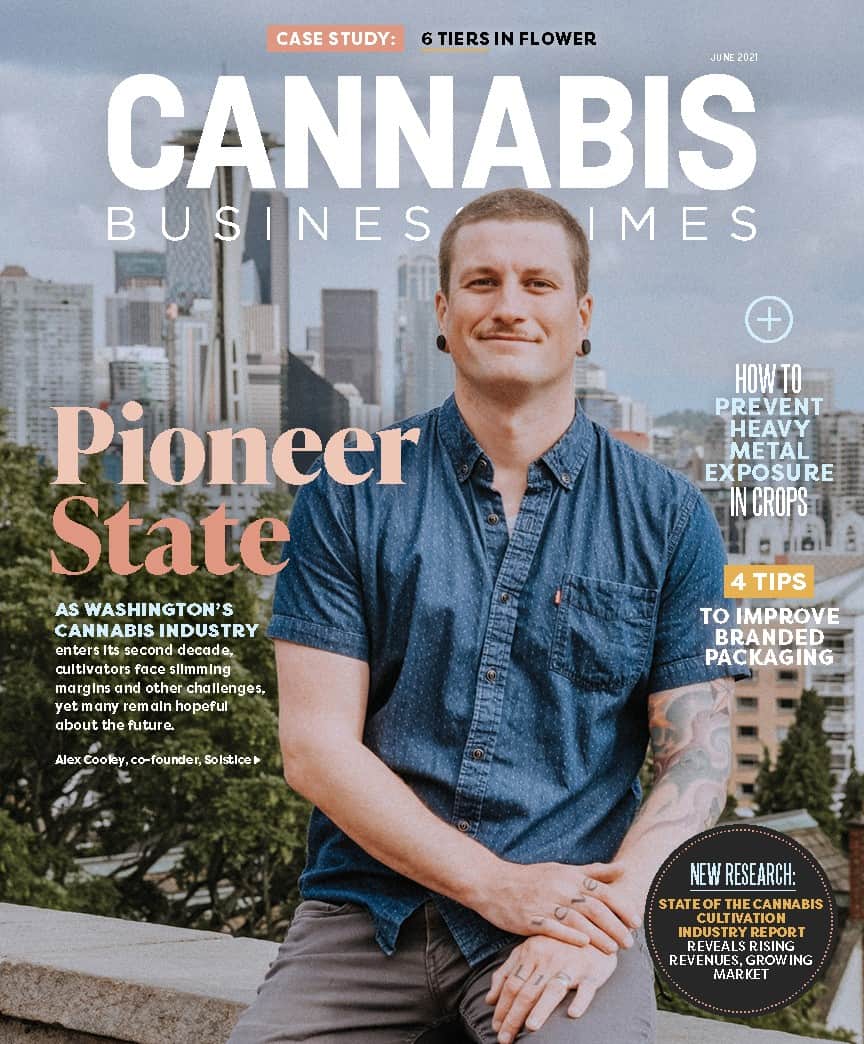

Every year, Cannabis Business Times asks readers to share business and cultivation data to gain a better understanding of how the cultivation market is navigating the creation of a new industry. And every year, readers offer fresh insights that the CBT team delivers in its annual “State of the Cannabis Cultivation Industry Report.”

Now in its sixth iteration, this year’s “State of the Cannabis Cultivation Industry Report” grew its focus as the industry continues to morph into its next phase. Extraction capabilities are an expanded focus in this year’s research as more cultivators bring extraction and processing equipment in-house, perhaps to streamline operations and create value-added products.

More than a quarter (28%) of this year’s research participants who currently cultivate also indicated they process and/or extract cannabis. Additionally, nearly 1 in 10 (8%) of current cultivators indicated having plans to add extraction/processing capabilities within the next 18 months. How they are extracting and at what volume are more deeply explored in the report.

This year’s research report also is filled with updated business health and cultivation trends. Overall, the data presented in these pages indicates the cannabis industry continued its growth in 2020: 44% of cannabis cultivators are newcomers who indicated they cannot compare growth as they have not been in operation for two years. Those who have been in operation for two years or more generally faired well despite an economy that struggled. During the most recently completed fiscal year, 31% of research participants indicated an increase in revenue, with only 5% noting a drop in revenue. More details about revenue and profit changes during the past six years can be found starting on page S4.

Notably, the portion of growers who indicated cultivating indoors ballooned to levels not seen since the first year of the report. While data pointed to a steady decline in indoor cultivation facilities from 2016 to 2020, 80% of 2021 research participants indicated cultivating indoors, a 20-percentage-point jump compared to last year’s report. Meanwhile, 35% reported they cultivated outdoors, and 30% noted they grow in covered or semi-covered greenhouses. Where these growers plan to expand in the coming years also is included in this report.

Participants in this year’s research also noted smaller canopy sizes: the average canopy size in 2021 was 33,900 square feet, down from 36,300 square feet in last year’s report. The gap between very large cultivators (80,000 square feet or more of canopy) and small cultivators (less than 5,000 square feet of canopy) also is widening: 18% of this year’s respondents indicated cultivating more than 80,000 square feet of canopy (up from 7% in 2016), while 39% indicated growing less than 5,000 square feet of canopy (up 5% from 2016).

This report, made possible with the support of Prospiant and based on a study conducted by third-party researcher Readex Research, contains industry cultivation trends to help cultivators make more informed decisions about their businesses. CBT looks forward to continuing to serve the industry by offering data-backed, actionable information.

Explore the June 2021 Issue

Check out more from this issue and find you next story to read.

Latest from Cannabis Business Times

- South Dakota Group Submits 29K Signatures for 2024 Adult-Use Cannabis Legalization Measure

- Rescheduling Would Have Saved Verano $80M in 2023 Tax Payments, CEO Says

- Aurora Marks 1st Medical Cannabis Shipment to New Zealand Market

- Where All 100 US Senators Stand on SAFER Banking Act

- Blumenauer Unveils Legislative Blueprint, Additional Administrative Action Needed Following Rescheduling

- Cannabis Rescheduling FAQ: What Now?

- From Custodian to Cultivation Supervisor

- California City in Cannabis Retail Desert Welcomes 1st Dispensary