For most of their lives, baby boomers were the largest generation in U.S. history.

Though they’ve been eclipsed by millennials, they still comprise nearly 25% of the nation’s population—and a big segment of a dispensary’s potential customer base.

Born between 1946 and 1964 and weaned on Woodstock and Watergate, boomers turn 55 to 73 years old in 2019. Depending on a person’s perspective, that may sound ancient or young and may influence whether dispensary sales are lost or won.

The following insights shine a light on common misconceptions about boomers and what makes them unique. Understanding this demographic can help dispensaries provide the service and products boomers have come to expect.

1. Boomers aren’t disinterested bystanders.

Jennifer Culpepper, founder and creative director of cannabis branding agency Brand Joint, believes that baby boomers are one of the industry’s most underserved markets. “Sometimes people assume that because someone is older they’re not going to be interested in cannabis,” Culpepper says. “They actually seem to be among the most interested because they’re facing different ailments that cannabis can really help.”

Consumer behavior in fully legal states provides a glimpse into boomer attitudes. Jessica Lukas, vice president of consumer insights for BDS Analytics, a cannabis market intelligence and consumer research company, puts it in perspective: 30% of cannabis consumers in fully legal states are 55 or older.

People in this age group are likely drawn to cannabis because they believe it offers health and wellness benefits, Lukas says. According to BDS research, 90% of boomers who consume cannabis believe it relieves pain, and another 90% strongly believe it has medical benefits. Boomers also have a highly favorable opinion of cannabis if it can help a sick loved one, with 97% supporting its use in such cases.

2. Boomers consume for more than aches and pains.

Belief in cannabis health benefits doesn’t mean that pleasure takes a back seat. While 64% of cannabis-consuming boomers consume for health or medical reasons, 60% also purchase it for recreational and social benefits, Lukas says.

In addition, boomers are less likely than younger consumers to use or prefer inhalables but still use them. “It actually starts in the data to look a little bit like a nostalgic form of consumption,” Lukas explains.

Edibles and topicals are boomer go-tos when it comes to relieving pain, improving sleep or avoiding prescription medications. But they prefer inhalables for recreational and social use, Lukas says. “And boomers, more so than other generations, are willing to tell us they consume inhalables to have fun, be happy and get high or stoned,” she adds.

3. Boomers expect personalized, professional, trustworthy service.

Boomers grew up being catered to, earning them the nickname the "me generation.” They expect sellers to understand. Jennifer McLaughlin, vice president of merchandising for multistate cannabis operator Calyx Peak Companies, speaks from 20 years of retail experience as an apparel executive. “Customer service is everything to the baby boomer. They grew up in brick and mortar,” she explains.

“Hands-on communication and interaction with people working in dispensaries is mission critical. Boomers need to be able to ask questions and get the help that they want,” McLaughlin says. She suggests creating an inviting, inclusive, customized dispensary experience where customers can sit with budtenders one-on-one.

BDS research shows the No. 1 driver for how boomers choose their dispensary is a trustworthy and professional staff. “Those two things trump price and they trump location for this group of consumers,” Lukas says. “They’re willing to drive out of the way to go to a place that offers them that … trusted experience.”

“Sometimes people assume that because someone is older they’re not going to be interested in cannabis. They actually seem to be among the most interested because they’re facing different ailments that cannabis can really help.” Jennifer Culpepper, founder and creative director, Brand Joint

4. Boomers look to the cannabis industry to educate them.

“In trying to market to boomers, education is probably going to be one of your best tools,” Culpepper says. “They’re familiar with cannabis in another generation of it, so many aren’t familiar with all the new ways of consumption and new types of products.”

Barriers, such as getting a medical card, amplify the importance of educating boomers via electronic avenues. “They are responsive to email, and they are on Facebook, too,” Culpepper explains. Education-related social media can be valuable when targeting this group.

For boomers who shop dispensaries, 60% name budtenders as their main information source, according to BDS. Also, 40% rely on cannabis websites, and 25% read cannabis-related publications to obtain information. “Boomers are more likely to get info from these sources than by talking with a doctor or going to health publications or websites,” Lukas shares.

McLaughlin emphasizes the power of engaging with boomers one-on-one, asking if it’s their first visit or how they’re feeling about the experience. This gives them the OK to seek answers and education they need. “When a customer gets confused, they freeze. They don’t buy,” she says. “That’s pretty important as it relates to this generation.”

5. Boomer consumption preferences offer sales opportunities.

Nearly half of boomers prefer inhalables, while 31% prefer edibles and 20% indicate topicals are their preferred consumption methods, according to BDS data. But a substantial amount of cross consumption occurs. For example, among boomers who prefer inhalables, 35% still consume edibles, and 16% use topicals. That presents a big opportunity to upsell.

Not everyone is open to trying different product forms, but numbers suggest vape-loving boomers may go for edibles and topicals, too—if dispensaries elevate service and sales pitches to explain how an edible or topical, for example, might complement a boomer’s vape use.

“Educating consumers on product forms and methods and how they can be used together is a great way to see growth in a single store, among your current shopper base,” Lukas says.

Stay tuned for part two of this series, which will take a closer look at Generation X.

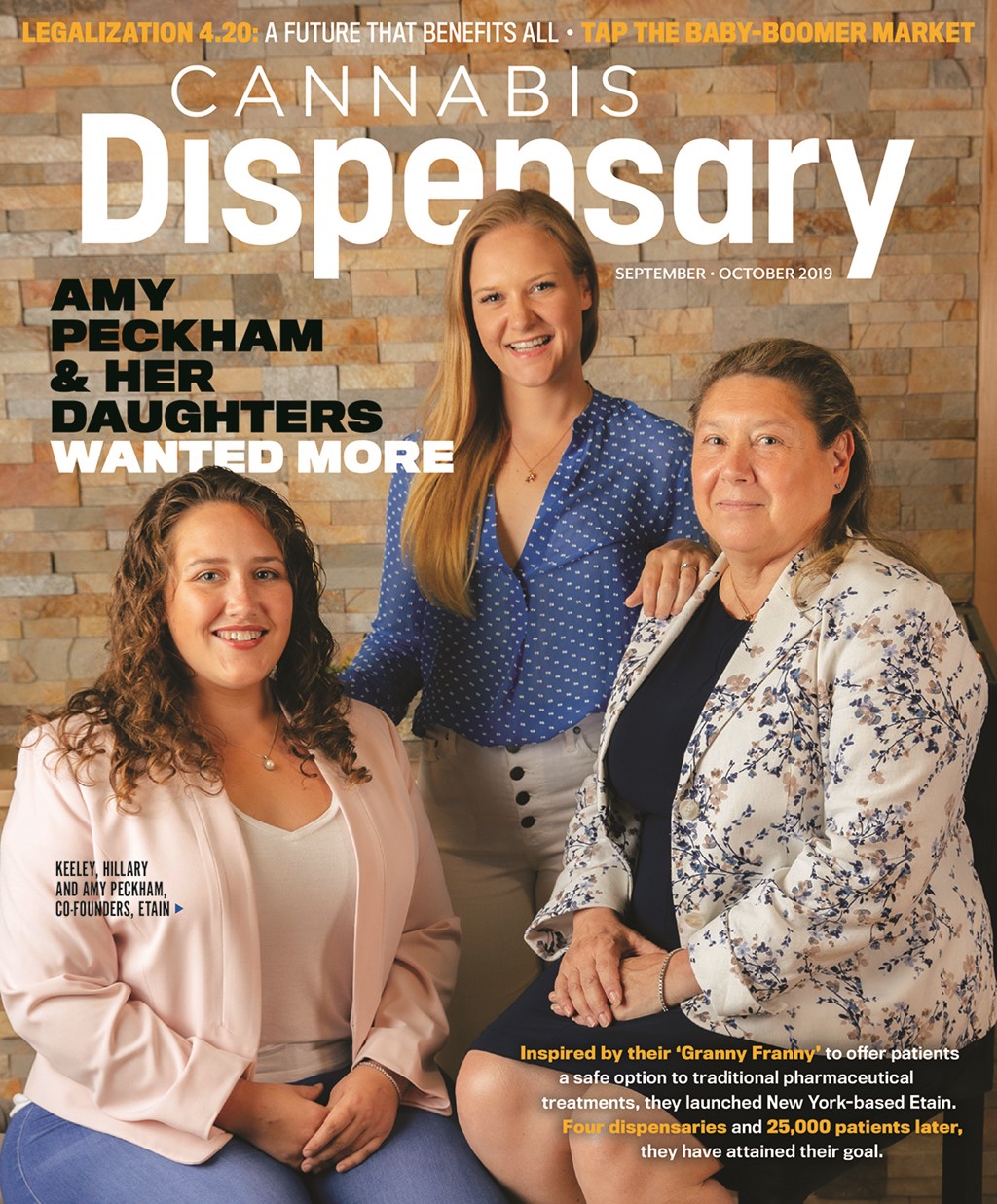

Explore the October 2019 Issue

Check out more from this issue and find you next story to read.

Latest from Cannabis Business Times

- Cannabis Rescheduling: Where Do We Go From Here?

- Verano Opens MÜV Haines City, Company’s 75th Florida Dispensary

- Ascend Wellness Holdings Reports $142.4M Net Revenue for Q1 2024

- Trulieve Reports $298M in Revenue for 1st Quarter 2024

- SNDL Reports 1st Quarter 2024 Financial, Operational Results

- Leading Cannabis Brand STIIIZY Expands Retail Presence With Fresno Location Opening Saturday, May 11

- The Cannabist Co. Reports 1st Quarter 2024 Results

- Green Thumb Reports $276M Revenue for 1st Quarter 2024