West Coast wildfires in 2020 have killed at least 40 people, burned over 5 million acres of land and leveled more than 7,000 buildings, according to The New York Times. Fatalities from the smoke number in the thousands, the Associated Press reports.

Cannabis industry entrepreneurs’ and workers’ livelihoods have not been spared, with blazes reaching hemp farms and state-legal cannabis grows and dispensaries in California, Washington and Oregon. And when wildfires surround a grow—even if they’re miles away—smoke, soot and ash can mar product quality.

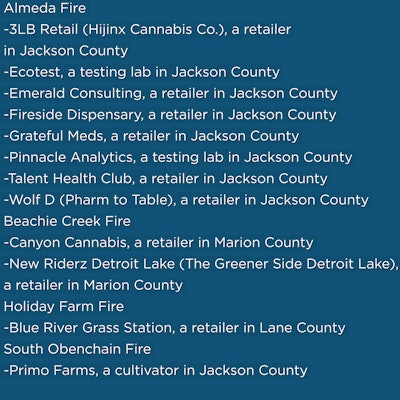

The Oregon Liquor Control Commission (OLCC) has been monitoring the ongoing crisis in that state. Mark Pettinger, spokesman for the OLCC, told Cannabis Business Times and Cannabis Dispensary that as of Sept. 29, the agency has confirmed that four fires have destroyed 12 Oregon businesses. Those are:

On Sept. 15, fire officials said the Almeda Fire had been completely contained, according to The Oregonian. The South Obenchain Fire was 96% contained as of Sept. 29, per KMVU Fox 26 Medford.

On Sept. 28, Oregon Public Broadcasting (OPB) stated, “The Beachie Creek, Archie Creek, and Holiday Farm fires are all over 55% contained, and almost all of the uncontained areas are far away from where people live. The Riverside Fire remains just 37% contained, but officials say there’s little chance the fire will grow in the next few days.”

OPB also reported that fire officials have seen hotspots from the Slater Fire, which is active in Oregon and California, diminish.

The OLCC estimates 20 licensees, including the 12 that experienced a “total loss,” are in wildfire burn zones, based on the fire zones during the fires’ height, Pettinger said. Eight are cultivators, one is a testing lab and the rest, including retailers, are in an “other” category.

Out of 64 businesses that responded to the OLCC’s Wildfire Impact Study that it sent out Sept. 17, 34 said they were given Level 3 evacuation orders (“go”), five were given Level 2 orders (“be set”) and another five were given Level 1 orders (“be ready”).

Seven companies who responded to the survey said they suffered a complete crop loss, 12 experienced partial losses or damage, and 15 didn’t know if their crops were lost or damaged, or if so, by how much.

Six licensees temporarily transferred product to another business, three of which have received that product back, according to the OLCC.