It’s been five years since the Agriculture Improvement Act of 2018 (the 2018 Farm Bill) was enacted, which legalized hemp at the federal level.

The farm bill expires every five years and “goes through an extensive process where it is proposed, debated, and passed by Congress and is then signed into law by the president,” according to the National Sustainable Agriculture Coalition.

With the 2018 Farm Bill set to expire this year, Cannabis Business Times reached out to hemp industry stakeholders to discuss what reforms they are advocating for in the 2023 Farm Bill to address pain points and benefit the hemp industry.

Changing Hemp’s THC Limit From 0.3% to 1%

The 2018 Farm Bill defines industrial hemp as any derivative of the Cannabis sativa L. plant that contains less than 0.3% delta-9 THC on a dry-weight basis, CBT previously reported.

Rick Fox, the National Industrial Hemp Council’s (NIHC) Government Affairs Committee co-chair, says this definition has caused challenges for hemp growers.

“Unlike processors who are formulating final products for market, growers don’t have control over such [a] minuscule amount of THC," Fox says. "THC, like the other compounds in the plant, can fluctuate a bit based on weather and stress."

As these conditions can cause the THC levels to fluctuate in the plant, this causes a challenge for farmers as they may not know whether they are growing legal or illegal hemp until harvest.

"That said, over the years, varieties of hemp have been grown to produce CBD primarily. They've been bred for decades now to be very low in THC, but the 0.3 [percentage] puts a fine pin on it," Fox says.

"So, this has been a huge risk factor for a lot of the bigger farm companies. Also, this has caused problems with getting banking services, just like our cousins on the high-THC side, because [most people are] scared of dealing with a controlled substance,” Fox says. “So, stakeholders throughout the industry and many regulators ... have been recommending this for a couple of years now, to change that threshold to 1%."

Erica Stark, executive director of the National Hemp Association (NHA), also told CBT that she anticipates a big push to raise the THC limit for hemp to 1% in the 2023 Farm Bill.

"That's certainly important for a whole lot of people to alleviate some of the pressures that cultivators have because the reality is that it is the end products that are going to consumers–that really needs to be the focus of compliance testing, not so much what's happening on the farm," Stark says.

Distinct Industrial Hemp from Floral and Cannabinoid Hemp

Stark says the NHA hopes to see the 2023 Farm Bill include a sub-definition of industrial hemp grown explicitly for grain and fiber—creating distinctions in regulations for grain and fiber hemp versus cannabinoid and floral hemp.

"I think we kind of—at least I very naively thought that once the 2018 Farm Bill passed, everything was going to be roses and clear sailing, and that just has not proven to be true. We're still seeing issues with banking, transportation, and things that are now federally legal," Stark says. "There's still so much confusion surrounding the industry. So, even companies who are dealing strictly with fiber, making paper or nonwoven products, are still having trouble with banking and transportation because that confusion is still there between these two crops.”

Stark adds that the language would simplify regulations for fiber and grain cultivators.

“So, if your intended purpose is only to grow for grain or fiber, you would be exempted from the background checks, and you would also be exempted from compliance testing,” Stark says. “You would only be subject to a visual inspection to make sure that you are cultivating in accordance with your designation on your application.

“If you’ve seen fiber and grain crops, and you’ve seen cannabinoid fields, you know that within two seconds of looking at those fields, it’s pretty evident what was being cultivated and for what purpose. So, if you grow your hemp in a traditional row crop environment, then you’re growing for fiber and grain. …. So, it wouldn’t eliminate all inspection; there would be a required visual inspection to ensure that you are planting in a row crop environment.”

RELATED: Question: Will the FDA Take Steps to Regulate CBD This Year? Answer: Well… Maybe.

Stark says for growers who operate a “dual/tri-purpose model,” where they extract cannabinoids from fiber and grain, this language would still allow them to do that; however, they would have to conduct that under the cannabinoid regulations.

“We’re not impacting negatively at all what happens on the cannabinoid side; we’re just making it easier for those traditional farmers cultivating solely for fiber and grain,” Stark says.

“If for some reason the visual inspection should fail, or it’s questionable, … you would be able to submit backup documentation, like the genetics that you purchased, the planting report that you’re required to submit to FSA [Farm Service Agency], and those things would help substantiate what your actual intent is.

“When you look at what the current rules are through USDA for the final rule, if your crop goes hot, your remediation option is to just sell the stock and the grain. So, if that’s what you’re going to do intentionally in the first place, what is the point of going through the time and the expense of compliance testing?”

Geoff Whaling, chair of NHA, says that in listening to constituents and farmers, many have voiced these challenges as to why they haven’t added hemp into their crop cycles.

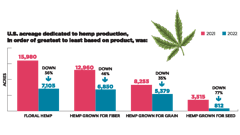

“To get farmers to adopt this crop, we need to make it as easy for them as possible,” Whaling says. “The other thing to take into account is that USDA themselves have helped us delineate the difference between cannabinoid floral and fiber and grain hemp in their very first report issued on the industry after the passage of the 2018 Farm Bill. That’s exactly what they did: they reported on cannabinoid floral growth and harvest versus fiber and grain, so this is just a natural evolution of what’s happening with this crop.”

Separately Define Processed Materials

“In the process of manufacturing CBD consumer products, you can’t find the most cost-effective way unless you’re making concentrates as an intermediate step and those concentrates are going to be above 0.3%, usually above 1%,” Fox says.

These products are then diluted to produce compliant CBD products that are suitable for the market.

“So, the products that people buy off the shelf remain not more than 0.3% delta-9 THC. It’s just that intermediate step,” Fox says. “So, another major pain point is to address this in law and make a special definition for these in-process materials. The proposal has generally allowed in-process materials to exceed this threshold, as long as they are not offered for sale, and only among those with a hemp license.”

Jonathan Miller, president of theUS Hemp Roundtable (USHR), told CBT that he also hopes this pain point gets addressed in the 2023 Farm Bill because, from a technical standpoint, as the THC levels spike during the manufacturing process, those products would be considered a “controlled substance.”

“We want to make sure that, as long as the products being sold to retailers are non-intoxicating, no one would be committing a crime by simply processing hemp into CBD or another product,” Miller says.

Remove the DEA-Registered Lab Testing Requirement

Following the passage of the 2018 Farm Bill, the USDA released an Interim Final Rule (IFR) in October 2019 to address issues under the farm bill, which included clarifying that all hemp testing laboratories must be certified by the Drug Enforcement Administration (DEA).

Since then, the USDA has extended its deadline for hemp testing at DEA-certified labs several times, including recently, when it expanded the deadline another year, until Dec. 31, 2023, CBT previously reported.

Miller says the USHR wants to see the DEA-certified hemp testing lab requirements be removed in the 2023 Farm Bill.

“It doesn’t need to be DEA-registered to measure THC. There’s plenty of other internationally certified labs that can handle that,” Miller says.

Miller also noted that there is an insufficient number of DEA-registered testing facilities. For example, he says there are no DEA-registered labs in Maine. Growers would have to travel to nearby states with DEA-registered labs, such as New Hampshire or Massachusetts, for testing.

Larry Farnsworth, senior vice president of marketing and communications at NIHC, says the NIHC spoke with individuals from state hemp programs across 26 states to gather feedback on the most significant issues they were facing. The majority said their biggest concern is the lack of DEA-certified labs and that it could back up farmers’ ability to grow and produce and essentially create a “bottleneck.”

“The USDA recognizes that [DEA-certified labs] are not really a doable option at this point, so they use their enforcement discretion to let it ride a little longer,” Fox says. “I can’t speak for the USDA, but I think, from the outside, the hope is that Congress will make this clear. And this is, I think, one of those really big banners over our interests in the farm bills treatment of hemp is that not only the industry, but also USDA, needs clearer direction.”

Provide Clarity on Hemp-Derived Cannabinoids like Delta-8 THC

Over the last couple of years, hemp-derived cannabinoids like delta-8 THC, delta-10, THC-O acetate and more, have continued to increase in popularity.

The legal status surrounding these cannabinoids, which many have deemed as “intoxicating,” remains unclear—an issue many in the industry hope to see addressed in the next farm bill.

Fox says the NIHC is not only advocating to raise the THC threshold from 0.3% to 1% for just hemp, but rather broadening that threshold to cover all cannabinoids.

“So, instead of 0.3% delta-9, what we and many other stakeholders are advocating for is 1% total concentration of all," Fox says. "That's a really important nuance to capture because it's not just like we're asking for more. You need to put some other things in place if you really want to meet the objectives for public health and consumer safety."

Miller says the USHR is advocating for more scientific research regarding these products and their effects.

"What we're proposing as a federal commission is that we bring together the industry, law enforcement, and federal agencies to come up with standards for products that would treat intoxicating products differently from non-intoxicating products."