Green Thumb Industries CEO Ben Kovler took a swing at the federal government during the company’s third quarter earnings call Nov. 8, the same day that a new poll showed a record number of Americans in support of cannabis legalization.

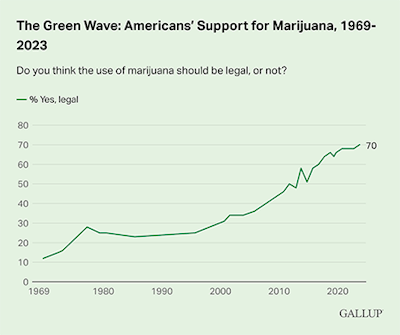

Seventy percent of U.S. adults now favor federal cannabis reform, up 2% from a three-year flatline, according to a Gallup poll conducted Oct. 2-23. This compares to 15% of Americans who supported cannabis legalization in 1971, when the Controlled Substances Act, which classifies cannabis as a Schedule I drug, went into effect.

Notably, Gallup pollsters reported that majority support for cannabis legalization in 2023 is found among all major subgroups, including by age, race, political party and ideology. And the pollsters found no difference in support for legalization between residents living in states where adult-use cannabis is legal versus those living in states where it’s not.

Yet the nation’s broad consensus on cannabis legalization comes at a time when the federal government continues to retain outdated laws that no longer align with the beliefs of its citizens. Kovler called this fact out during Green Thumb’s earnings call on Wednesday.

“Just today, Gallup released a new poll showing a record 70 percent of U.S. adults believe marijuana should be legal,” he said. “With Ohio legalizing yesterday, more than 50 percent of the U.S. population lives in a state with adult-use cannabis, yet it remains a Schedule I narcotic in the eyes of Uncle Sam.”

From a federal perspective, Kovler said, “It is impossible to predict whether we’ll get regulatory change from SAFER Banking, rescheduling of cannabis, a potential [Merrick] Garland memo or something else, and if so, what the timing might be.”

The unknown timing of federal reform in particular makes it all the more difficult for multistate cannabis operators abiding by the scattered patchwork of state-by-state regulations to plan for what the future of the industry may hold.

Kovler said he believes this change will come eventually and that Green Thumb will be well-positioned.

“Regardless of what happens, we’ll continue to build our business by focusing on our long-term strategy, creating brands and products that resonate with the consumer, remaining disciplined with our capital allocation, and driving growth that generates cash flow regarding the cannabis industry and the economy,” he said. “Nothing has structurally changed since the last quarter.”

While the nuts and bolts of the company remained intact for the third quarter, the Chicago-based multistate operator reported a record $275.4 million in revenue, up 5.4% from the prior year period, with the increase primarily driven by retail and consumer packaged goods sales in Maryland. The company had a generally accepted accounting principles (GAAP) net income of $11 million, or $0.05 per basic and diluted share, for the third quarter.

Maryland is the latest state to launch commercial adult-use sales with the retail market commencing July 1 via existing medical operators like Green Thumb.

RELATED: Cannabis MSOs Jumping Up, Down for Maryland’s Adult-Use Launch

In the first four months following that launch, Maryland’s dispensaries sold nearly $360 million in adult-use and medical cannabis, or roughly $90 million per month, according to the Maryland Cannabis Administration. That’s a nearly $1.1 billion annual run rate.

Green Thumb has the state maximum of four dispensaries in Maryland. Kovler called the state’s adult-use market a “great start” during Wednesday’s earnings call with investors.

“We’re very bullish on Maryland,” he said. “We remain optimistic on what’s going on in Maryland. The team there continues to really kill it. They’re grinding it out and it’s showing up, and we can take that playbook, and we know what consumers want, and we can continue to deliver on that across the country, because that’s where we’ve been focused. It’s really the same script over and over for us in order to drive those gains.”

With that respect, Kovler said he has September 2024 marked on his calendar for a possible launch of adult-use sales in Ohio.

He also said Green Thumb is also looking ahead to Minnesota, where adult-use sales could launch in early 2025, as well as potential expansion in Virginia, where Democrats just took back a majority in the House and retained it in the Senate, and Florida, where the Supreme Court is currently considering an adult-use ballot measure’s validity for 2024. Pennsylvania is also on the company’s radar for potential adult-use reform, Kovler said.

“All of this long-term planning was focused on driving one outcome: organic growth that generates cash flow,” he said. “And because we’ve been successful at executing this model, we have sufficient cash flow to continue investing in the business and pay our heavy tax burden without taking on additional debt or diluting our shareholders with an equity raise.”

Green Thumb’s third-quarter cash flow from operations was $61 million, bringing the year-to-date total to $154 million. The company’s cash at quarter end totaled $137 million.

Taking that into consideration, Kovler said, Green Thumb’s board of directors authorized a share repurchase of up to $50 million, with the company spending $25 million of that amount in September.

“Going forward, we have the flexibility to use our cash reserves to repurchase more shares, or on debt refinancing, strategic M&A or investments in the business, as opportunities present themselves,” he said.

Kovler added that Green thumb remains in a solid financial position, “mainly due to our intense focus on capital allocation and being fiscally responsible with the dollars."