Cannabis excise taxes are far from standardized throughout the U.S., where myriad state-by-state structures often provide for chaotic taxing landscapes.

For instance, some states levy a weight-based cultivation tax, such as Alaska, where a $50-per-ounce excise tax (or $800 per pound) is applied on flower from cultivation to retail. This means as the price of flower fluctuates, so does the tax percentage paid on that flower.

Other states levy a THC tax that varies for different products, such as New York, where a $0.03-per-milligram distribution tax is applied on edibles, as well as $0.008 on concentrates and $0.005 on flower. This is in addition to the state’s 13% excise tax at retail.

And then there is a wide range of excise tax rates levied on retail sales, from 37% in Washington’s adult-use market to 6% in Missouri. Washington legalized adult-use cannabis in 2012, a decade before Missouri.

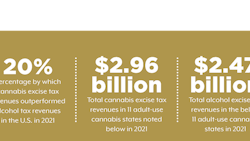

While cannabis excise tax revenues outperform alcohol in several state markets, a well-designed cannabis tax structure plays a significant role in each state’s respective priorities for a regulated industry. And the successes of these cannabis excise taxes are measured in varying regards:

- How much revenue does the tax provide?

- Where is this revenue allocated?

- What’s the cannabis tax revenue’s percentage of the state’s total tax revenue?

- Does the excise tax rate effectively allow licensed operators to eradicate the unregulated market?

These questions are often weighed by state lawmakers who debate legalization bills in their legislatures, where some politicians still aim to treat the industry as a cash cow for their preferred coffers—whether that be for education, law enforcement or other government funded programs.

Meanwhile, others argue that the safety of tested and regulated cannabis products should outweigh the tax benefits of legalizing the plant: Providing adult access to cannabis that is free of potentially harmful contaminants is a primary goal often mentioned by lawmakers supporting reform as well as legalization proponents pushing forward ballot initiatives.

And in recent years, excise tax rates enacted by states that have legalized adult-use cannabis have trended downward with Missouri (6%), Maryland (9%), Delaware (15%) Minnesota (10%) and Ohio (10%) when compared to the excise tax rates of legalization pioneers like Washington, Alaska, and Colorado, which levies a 15% wholesale tax and 15% retail tax.

Still, cannabis excise tax revenues make up a very small percentage of a state’s total tax revenue, according to data from the U.S. Census Bureau that features estimates for states that levy this tax.

Below, Cannabis Business Times provides a breakdown of the U.S. Census Bureau’s data for 23 states and Washington, D.C., which combined for roughly $2.9 billion in cannabis excise tax collections for 2023.

This list includes 18 adult-use states and six medical-only cannabis programs that incorporate an excise tax structure.

Editor’s note: The U.S. Census Bureau considers this information “new experimental data” featuring estimates of state and local tax revenues for cannabis sales. Some of these numbers may differ from data provided by various state agencies. New Jersey and Maryland—both adult-use states—had incomplete data for this report. The sale of medical cannabis in most states is not subject to excise taxation.

Rank | State | 2023 Cannabis Excise Tax Revenue | Percent of Total State Tax Revenue | Excise Tax Structure |

| 1 | Alaska | $28.3 million | 1.34% | $50 per ounce (flower) |

| 2 | Colorado | $263 million | 1.33% | 15% (retail); 15% (wholesale) |

| 3 | Washington | $460.3 million | 1.23% | 37% (retail) |

| 4 | Montana | $49.4 million | 1.05% | 20% (retail) |

5 | Nevada | $121.5 million | 0.99% | 10% (retail); 15% (wholesale) |

| 6 | Oregon | $169.4 million | 0.88% | 17% (retail) |

| 7 | Arizona | $176.2 million | 0.78% | 16% (retail) |

| 8 | Michigan | $270.4 million | 0.70% | 10% (retail) |

| 9 | Maine | $33.8 million | 0.51% | 10% (retail); $335/pound (flower) |

| 10 | Illinois | $278.2 million | 0.44% | 7% (wholesale); 10% (<35% THC); 25% (>35% THC); 20% (infused prods.) |

| 11 | Massachusetts | $168.1 million | 0.41% | 10.75% (retail) |

| 12 | *Oklahoma | $51 million | 0.39% | 7% (retail) |

| 13 | Missouri | $67.4 million | 0.39% | 6% (retail) |

| 14 | New Mexico | $45.3 million | 0.32% | 12% (retail) |

| 15 | Vermont | $13.9 million | 0.31% | 14% (retail) |

| 16 | California | $567.4 million | 0.24% | 15% (retail) |

| 17 | *Arkansas | $15.1 million | 0.12 | 4% (retail) |

| 18 | Rhode Island | $5.2 million | 0.11% | 10% (retail) |

19 | Connecticut | $17.3 million | 0.08% | Per Milligram THC: $0.00625 (flower); $0.00275 (edibles); $0.009 (other) |

| 20 | *Pennsylvania | $33.7 million | 0.06% | 5% (wholesale) |

21 | New York | $33.5 million | 0.03% | Per Milligram THC: $0.03 (edibles); $0.005 (flower); $0.008 (concentrate). 13% (retail) |

| 22 | *Washington, D.C. | $1.97 million | 0.02% | 6% (retail) |

| 23 | *Mississippi | $1.03 million | 0.01% | 5% (retail) |

| 24 | *Louisiana | $993,000 | 0.006% | $3.5 per gram (flower) |

| *Medical-only cannabis retail markets | ||||