With some of the more mature U.S. cannabis markets shrinking on the retail sales front in 2022 for the first time since legalization, momentum behind the green wave may appear to be slowing down.

Specifically, California (-7%), Colorado (-21%), Nevada (-15%), Oregon (-16%) and Washington (-12%) all faced unprecedented cannabis retail trends in 2022, with year-over-year cannabis sales taking major dips in those five states.

And strategic movements by some of the largest cannabis companies in the world reflected those downturns. In January, multistate operator (MSO) Curaleaf announced it was closing the majority of its operations in California, Colorado and Oregon in an optimization effort to reduce costs and streamline its business.

“We believe these states will represent opportunities in the future, but the current price compression caused by a lack of meaningful enforcement of the illicit market prevents us from generating an acceptable return on our investments,” CEO Matt Darin said at the time. Darin added that the market exits would allow Curaleaf to devote greater resources to tangible growth opportunities in “emerging” markets.

Trulieve, which leads the world with nearly 200 dispensaries in the U.S., announced last month that it would be closing its third retail location in California and exiting the Massachusetts market entirely, including shutting down three dispensaries and a cultivation and processing facility. CEO Kim Rivers said the decision would allow the company to focus on its business strategy of “going deep in our core markets.”

Columbia Care and Cresco announced in November a $185-million selloff of assets in New York, Illinois and Massachusetts as part of the necessary divestitures required in a definitive merger agreement between the two companies. That decision was connected to their overlapping footprints.

With these business moves by major players grabbing the headlines, it’s easy to focus on certain trends in struggling markets. And the industry as a whole has faced a major test of perseverance through myriad trials and tribulations associated with economic and regulatory variables throughout the past 12 to 18 months.

But the green wave is not rolling back in the U.S.

Cannabis reform remains contagious, and legalization is still building—just in different regions throughout the nation.

Notably, nine states have launched adult-use cannabis sales since the beginning of 2022, including Connecticut, Maryland, Missouri, Montana, New Jersey, New Mexico, New York, Rhode Island and Vermont.

Combined, these states represent roughly 50 million people whose adult 21-and-older populations have gained legal access to cannabis in the last 18 months, representing major opportunities for business.

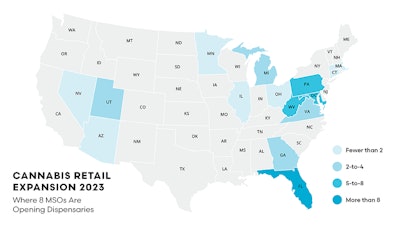

For eight of the nation’s largest publicly traded companies—Ascend Wellness, Columbia Care, Cresco Labs, Curaleaf, Green Thumb Industries, TerrAscend, Trulieve and Verano—which have fiduciary responsibilities to their shareholders, this means capitalizing on emerging markets as well as anticipated opportunities in states like Florida, Pennsylvania and Ohio, where adult-use legalization could materialize in the not so distant future.

These eight MSOs combine to operate 775 cannabis retail facilities in the U.S., including 65 dispensaries they either opened or acquired so far in 2023 (as of July 12). Specifically, Florida has been a top target for expansion this year with no cap on the number of dispensaries licensees can open to serve a medical cannabis patient base approaching 850,000. Not to mention, the Sunshine State has the necessary signatures gathered for a potential 2024 adult-use ballot measure.

And while many companies are downsizing or streamlining their cultivation footprints to match demand in certain markets, that’s not to say they’re solely focused on retail growth in their vertically integrated operations.

“Green Thumb plans to expand its grow facilities towards the end of 2023 and continue opening stores in strong markets like Florida, Virginia and Nevada—all of which will position the company for a strong 2024,” Green Thumb CEO Ben Kovler recently told Cannabis Business Times.

Here, the CBT editorial team provides key data about the eight MSO’s current footprints, strategic growth decisions made in 2023, and commentary from business executives about their companies’ forward-thinking initiatives.