The world has been watching closely as Canada opened its doors to formal recreational cannabis sales. Its population size and diverse economy (different regions have different industries and wages) make it an interesting and significant proving ground for full-boat legal cannabis sales.

Despite the overblown hype surrounding the opening of the country’s recreational cannabis market and the disappointing sales figures following the initial months of sales, Canada still offers a great deal of potential. Brightfield Group estimates that although Canada’s adult-use cannabis market brought in less than US$160 million from mid-October to December 2018, it will grow to a US$7.4-billion market by 2023.

Preliminary consumer data collected by Brightfield Group following the first few months of the program’s enactment have shed further light on the results of the program’s initial launch. Given Canada’s limited product menu on the legal market (edibles and topicals are expected to be legalized on or before Oct. 17, 2019), it was universally anticipated that flower would sell well, followed by oils and medicinals—as was indeed the case. But what are adult-use consumers looking for when it comes to legal cannabinoids?

THC

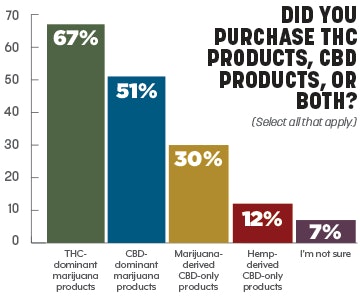

Not surprisingly, their primary interest was in tetrahydrocannabinol (THC)-dominant products, which more than two-thirds of customers purchased through the adult-use market during its first months of operation.

CBD

What has been more surprising is the depth of interest in CBD, with approximately half of new recreational users purchasing CBD-dominant products and more than one-third purchasing CBD-only products (30.4-percent marijuana-derived, and 12.1-percent hemp-derived). CBD sales figures may have been even higher had manufacturers and retailers anticipated such interest levels and made more CBD-dominant and CBD-only product available. Unfortunately, supply shortages were a problem across Canadian provinces, keeping numbers artificially low for both THC and CBD products.

Because CBD products, particularly CBD-only products, tend to have medical and wellness applications (rather than leading to a “high”), some CBD demand was likely driven by ease of access to the recreational market relative to purchasing through medical channels. In other words, accessing the same CBD products via the medical market would require planning and meeting a number of requirements, as well as purchasing through a limited number of channels. The logistical and physical accessibility of recreational retailers seems to have driven a number of medical users, both new and old, to the adult-use market. As a result, the MMJ patient growth rate suffered both in the lead up to and following the recreational market launch.

Consumers who purchased CBD, however, did not show lower levels of THC use compared to non-CBD cannabis consumers, suggesting there is overlap between CBD- and THC-consumers. While many purchase a full menu of products in search of “entourage effects,” others also seek to experience a wider spectrum of experiences through the various cannabinoids, depending on occasions of use, or to get familiar with their effects.

As the new adult-use market continues to unfold, supply issues get ironed out, and a greater variety of products becomes available, Canadian demand for both THC and CBD is expected to increase dramatically, and those operating in the space should remain mindful of the market potential that both cannabinoids carry.