Since July 2017, Nevada’s cannabis market has captured significant attention as strong sales have easily surpassed state projections. The majority of the state’s cannabis market (both medical and adult-use) is centered in the Las Vegas metropolitan area, where licensed storefronts are ready to serve more than 40 million tourists who visit Sin City annually. In the first 12 months after adult-use sales began in Nevada (July 2017 through June 2018), licensed retailers racked up about $530 million in total sales to both adult-use consumers and medical patients, with the adult-use market generating roughly $425 million of that revenue, according to data from the state Department of Taxation.

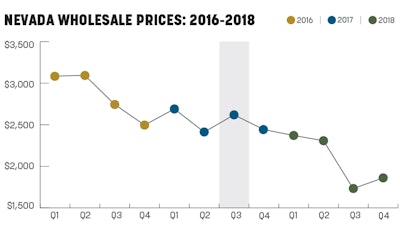

Wholesale prices in Nevada’s market reflected strong initial demand. In Q3 2017 (July through September), the first full quarter in which adult-use sales took place, Nevada’s Spot Index, which tracks the current wholesale price at which cannabis (both medical and adult-use) can be bought, averaged $2,619 per pound, an increase of 8.6 percent from the prior quarter when the only wholesale deals were in the medical market.

Wholesale prices writ large declined in the state the following year. Unlike most other markets, licensed cultivators in Nevada do not have production capacity limits, allowing them to expand as they deem necessary. Grower accounts from April and May 2017 already pointed toward an oversupplied (medical) market even before adult-use sales became legal, as growers generated excess inventory in anticipation of recreational sales. As a result, Nevada’s quarterly average Spot Index fell 6.8 percent in Q4 2017, to $2,442 per pound.

In addition to more cultivation capacity becoming operational in general, new greenhouse facilities with lower costs of production came online in 2018, applying downward pressure on wholesale rates in Nevada. In Q1 2018, the average price per pound was $2,371. That average fell to $2,308 in Q2. Q3 2018 saw Nevada’s volume-weighted price average $1,733 per pound, down almost 33 percent compared to the same period the previous year, when adult-use sales launched.

Nevada’s Spot Index recovered slightly to end 2018, averaging $1,820 per pound for Q4, up 5 percent from the prior quarter. Persistent, strong demand likely contributed to the rising wholesale prices. State data revealed October 2018 sales and tax collections, the most recent month for which official data is available at press time, set new records: Storefronts generated more than $51 million in total revenues, while receipts from the wholesale excise tax topped $4 million for the first time.

Wholesale price data from the first 18 months of adult-use sales in Nevada suggests that the state’s market may see further price erosion as it matures and expands. This has been the case in other markets such as Colorado, Oregon and Washington state.

However, officials issued more than 60 new conditional retailer licenses at the end of 2018, nearly doubling the number of storefronts currently open in the state (65). More retailers could expand access to the regulated market and capture additional demand. There are also concerns about a small number of businesses gaining multiple licenses, allowing them to corner the market in the future and exercise outsized influence on prices. Combine all this, and Nevada’s wholesale prices will be a topic worth watching in 2019.