For most cannabis consumers who enjoyed the plant prior to the recent waves of legalization, it came in limited forms: flower or hash. Only the most dedicated enthusiasts turned their ounces into trays of brownies, and relatively high-tech concentrates like shatter and wax were rare.

Cannabis pills? As a practical matter, they did not exist.

As legalization continues across the country, however, laboratories from California to Massachusetts are manufacturing THC pills, and the once-unfamiliar vehicles for cannabis consumption are rising in popularity.

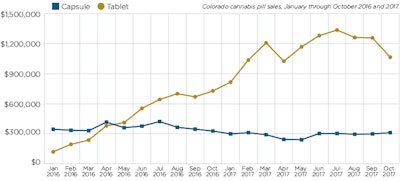

In fact, pills were one of the fastest-growing categories in Colorado between January and October 2017, according to data from cannabis market research firm BDS Analytics. Sales during the 10-month period were 74-percent higher than the same period in 2016, making pills an especially fast-growing subcategory

Demand for pills is also spiking in Oregon and Washington. Sales rose by 87 percent in Oregon from January through October 2017, and by 54 percent in Washington from January through September 2017.

Companies that make pills in Colorado say increased consumer attention toward their products is derived from shoppers who are looking for lifestyle enhancements rather than ways to get higher.

“Our tablets are something everybody is familiar with-they don’t scare people off, like dabbing might. They are willing to try it,” says Charlotte Peyton, one of the owners of Stratos, a leading THC-pill manufacturer in Colorado.

Another rising pill manufacturer in The Centennial State, Altus Labs, revolves its product line around wellness, rather than getting “stoned.”

A benefit of a properly manufactured tablet is the ability to cut it into smaller pieces and trust, for example, that half of a 10-mg tablet contains 5 mg of THC, says Josh Richman, Altus Labs’ senior vice president for sales and marketing. Altus’ pills already fall into the rough definition of a “microdose,” with 5 mg of THC per tablet.

Stratos and Altus now offer CBD tablets as

Much of the overall cannabis marketing and product-development energy since legalization in Colorado has targeted the 21-to-34 age bracket, with an emphasis on males, says Richman. “Forty-four percent of the cannabis market is between the ages of 35 and 64. That represents a lot of people [consuming] cannabis on a regular basis who don’t fit into the more high-profile, younger demographic,” he says. “I think the growth of the tablet market is representative of the average age of cannabis users rising as well.”