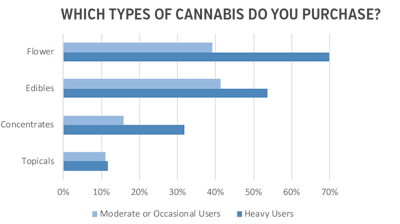

While flower is certainly declining as a percentage of total sales, it still makes up more than 60 percent of sales nationally and more than 70 percent of sales in some key markets, including California. This is largely due to the continued support for flower by heavy consumers (those who consume at least five times per week either for medical or recreational purposes). Seventy percent of heavy consumers report using flower, compared with less than 40 percent of moderate and occasional users. Many heavy users purchase both flower and other products, such as edibles and concentrates.

Considering also that these consumers or patients have the highest expectations of their cannabis, dispensaries would be wise to stock a wide variety of high-quality flower and educating budtenders on each strain’s specific effects and unique selling points, as well as strategic price segmentation in flower selection. More than half of heavy users are willing to pay at least 50 percent more for lab-tested or organically grown cannabis.

However, 20 percent to 40 percent of heavy consumers in most states have incomes below $20,000, so having more economical options available for price-sensitive consumers also would be wise.

Package deals or bundles will go over well with heavy consumers. These deals can encourage them to try new edibles or concentrates brands, gradually building up loyalty to both product brands and the dispensary.

Strong Loyalty to Favorite Brands

Edibles are not just for tourists. More than half of heavy consumers report purchasing edibles. Given that these heavy users drive the vast majority of industry sales, edibles companies’ success rises and falls with heavy users’ loyalty.

Above all, heavy users want a product that tastes great. This may seem obvious, but it is a sign that the industry has gotten more sophisticated — your parents’ pot brownies are not going to fly. Heavy users show the most interest, by far, in infused chocolates, as many cannabis chocolate companies pride themselves on incorporating high-quality cacao or methods used by artisanal chocolatiers.

Once heavy users find a favorite edibles brand, they are quite loyal. Nearly 20 percent of this group reports only purchasing their favorite brand (compared with 2 percent for moderate or occasional users), while two out of three purchase their favorite brand at least 75 percent of the time.

Winning over heavy users will be an uphill battle for retailers, manufacturers and cultivators alike, but will be crucial to their success; these heavy users in the legal market will translate into billions of dollars in revenue.