Now that the various recreational markets have matured, it is timely to take another look and determine what the stable, long-term recreational customer looks like. Using data collected in a late 2016 survey of more than 1,300 cannabis users from Washington, Oregon and Colorado, cannabis research and analytics firm Brightfield Group has determined four important characteristics and behaviors of the established rec consumer.

1. Many rec clients still use cannabis medically.

Half of the consumers surveyed in these three recreational markets were still using cannabis as medical patients. As the markets mature and evolve, cultivators should not do away with medically focused products nor quality medical strains, as medical patients will continue to make up an important part of the market.

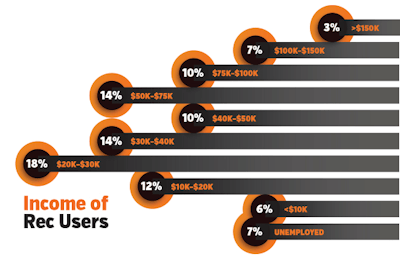

2. Many are lower-income.

Despite the costs involved in regular use, many cannabis buyers have lower-incomes—about one-third of consumers are working less than 20 hours per week or are unemployed, according to Brightfield data. Just over 18 percent of recreational consumers makes between $20,000 and $30,000 annually (the highest percentage of any income group studied), and nearly 60 percent of this market makes less than $40,000 per year. (According to The Wall Street Journal (“What Percent Are You?” published in 2016), more than 64 percent of Americans made less than $40,000 annually, so this seems to reflect general population patterns as well.) Higher-income consumers make up a smaller, though still significant portion of the market. Consumers who make $50,000 to $75,000 annually are the third-largest income group to buy cannabis (14 percent of consumers surveyed).

3. The novelty of legal marijuana not wearing off.

When recreational marijuana use was first becoming legalized, many were concerned that purchases would spike and then fall as the novelty of purchasing cannabis through legal channels wore off. However, regular and frequent buyers appear to be sustaining the legal cannabis markets in Washington, Colorado and Oregon. Consumers in these mature markets are buying as much as they ever have, with almost half of them consuming cannabis daily and three-fourths consuming it three or more days per week.

4. Flower still a favorite, though lead is shrinking.

Based on Brightfield data, flower remains the “old faithful” among users in mature rec markets, but edibles appear to be closing the gap, while concentrates and topicals become more popular and mainstream as well. It is worth noting that some markets, such as Oregon, have been hesitant about allowing the sales of edibles.