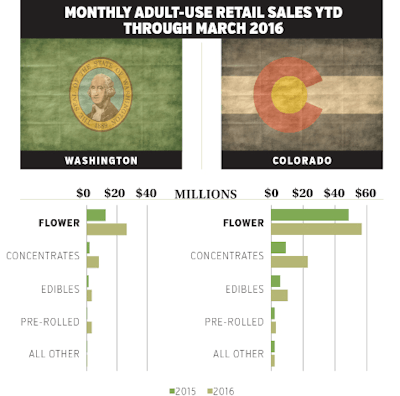

Year-to-date through May, Colorado’s cannabis industry is up 36 percent in retail revenue, averaging $97 million per month, according to BDS Analytics, a Boulder-based firm that tracks retail cannabis sales by brand, item and category. Washington state, for which detailed data is available through March, is up 153 percent in the first quarter. In both states, all categories are growing, but no major category exceeds concentrates’ growth, with sales more than doubling in Colorado and quadrupling in Washington over the same respective time periods one year earlier.

Colorado adult-use and medical dispensaries sold $22 million worth of concentrates per month through May this year, while Washington’s adult-use shops tallied $8 million per month through March. (Data is not yet available for Washington’s medical market.)

The most popular subcategories vary across the states. Shatter is the No. 1 subcategory in Colorado, with $5.7 million in sales per month (adult-use and medical combined) and growth of 90 percent over the same period last year, while Washington’s top subcategory spot goes to prefilled cartridges with $3 million per month (adult-use only) this year on 364-percent growth. But shatter, prefills and wax occupy the top three subcategory positions in both states.

For a meaningful comparison to Washington data, especially with respect to pricing, we can eliminate Colorado medical sales of concentrates and focus on adult use. Colorado still has larger volume, with $12 million in total concentrates sold per month in the adult-use market, compared to Washington’s $8 million. Colorado’s shatter and wax prices per gram were about 22 percent greater than Washington’s. But in prefilled cartridges, for which prices are calculated per unit sold rather than per gram of cannabis, Washington’s unit price averaged $58.30, which is 27 percent higher than Colorado’s $45.74 per unit. (Data sourced from GreenEdge, BDS Analytics' proprietary data mining tool.)