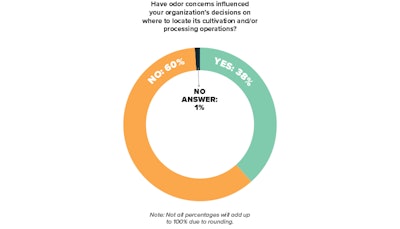

Cannabis cultivators face many challenges unique to their profession, especially when compared to other agricultural crops. One prime but often understated example of this is odor control. Cannabis’s pungent odor is not universally loved. As cannabis becomes increasingly integrated into communities throughout North America, odor control issues have made their way into courthouses in several high-profile lawsuits (see p. S7), as well as into state and local regulatory frameworks.

No quantitative data has existed, however, to explore the impact that odor has on cultivation businesses and related regulations. Until now.

Here, in the first-ever “Special Report: Cannabis Odor Control,” Cannabis Business Times explores odor control in-depth. Based on a study conducted by leading research organization Readex Research and made possible with support from Byers Scientific & Manufacturing, this report sheds light on the technologies that cultivators are using and the best practices they are employing for being responsible neighbors in their communities.

Why Prioritize Odor Control?

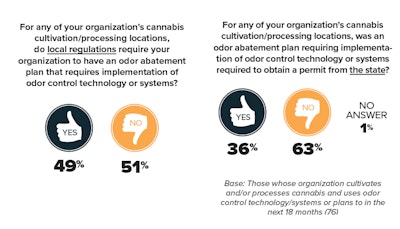

An important finding from the study is that odor control is local—nearly half (49%) of research participants who indicated they either use odor control technologies or plan to in the next 18 months said that local regulations require their organizations to have an odor abatement plan that includes implementing these systems. State mandates are also in play—36% indicated that state regulations require their organizations to implement these systems.

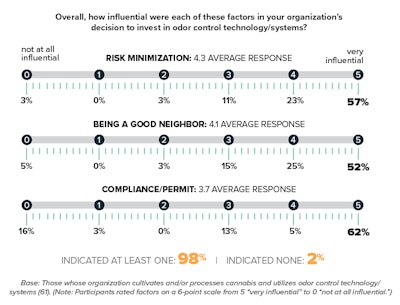

While state and local regulations may dictate whether many businesses decide to implement odor control technologies, other factors weighed heavily as well, including the desire to minimize risk and to be considerate neighbors. When considering how influential specific factors were in their decision to invest in odor control technology or systems, 57% of research participants said “Risk Minimization” is “very influential,” while another 23% said it was “influential.” More than half (52%) of study participants ranked “Being a Good Neighbor” “very influential,” and another 25% said it was “influential.”

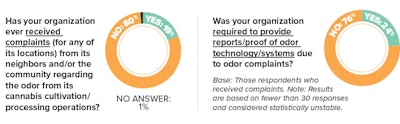

Another key finding of this study was that nearly one out of five respondents (19%) has received complaints from neighbors or surrounding businesses about the smells emitting from a cannabis business operation. Interestingly, 24% of those who have received complaints were required to provide proof of odor control technology or systems, indicating the value of having such systems when it comes to defending against complaints, as well as civil and criminal defense proceedings.

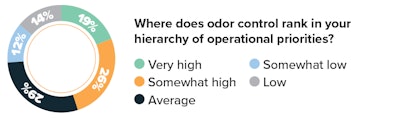

Regardless of their motivation for doing so, many cannabis businesses prioritize odor control in their operations, according to the data: 45% of participants said that odor control ranks “somewhat high” to “very high” in their hierarchy of operational priorities, while only 26% said it was “low” or “somewhat low.”

Odor Control Processes & Technology Choices

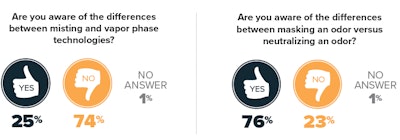

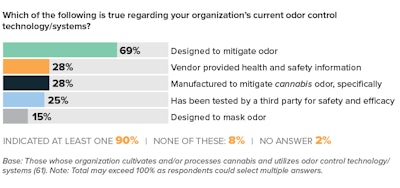

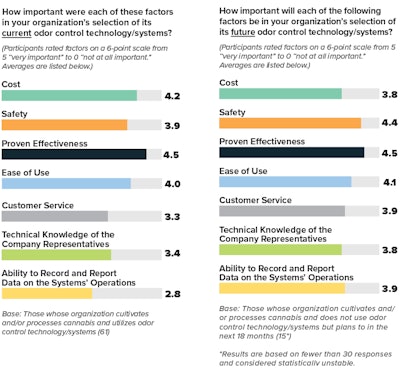

Despite the significant number of research participants that said they consider odor control essential to their facility plans, a lack of understanding of basic odor control processes and technologies exists: 74% of research participants indicated they are not aware of the differences between misting and vapor technologies, while another 23% are not aware of the differences between masking versus neutralizing an odor. (To help improve the level of understanding of odor control, this report also includes a glossary of key odor-control terms on p. S11.)

Whatever their level of odor-control understanding, the majority of research participants are working to control odor in some fashion: 67% of research participants said they use at least one type of odor control technology. A wide range of products and systems are being used, but the most popular are carbon filtration and scrubbing systems. More than half (52%) of respondents utilize carbon filters/scrubbers in at least one cannabis cultivation or processing location. Other odor control technologies in use at cannabis facilities include: Ozone generators (12%), odor masking agents (11%), high pressure fogging systems (7%), biofiltration (5%), and vapor phase systems (4%). Fewer than one in 10 participants (9%) indicated they used other forms of odor control technologies.

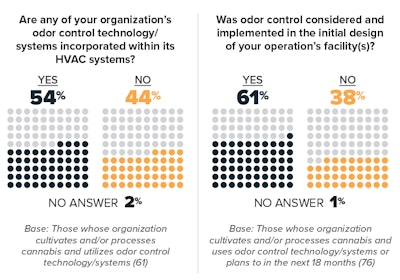

Cannabis cultivators are not waiting on neighbors to complain about their facilities before utilizing odor control technologies or systems: 61% of respondents who currently utilize odor control technology or systems or plan to in the next 18 months said that odor control was considered and implemented in the initial design of their facilities.

As the North American cannabis industry continues to expand at a rapid pace, odor issues will continue to confront cultivators in nearly all geographic locations. And as education about odor control and related technologies advance, time will tell how this knowledge will impact cannabis cultivation businesses and the regulatory landscape.

About the Research & Participants

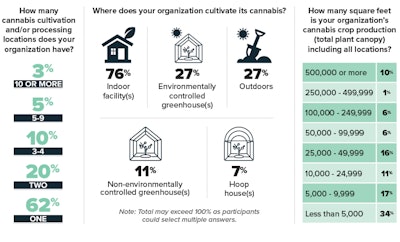

participants in the odor control study grow and process cannabis in a variety of environments. Nearly half of research participants (49%) said they cultivate or process cannabis in a rural area; 40% said their operations are in an industrial area; 30% indicated their operations are in an urban setting; and 22% said they are in the suburbs. (Total exceeds 100% because multiple locations could be selected.)

Beyond location diversity, cannabis business owners are operating in a wide range of facilities, as well: 76% of respondents indicated they grow or process cannabis in indoor facilities, 27% indicated they grow in environmentally controlled greenhouses, 11% indicated they grow in non-environmentally controlled greenhouses, 7% indicated they grow in hoop houses, and 27% indicated they grow outdoors.