The biggest legal cannabis marketplace in the world flung open its doors Jan. 1, inviting everyone age 21 and up to head to stores or call delivery services in California to legally purchase eighths of flower, pre-rolled joints, vape pens, edibles and a wilderness of other cannabis products.

Although many Californians already had been accessing legal cannabis under California’s medical regulatory regime (the first in the nation, established in 1996), make no mistake: Recreational cannabis in California represents a transformation not only of the cannabis industry in California, but nationwide. A new report by The ArcView Group and cannabis market research firm BDS Analytics predicts California’s cannabis market will reach $3.7 billion this year and grow to $7.7 billion in 2021. This year’s projected revenue for California alone is 32 percent higher than the combined 2017 sales in Colorado, Washington and Oregon, which reached $2.8 billion.

So what, exactly, are Californians buying under the new regime?

Prior to recreational legalization, California enjoyed a range of retail and consumer trends unique to the state, most notably a love for vape pens. The move to recreational only increased that affection.

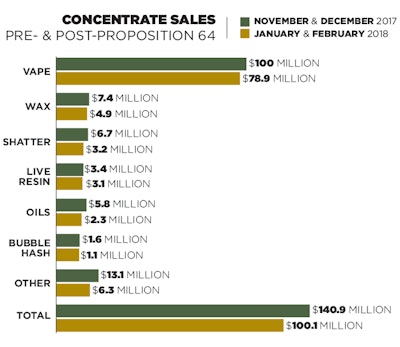

While it should be noted that sales in all cannabis categories fell from November and December 2017 to January and February of this year due to fewer licensed dispensaries being open for business—during the last two months of medical—only sales in California (November and December 2017) vape cartridges captured 73 percent of the concentrates market. The Golden State’s market share for vapes was already an outlier; in Colorado, for example, vapes captured just 40 percent of concentrate sales during those months.

However, in 2018, recreational sales upped cartridges’ market share to 79 percent in California, despite the average pre-tax retail price for a vape pen rising from $36.91 during November and December to $41.95 in January and February. Boosted prices for all cannabis items, not just vapes, represents one facet of the pivot from medical to recreational: Average pre-tax prices for nearly everything increased in January.

Another California quirk—its embrace of infused pre-rolled joints—took a hit after the adult-use program launch. During the last two months of 2017, infused pre-rolls represented 28 percent of the pre-roll market. Joints that come spiked with other cannabis products, such as kief and shatter, had an average retail price of $15.90, making them premium products. The average price for a non-infused pre-roll during the period was $8.67.

But Californians’ all-in attitude toward infused pre-rolls weakened substantially during January and February this year, when the infused pre-rolls’ market share among overall pre-rolled joints fell to 18 percent.

The explanation could come, in part, due to price hikes. The average infused pre-roll during January and February was $17.57, while the price for a non-infused pre-roll was $10.27.

As adult-use cannabis in California unfolds in 2018, expect a wild ride. With many investors and entrepreneurs wading into the commercial cannabis landscape, evolution is going to be the name of the game this year.