Spot Market Updates:

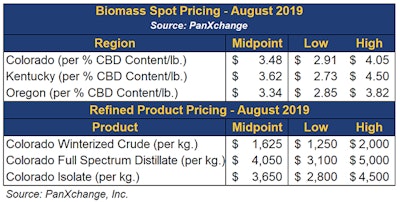

The spot biomass market throughout August has been transacting in the range of $2.73 to $4.50 per percentage point of CBD content (/point) as supply from the 2018 crop year is sporadic and early season crops are being harvested. The trend of biomass selling near the lower end of the range has continued from July, as those who are holding product from the 2018 have incentive to sell before large quantities of product enter the market from the 2019 crop year. Instances of this trend have increased in the last few days, depicting the eagerness to move product and exit positions.

hemp august benchmark pricing data

hemp august benchmark pricing dataThe Colorado isolate market in August has transacted between $2,800 and $4,500 per kg, and continued the trend of downward pressures on prices. Looking at the change from July to August, the PanXchange Isolate midpoint is 19% lower on a month-over-month basis. Transactions at or below $3,000 per kg are likely discounts due to large volume sales and also indicate the competitiveness of the market. PanXchange is excited to announce the addition of distillate prices in this edition of the hemp market update. Full spectrum distillate is trading between $3,100 and $5,000 per kg, while THC remediated, broad spectrum distillate carries a premium ranging between $1,000 and $1,500 per kg.

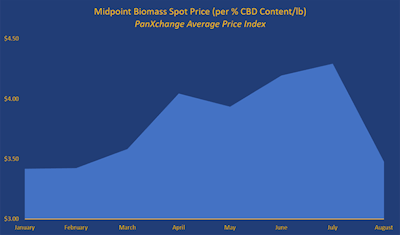

hemp biomass spot price

hemp biomass spot priceState of the Hemp Market:

As the summer is nearing an end, the hemp industry is quickly turning the page and starting a new crop year. Looking back at the crop year of 2018-19, the industry rapidly progressed from a series of pilot programs to full-scale commercialization and took major steps toward becoming a true commodity market. The 2018-19 crop year was a period of massive capital and knowledge influx in terms of the physical supply chain - from investments in capital equipment for farming, drying, processing, extraction, and refining - as well as innovation in research and development capacity related to science and process improvements. As the major harvesting period begins over the next few weeks, we are taking an in-depth dive into data being circulated to glean valuable insights into the market going forward, particularly around supply and demand dynamics. While numerous organizations recently published articles painting an extremely bearish outlook on this year's post-harvest prices, we are presenting a series of scenarios and mitigating factors that could lead to wildly different supply and demand situations.

The Raw Numbers:

On August 27th, The Farm Service Agency (FSA) released an updated version of the Crop Acreage Dara report which assessed the United States Hemp market to have planted 136,950 acres of hemp as of August 22nd. Although some states and entities could be slow to report, this initial number is vastly different than the 310,000+ licensed acres published in the “Cultivation Snapshot” report by Hemp Industry Daily.

Growing hemp in 2019 is inherently a risky proposition, even for seasoned farmers with experience in other crops. The risks of planting are driven by a lack of crop insurance, a fragmented market, a lack of easily accessible quality seeds, and the lack of a developed financial hedging mechanism. Even if the FSA numbers are understated, a licensed acre does in no way result in a planted acre.

Pre-harvest (Cultivation):

In terms of cultivation, there is a myriad of factors that have the potential to dramatically influence the amount of hemp that will enter the market during the 2019 crop year. As true with any commodity market, the weather is both an erratic and a prominent factor impacting the quality and yield of crops. In addition to weather, and specifically with hemp cultivation, pollination and cannabinoid concentrations also affect production and yield.

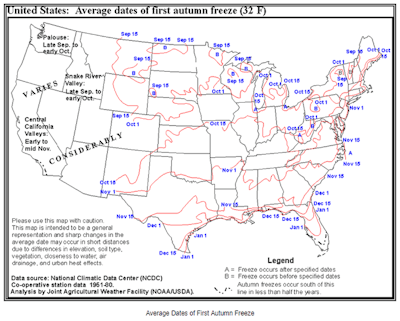

first autumn freeze hemp cultivation

first autumn freeze hemp cultivationA few weeks back, a hail storm hit Oregon and caused significant damage to hemp crops. Throughout August, Colorado, North Dakota, North Carolina, and Montana saw the most days of recorded hail storms with fourteen, thirteen, six and five, respectively. After hail season concludes, chances of early season snow and frost increase. With the amount of hemp that we heard was planted in July and August, the likelihood of these adverse weather instances will only increase with time, leading to more acres being affected.

"Considering the number of unknowns regarding concrete supply and demand numbers, varying yields, and bottlenecks in drying and processing come late fall into early winter, the market faces huge uncertainty."

For hemp acreage in the Southeast, we are nearing peak hurricane season. This year has been a relatively quiet year of activity as NOAA has only named five storms, of which two are currently in the Atlantic Ocean (Dorian and Erin). Although Tropical Storm Erin is projected to stay off the East coast of the United States, Dorian is currently projected to make landfall in Florida later this week as a Category 3 or 4 hurricane.

While in certain cases the hemp plant can recover from hail and excess moisture, unintended pollination poses a risk that is much harder to remediate. Throughout the country, the PanXchange team has heard of pollination affecting multiple farms as the quality of the biomass suffers due to low cannabinoid profiles. Although precautions can be taken to limit exposure to pollen from within one's crop, the risk of pollen drift from neighboring farms is always present.

The ultimate goal of cultivating hemp for the CBD focused hemp industry is to maximize CBD and other cannabinoid production (CBG, CBN, CBC, etc.). But hemp also produces varying concentrations of THC depending on the varieties planted. Over the past few weeks, we’re heard of crops exceeding the 0.3% THC limit. In Hawaii, although a relatively small producer of hemp, over half of the hemp crops were destroyed for surpassing the legal limit. The problem is not unique to Hawaii, with farmers or regulators from state governments throughout the contiguous United States performing initial tests and finding higher than expected THC concentrations in violation of the 2018 Farm Bill. Testing remains an inconsistent practice and the cannabinoid potencies can vary dramatically from one test to another.

Post-Cultivation:

The last major obstacle that will surface during the 2019 crop year involves harvesting techniques and what exactly to do with the biomass once harvested. There are various ways to harvest, from deploying significant manual labor and harvesting by hand to using equipment and machinery typically used for other crops. For machine harvest, we’ve heard of farms that are heavily infested with weeds complicating the harvesting process.

Beyond harvesting, drying services might become the most prominent near-term bottleneck within the industry. While hemp production and processing investments have been the focus of capital deployment, the major question remains as to how large quantities of harvested biomass will be properly dried before storage. Many drying services are already booked out at capacity. Producers have other options for drying, including using drying equipment used for other crops, hang drying in outbuildings, using corrugated cardboard containers, and a slew of other interesting ideas, but these techniques carry the risk of quality degradation or product loss.

Large increases in supply without an equal increase in demand will place downward pressure on prices. Considering the number of unknowns regarding concrete supply and demand numbers, varying yields, and bottlenecks in drying and processing come late fall into early winter, the market faces huge uncertainty. One certainty is that the industry is set to see a wide range of product qualities, and the corresponding effect on off-spec product — low CBD concentrations, issues with contaminants, improperly dried and ineffectively stored product — will cause even more volatility. These quality spreads will in turn exacerbate differences between premium product and off-spec product as buyers will have more options to choose between. The PanXchange internal scenario analysis based on the above risk factors produced vastly different price forecasts.

The 2019 crop year is the first year of large-scale commercialization in the hemp industry. Stakeholders along the entire value chain should recognize and anticipate the risk factors leading to price volatility and product quality issues that are amplified in this new and rapidly scaling market. Recognizing these factors enables strong organizations to use tools to face, reduce, and when possible mitigate these risks. Those who will come out on top in this market will be those who are able to mitigate these risks with access to working capital, storage and access to new alternative counterparties.

PanXchange produces indices for emerging commodities bringing price transparency, price discovery, and key market intelligence. We acquire pricing information by conducting surveys with vetted and anonymous market participants and make expert assessments based on a variety of factors. We will publish monthly spot biomass assessments for Colorado, Oregon, and Kentucky, with plans of expanding crude, distillate, and isolate reporting as well as additional regions. As the market evolves, PanXchange will evolve with it. Monthly assessments will be published on the last Thursday of every month.

Please reach out to RJ Hopp by email at [email protected] or by phone at (877) 917-9658 for any questions or to be added to the distribution list.