[PRESS RELEASE] - TALLAHASSEE, Fla., May 7, 2025 – Trulieve Cannabis Corp., a leading and top-performing cannabis company in the U.S., announced its results for the quarter ended March 31, 2025. Results are reported in U.S. dollars and in accordance with U.S. generally accepted accounting principles (GAAP) unless otherwise indicated. Numbers may not sum perfectly due to rounding.

Q1 2025 Financial and Operational Highlights*

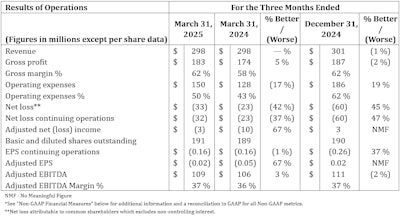

- Revenue of $298 million increased slightly year over year, with 95% of revenue from retail sales.

- Achieved gross margin of 62% versus 58% last year, with GAAP gross profit of $183 million.

- Reported net loss attributable to common shareholders of $33 million. Adjusted net loss of $3 million* excludes nonrecurring charges, asset impairments, disposals and discontinued operations.

- Achieved adjusted EBITDA of $109 million*, or 37% of revenue, up 3% year over year.

- Generated cash flow from operations of $51 million and free cash flow of $34 million*.

- Cash at quarter end was $329 million.

- Rewards program members reached over 625,000 members as of March 31, 2025. Loyalty members accounted for 68% of transactions during the first quarter.

- Launched Onward, a premium, nonalcoholic THC beverage available for purchase by consumers 21 years and older at select retail locations in Florida or ordered via DrinkOnward.com for direct shipment to 36 states.

- Opened six dispensaries in Maricopa, Ariz.; Middleburg, North Miami Beach, and Palm Coast, Fla.; and Columbus and Zanesville, Ohio. Relocated one dispensary to Lancaster, Pa.

*See "Non-GAAP Financial Measures" below for additional information and a reconciliation to GAAP for all Non-GAAP metrics.

Recent Developments

- 4/20 holiday season units sold and traffic increased 20% and 9%, respectively, versus last year.

- Opened one new retail location in St. Petersburg, Fla.

- Currently operate 229 retail dispensaries and more than 4 million square feet of cultivation and processing capacity in the United States.

Management Commentary

"Strong margins and cash flow achieved in the first quarter clearly demonstrate our commitment to operational excellence," Trulieve CEO Kim Rivers said. "With our loyal customer base, branded products and efforts to drive cannabis reform, Trulieve stands out as an industry leader."

Financial Highlights*

A line-by-line breakdown of the company’s balance sheet is available here.

Non-GAAP Financial Measures (Unaudited)

In addition to our results determined in accordance with GAAP, we supplement our results with non-GAAP financial measures, including EBITDA, adjusted EBITDA, EBITDA margin, adjusted EBITDA margin, adjusted net (loss) income, adjusted net (loss) income per diluted share, and free cash flow.

The company calculates EBITDA as net income (loss) before net interest expense, interest income, income tax expense, depreciation and amortization; adjusted EBITDA as net income (loss) before net interest expense, interest income, income tax expense, depreciation and amortization and also excludes certain extraordinary items; EBITDA margin as EBITDA as % of revenue; adjusted EBITDA margin as adjusted EBITDA as % of revenue; adjusted net income (loss) as net income (loss) less certain extraordinary items; adjusted EPS as adjusted net income (loss) divided by basic and diluted shares outstanding; and free cash flow as cash flow from operations less capital expenditures.

Our management uses these non-GAAP financial measures in conjunction with GAAP financial measures to evaluate our operating results and financial performance. We believe these measures are useful to investors as they are widely used measures of performance and can facilitate comparison to other companies. These non-GAAP financial measures are not, and should not be considered as, measures of liquidity. These non-GAAP financial measures have limitations as analytical tools in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP. Because of these limitations, these non-GAAP financial measures should be considered along with GAAP financial performance measures. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP.

Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures. A reconciliation of the non-GAAP financial measures to such GAAP measures can be found below. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, our reported financial results prepared in accordance with GAAP.