One of the more important consumer-facing issues for budtenders and all dispensary employees is the matter of dosage, especially in the edibles product category. The difference between 20 mg of THC and 5 mg of THC in a single serving of chocolate can mean the difference between an enthusiastic, loyal customer and a fiasco.

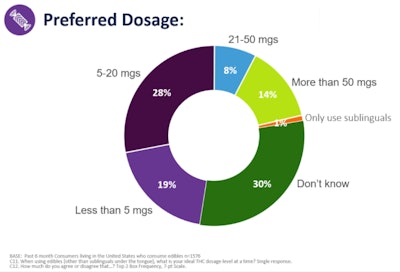

That said, new data from BDS Analytics shows that 28 percent of all edibles consumers prefer their edibles dosage to be in that 5 to 20 mg range. Even more notable, however, is the statistic that one-third of those consumers don’t know their preferred dosage. This is where in-store education comes in handy.

RELATED: 5 Ways to Make a Customer's First Trip to Your Dispensary a Success

Linda Gilbert, managing director of consumer insights at BDS Analytics, and Jessica Lukas, vice president of consumer insights, recently shared some of the most pertinent consumer data trends in the burgeoning edibles market.

“It’s really important to think about that trust and the consistency in people purchasing products because they know they’ll have a good experience—or a friend or family [member] recommended it, or a budtender recommended it,” Lukas said.

The best way to manage this trust issue is by communicating clearly on both sides of the business: with vendors and with customers. Make sure that your staff knows the ins and outs of the edibles that you’re selling; pass along any unanswered questions to the vendor. And behind the counter, ensure that budtenders are clearly and patiently walking customers through the context of THC dosage in edibles.

The individual experience can be hard to gauge ahead of time, but by starting slow with new customers (and even experienced customers), that trust can be built.

In past year, Lukas said, micro- and low-dose cannabis consumption has brought many new consumers into the market. Edibles, offering a more discreet method of consumption and a keener ability to tailor dosage metrics, are often seen as a simple entry point. “We’re seeing a lot of new brands and products emerge in that space,” Lukas said, “and we’re seeing the volume come with that—meaning, the consumer demand is there, and those products are selling.

“Consumers are wanting that,” Lukas continued. “They’re wanting portion control, they’re wanting to consume throughout the day. They’re looking for lower milligrams.”

This growing market trend is at odds with long-running industry tendencies toward high THC content. As the consumer market grows, more and more individual consumers are shifting into lower-dose products.

“These are people who are coming into this oftentimes for a more purposeful kind of consumption,” Gilbert said. “They’re not looking to get inebriated.”

In California, data provided by the Bureau of Cannabis Control shows that one-third of all edibles products failed their state-mandated lab tests from July 1 through Aug. 29. (California’s new testing rules went into effect July 1.) More than half of those test failures involved “label claims,” or, as Gilbert described the problem in a separate forum, “labeling for effect.”

Too often, she noted, cannabis product manufacturers across the industry are found reaching for higher and higher THC content as the prime metric for the retail market.

“There is a real need for all of us in this industry—and those of us outside of the industry who are food scientists and analytics folks on the chemistry side and pharmacological side—to start bringing our best practices to play here, in terms of: How do we deliver products that are safe, that are reliable?” Gilbert said.

Top photo courtesy of Adobe Stock