Based on its nationwide survey of 3,600 hemp-derived CBD consumers conducted in mid-2018, Brightfield Group expects the hemp-derived CBD market to explode in the coming months and years, once a clear legal status and regulatory system are in place—paving the way for major investments, marketing campaigns and retail channel expansion. In 2018, hemp CBD is expected to make up a $591 million market—and by 2020, it is forecasted to be a more than $11-billion industry.

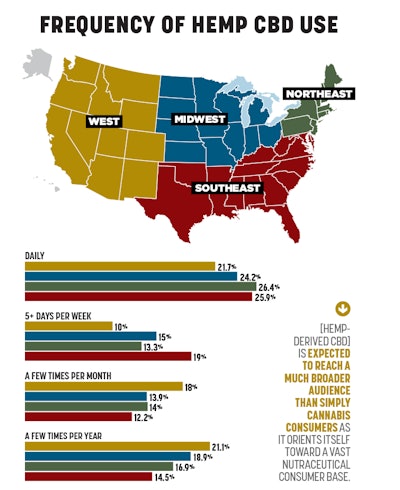

As hemp-derived CBD continues to leave the cannabis industry’s shadow, it is expected to reach a much broader audience than simply cannabis consumers as it orients itself toward a vast nutraceutical consumer base. As such, those looking to cultivate, manufacture and sell hemp CBD products effectively in the coming years must be conscientious of existing and evolving regional trends and differences that influence awareness, acceptance and availability of product around the country.

Following are three regional characteristics distinguishing between consumer groups in today’s hemp-derived CBD market, with an eye to the prominent differences between the West and the rest of the country.

1. Westerners Are Casual Shoppers…

Though the Western region contains (by far) the most states with legalized cannabis and infrastructure to support its sales, easy access to cannabis of all stripes has made hemp consumers in the region less inclined to purchase as much hemp as those in other regions. In fact, less than one in six consumers from this area of the country regularly spend greater than $50 on hemp products, as opposed to nearly one in three in the Midwest and Southeast. The West also contains the highest percentage of occasional, casual consumers, who use hemp CBD products at most a few times monthly.

2. …But They Are Willing to Be Trendsetters

Crucial to any industry, especially in the early stages of the product life cycle, are new consumers. Analysis shows the Western region excelling on this front, with 16.4 percent of Western consumers surveyed being new users who have used hemp CBD products for less than three months, versus approximately 2 percent fewer in the country’s other regions. The casual usage patterns and abundance of new consumers seem to indicate that the lack of red tape involved in purchasing any cannabis products (hemp-derived or otherwise) has led many Westerners to approach cannabis products as more of a casual or impulse buy rather than a regular purchase or a medical necessity, as is the approach in the remainder of the country.

3. They Are Socially Oriented, Rather Than Medically Motivated

Consumers in the West are less likely to learn about CBD from a doctor—and more likely to learn about it from a friend or family member—than those in the rest of the U.S. This again confirms that Westerners are generally more interested in casual, social use rather than strictly medical use. It also indicates that those in cannabis-legal states may be speaking about CBD products more openly than in more conservative regions where state-level cannabis legalization has not yet taken place.

To access more information about the hemp-derived CBD market, consumers, trends, innovations and growth drivers, visit www.brightfieldgroup.com.

Jamie Schau attained a B.A. in international studies and an M.A. in international development from the University of California, San Diego. Since early 2015, she has been a market analyst with Brightfield. Group, where she performs quantitative and qualitative analyses of various aspects of the U.S. marijuana markets.

Top photo courtesy of Adobe Stock