Despite a global pandemic keeping consumers at home and hurting stock prices already tamped down by the economic strain, North American cannabis companies had an overall solid Q2. Yet big questions remain about corporate cannabis performance for the balance of 2020, with physical retail sales likely to be impacted until 2021—possibly beyond.

Cannabis Business Times and Cannabis Dispensary spoke with leadership at three of the industry’s largest companies for a snapshot of this quarter’s results and the industry’s position as a whole moving into the second half of an unprecedented year.

Green Thumb Industries (GTI)

Chicago, Ill.

Q2 Revenue: $119.6 million (167.5% year-over-year increase)

Net Income: $12.9 million net loss

Highlights:

GTI, based out of the booming new Illinois market, became the first American cannabis company to draw $100 million in revenue in a quarter (in Q1 2020). In Q2, they repeated the feat. Despite the pandemic, GTI’s revenue in the first half of 2020 has already surpassed revenue from all of 2019.

CEO Ben Kovler says the company’s focus on the consumer experience is what separates them from others in the industry.

“We can’t control the external environment. We can control how we execute,” he said. “We just continue to deliver day in and day out, setting a standard of excellence … [in] each store, each transaction, treating each person with respect.”

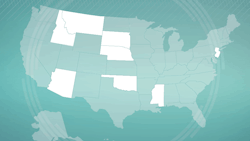

GTI’s products are available in nine states. The company recently finished expanding an Ohio production center and has similar plans to expand in its home state of Illinois, as well as Pennsylvania. And while things seem to be going smoothly at GTI, Kovler understands that there is still much more to come in the broader cannabis industry.

“We’re incredibly pleased, but at the same time we don’t think we’re at the top of the mountain and celebrating,” he added. “This is early in the story of U.S. cannabis turning into, we believe over the next decade, an $80-billion business. We’ve positioned Green Thumb to take advantage of that tidal wave of this new space.”

Acreage Holdings

New York, N.Y.

Q2 Revenue: $27.1 million (53% year-over-year increase)

Net Income: $11.1 million adjusted net loss

Highlights:

Acreage doesn’t have the nine-figure revenues of the other companies on this list. But the NYC-based operator, which has a deal to be acquired by Canopy Growth upon federal legalization in the U.S., has found success through a tight focus on key markets, especially in the East Coast and Mid-Atlantic regions.

“We are extremely pleased,” interim CEO Bill Van Faasen told Cannabis Business Times and Cannabis Dispensary. “We were able to improve performance without the typical tail-winds of markets expanding.”

CFO Glen S. Leibowitz added that the company is preparing now for the creation of new adult-use state markets in the coming years.

“There’s some really exciting opportunities ahead of us,” he said. “If New Jersey were to go adult-use we’re well-positioned there. Down the road, there’s other future opportunities for neighboring states. We’re well-positioned in New York, Connecticut, Pennsylvania.”

In November, Acreage acquired the Compassionate Care Foundation Inc. (CCF), a New Jersey-based cannabis operator with three retail dispensary locations and one of the state’s largest indoor grows. Recreational cannabis is on the ballot in New Jersey this year–polls indicate it has a good chance of passing in the Garden State, a liberal stronghold where Democrats control governorship and both houses of legislature, known as a “trifecta.”

Acreage also maintains an outsized brand in the industry thanks to associations with high-profile former politicians including Bill Weld and John Boehner (Weld resigned from the company’s board earlier this year). Boehner in particular has generated criticism for his anti-cannabis stances as Speaker of the House.

But Acreage leadership expressed an understanding of the industry’s role in correcting the ongoing injustices related to prohibition.

“We need to do more, we want to do more.” said Van Faasen.

Vice President of Communications Howard Schacter added via email: “There’s no question we and the entire industry need to do more in terms of taking care of those most impacted by the war on drugs.”

Schacter pointed to their recently-signed agreement with the Cannabis Equity Illinois Coalition for their forthcoming dispensary in Chicago. Acreage has agreed to hire 75% of employees from disproportionately impacted areas within two years and contract at least 10% of products and services from minority-owned/social equity businesses.

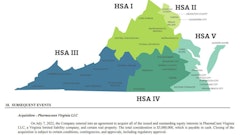

Canopy Growth

Smiths Falls, Ont.

Q2 Revenue (Q1 2021 in Canada): $110 million (22% year-over-year growth)

Net Income: $128 million net loss

Highlights:

Canopy is a leading cannabis company known for its high-profile partnerships, including with $8-billion beverage giant Constellation Brands, which owns Corona and Modelo. And while Canopy enjoys a strong suite of Canadian consumer brands and has a pre-existing path to American market penetration via its deal with Acreage, sales were relatively stagnant this quarter: excluding growth from acquired businesses, Canopy’s net sales only grew 9% year-over-year compared to Q1 2020.

But Jordan Sinclair, the company’s VP of Communications, expressed confidence that the worst of the coronavirus’ impact on sales was over.

“All corporate-owned stores that were closed in response to the COVID-19 pandemic have since been reopened and sales returned to pre-covid levels,” Sinclair said via email. “We have repositioned our value flower in the Canadian recreational market. We’ve increased THC levels and narrowed the range of THC levels per lot. This has had a positive impact on sales leading to doubling of our market share in the value category in Ontario since the beginning of Q2.”

Despite some short-term cost-cutting, Canopy bulls are confident that the impending deal with Acreage, plus the company’s ability to dominate the lucrative cannabis beverages space with Constellation’s backing, will keep its business on a path to success in the long-term.

“We have pivoted our R&D to focus on improving product quality and driving innovation,” added Sinclair.