"What’s your model?” is a question that acknowledges that different conclusions most often depend on different assumptions. For example, an investment in a commercial cannabis cultivation, processing and/or dispensary facility might be a reasonable or an unreasonable decision, depending on the predictions that we insert in our model. Needless to say, evaluating the viability of launching or expanding into a new market can be challenging.

The model that we use to evaluate a potential investment/expansion into any jurisdiction includes many variables (i.e., population base or regulatory support), to each of which we assign values.

Let’s use this scenario as a jumping-off point: Say that we are prepared to invest:

- $250,000 in a competitive application to get a cultivation license (an investment we will lose if the application is unsuccessful),

- another $10 million in a build-out of that facility (if the application is successful),

- an additional $250,000 if a separate application is required for a dispensary,

- and another $250,000 for a dispensary build-out.

Can all this be done for less? Yes. For more? Of course. The estimates all depend on our assumptions, and the actual costs will depend on the less than perfectly predictable reality.

We all want to evaluate any investment using good information. In this scenario, good information would be accurate estimates and quotes. The history of our industry, however, has shown that good information is hard to come by.

Estimating Costs

For example, consider the search for a location. Making a logical choice of location(s)—one where you would ideally like your business to be located for various business reasons—would seem to be a reasonable place to start. Nevertheless, many jurisdictions and many locations even within legal jurisdictions are off limits. Generally speaking, we focus on sites most likely to get license approval without considering the logical aspects of that location, such as how much will it cost both to get through construction and to create a positive cash flow at that location.

As you might expect, assuming that we have found a location where a local jurisdiction will accept our enterprise and where all state requirements are met, cost estimates begin with land, building(s) and equipment (all local building, fire and other codes still apply). Our budgets also include estimates for the cost of conforming to all relevant state regulations, including required security and other concerns. The possible location(s) in which we might find ourselves will have a lot to do with what our business will look like and how it will operate.

Once we settle on a location, we will want to control our “burn rate”—that is, the rate at which we burn through cash before our business creates a positive cash flow (usually in the tens of thousands per month). We will not want our operation to be too small for its market, but we especially will not want it to be too large.

Some people have gotten through this process for far less than $10 million, but others have spent far more. The money spent on the application will be true risk capital; again, unless the app is successful, that investment will be gone. The money for the build-out will be different in that we will not have spent it without a license in hand. Additional considerations will define whether we might reasonably expect to get a return on our investment in the foreseeable future.

Ask Yourself the Toughest Questions

Assuming 2% of a state’s population will eventually participate in the state’s medical cannabis program, and projecting that 10% of the state’s population will eventually participate in the state’s adult-use marijuana program, how many consumers can we expect to serve with a cultivation facility and/or a dispensary facility? The answer, of course, will depend on how many of those businesses might be awarded licenses by the state. States with large populations might seem attractive, but if a state awards too many cultivation licenses, recent history suggests that the following will occur:

- The state will have an oversupply of product;

- wholesale and retail prices will collapse;

- financial pressures will bring about substantial diversion of supply into the illicit market; and

- the same pressures that push product into the illicit market will work against desirable cultivation and testing practices, forcing cultivators and dispensaries that bear the expense of safe and compliant production and distribution into competition with a large supply of potentially contaminated, but cheaper, illicit-market product.

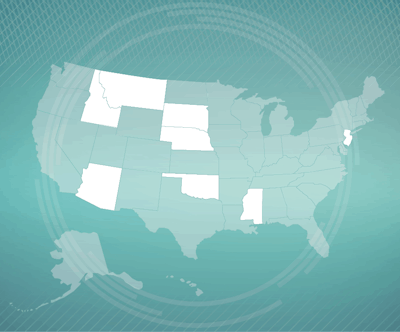

In short, when a state licenses too many producers (think: Washington state with a population-to-grower ratio of 5,300 to 1), the state creates extremely undesirable competitive pressures. It often seems that politicians like to spread around the business opportunities that seem to exist in our industry. The reality, however, is that awarding too many licenses, especially producer licenses, ensures that very few of the licensed businesses will succeed. In addition, the state’s program may well feed the state’s existing illicit market and work against compliance with respect to tax collections and product safety. In the end, everyone loses.

Back to the Toughest Questions

You should also ask the following:

- What will the state’s program roll-out look like?

- Will there be a reasonable list of products that may be produced and sold within the program?

- Will there be a reasonable set of conditions approved for treatment within a medical program?

- Will there be a reasonable number of dispensaries to distribute product to registered program participants?

- Will political forces delay all, or large portions, of the program?

- How long will it take for the program to register a sufficient number of patients and/or consumers to make the program viable?

Finally, how will the state regulator administer the program? For example, some states and their regulators support their programs by encouraging in-state banks to work with registered cultivators and dispensaries. Some states and their regulators respond quickly to unanticipated problems in their programs, offering reasonable solutions. Others do not.

Other Considerations

Of course, in evaluating a state for a potential investment, we consider many other factors, including:

- whether outdoor or greenhouse cultivation is allowed,

- cost of electricity,

- types of grow lights,

- optimal approaches to canopy,

- HVAC,

- carbon dioxide enrichment,

- strain selection,

- test lab selection,

- banking,

and other matters. The Occupational Safety and Health Administration (OSHA), the Environmental Protection Agency (EPA), the IRS (remember that the IRS administers Form 8300 compliance) and their state counterparts also will be very interested in our operation. These considerations are relevant in most states. We do not, however, consider them as seriously as we consider the toughest questions mentioned earlier.

The toughest questions help us define the character of a license, the character of the local jurisdictions, the character of the regulator and the character of the state’s politics. Answers to the toughest questions give us some sense of our probable cost of getting a facility into operation and of the probable rate of return on the investment. These factors extend beyond the considerations involved in evaluating an investment in a conventional business and are subject to far greater variability. The local jurisdictions, the regulators and the politics are generally frightening, and there are no rules as to how they will play out.

Last but not least, there’s always the illicit market already operating in any given state. We accept the estimates that place the size of the national illicit cannabis market at $50 billion. This makes the illicit market every registered producer’s and dispensary’s largest competitor. To get a sense of the illicit market in any state, we take the proportion of the national population living in that state and multiply it by $50 billion. We then acknowledge that we have a large competitor with an established distribution network, established customers and lower (nonexistent) costs of compliance and taxation.

As Mark Twain said, “There are two times in a man’s life when he should not speculate: when he can’t afford it, and when he can.” Speculating on market potential, state and local regulatory outlook and attitudes, as well as the other topics outlined above, is not wise in any market, but especially so in cannabis.

Read the Cultivation Startup & Expansion Guide