More than a few migraines were set off in late January and early February this year, when non-professional traders squeezed long-held short positions on unsuspecting stocks like GameStop, Nokia and AMC Entertainment Holdings. More than a few windfalls were cashed out, too, creating dozens of overnight millionaires.

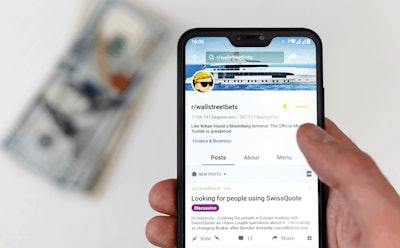

The saga sparked an interesting conversation about the shape of public trading, particularly with the advent of crowdsourced intel from the r/wallstreetbets page on reddit.com amassing against well-heeled hedge funds. For Tilray CEO Brendan Kennedy, the narrative prompted flashbacks.

“I’ve had a little bit of PTSD over the last couple of days,” Kennedy said on CNBC in late January. “I remember getting five different calls from Nasdaq in a single day about our stock being halted because the short sellers were being squeezed so badly.”

He was referring to August and September 2018, a fleeting moment when traders drove Tilray’s stock price from about $24 to a high of $300 per share—before the next year or so slowly spiked the price back to the floor.

Let’s back up: In basic terms, a “short” is a bet that a stock price will decline. A “squeeze” is one possible reaction to short plays, when purchase volume increases rapidly and puts pressure on those plays. In the case of Tilray, ca. 2018, that’s one interpretation of what happened. The financial lingo became household terms during the GameStop flurry earlier this year. But the squeeze can generate its own feedback loop, wholly divorced from the companies in the conversation.

As traders sought out fresh fodder for quick trades this past month, riskier market segments took their turn in the spotlight: crypto, tech, cannabis. As February ticked onward, traders juiced the stock prices of several public cannabis businesses.

The rally built its momentum on the back of a Feb. 1 announcement that U.S. senators plan to consolidate cannabis reform legislation “in the early part of this year,” as well as the blockbuster $7.2-billion deal cut between Jazz Pharma and GW Pharma. Excitement was in the air, as it tends to be with this industry.

Tilray shares leapt 23% the next day. From there, the price skyrocketed another 172% before tumbling Feb. 11. As of Feb. 15, Tilray was trading at $29 even.

Other oft-cited Canadian cannabis stocks (Aphria, Aurora, Cronos, Canopy) each saw their own sudden downturn in mid-February. Market observers, including Ihor Dusaniwsky, a managing director at short-selling analytics firm S3 Partners, have noted in recent weeks that traders should expect ongoing volatility in the cannabis sector. As of mid-February, short positions remained hefty on major cannabis stocks.

Kennedy leveled with the industry’s C-suite during his CNBC appearance: “My advice to those CEOs would be that, at times like this, your company is not your stock, and your stock is not your company. Keep it all in perspective as these very unusual market dynamics are taking place.”

The long view is similar to the short view here: Buckle up and maintain a clearly defined set of corporate values. It’s going to (continue to) be a wild ride.