The California Department of Tax and Fee Administration announced a sudden increase on wholesale cannabis taxes, effective Jan. 1, 2020.

Beginning in the new year, cannabis retailers will need to pay the state’s 15% excise tax on an 80% markup of wholesale product brought into the store. Currently, retailers pay the excise tax on a 60% markup.

The markup rate is the department’s attempt to square up the wholesale price (conducted as an “arm’s-length” transaction between distributor and retailer) and the average market price that the consumer will pay.

The department typically reviews these cannabis markup rates—which determine the total excise tax cost for retail businesses—every six months. And still, the news seemed to arrive suddenly on Nov. 21, sending financial worry through the industry.

The net effect is a higher tax burden on the developing legal industry in California and, one must presume, higher costs in the short term for consumers.

Here’s more information, quoted from the department, which provides an example of how the markup rate affects real costs:

After analyzing thousands of transactions in the state's Track and Trace system, CDTFA analysts have determined that the required markup rate for the period beginning January 1, 2020, is 80%.

Here is an example of how the markup calculation works when the actual sales data shows that the average markup between wholesale and retail prices is 80%.

A cannabis retailer purchases cannabis from a distributor for $50. The distributor will calculate the 15% cannabis excise tax due from the retailer as follows:

Retailer's wholesale cost $50.00

Mark-up ($50 x 80%) + $40.00

Average Market Price $90.00

15% excise tax (Average Market Price x 0.15)

Excise tax due $13.50

The distributor will collect $13.50 in cannabis excise tax from the cannabis retailer and remit that tax payment to the state.

If the 15% excise tax were on the retail sale, as provided for in Proposition 64, the 15% tax on a $90 sale would be $13.50, equal to the tax due under the markup method.

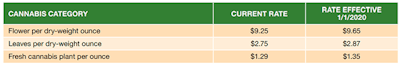

Further, the department issued inflation-adjusted tax rate increases on cultivators. These are flat rates levied against per-ounce metrics of dried flower produced by licensed growers.

Here are the relevant increases:

california tax raising cannabis

california tax raising cannabis

"What we really need to be doing is reducing our taxes and creating a reasonable pathway to get into a legal business,” Santa Cruz County Supervisor John Leopold told KSBW. “We know if we do that, we can generate more taxes because people in the business will pay those taxes and they'll be able to provide money for all of the enforcement, drug rehab and all the good things we want to see coming out of those taxes.”

This is part of a notable trend in California, where the illicit industry is thriving on consumer demand. The legal, licensed cannabis industry, however, is beset by rising taxes and rampant regulatory fees. In 2019 and for the foreseeable future, the illicit market’s growth is outpacing the legal market.