Far fewer states have launched commercial adult-use cannabis sales than medical cannabis sales, but those that have made the recreational jump are raking in the dough.

In 2021, there were 11 states with fully operational adult-use retail programs, and those programs were responsible for more than half of all legal cannabis sales in the U.S. Overall, legal adult-use and medical cannabis sales combined for $24 billion in the U.S. last year, according to BDSA’s rolling market forecast from March.

Specifically, eight of those states tracked adult-use sales figures separately from medical sales: Arizona, California, Colorado, Illinois, Maine, Massachusetts, Michigan and Oregon. That octet accounted for more than $12.8 billion in adult-use sales in 2021, according to data collected by Cannabis Business Times.

SEE BELOW FOR STATE-BY-STATE SALES BREAKDOWNS

Washington ($1.47 billion) and Nevada ($1.04 billion) did not separate adult-use and medical sales in their 2021 state databases. And a public records official from Alaska’s Department of Revenue told CBT that the state does not tax sales to end users and therefore does not keep records pertaining to those transactions.

While Alaska had the smallest population among the 11 adult-use states with operational retail programs in 2021, it’s a state that has been becoming increasingly competitive with the most cannabis retail shops per capita (20 per 100,000 residents) in the western U.S., Alaska Public Media reported.

However, Coloradans spent more money on adult-use cannabis at an estimated $429 on a per-capita basis for their 21-and-over population among the eight states that specifically tracked adult-use sales in 2021, according to data compiled by CBT.

California, the world’s largest cannabis market with $5.2 billion in adult-use taxable sales in 2021, represented an estimated $180 in adult-use sales on a per-capita basis for its 21-and-over population.

But California’s figures may appear inflated, as the state’s $5.2 billion in taxable sales in 2021 included cannabis products (such as a grinder) and other retail sales of tangible personal property (such as a T-shirt) on top of the actual cannabis sold by adult-use retailers.

Below is a state-by-state overview of the eight states that tracked adult-use sales in 2021.

Editor’s note: The per-capita statistics in this report are not exact, as they do not take non-resident cannabis transactions into consideration, despite tourism playing a significant role in each state’s adult-use retail market. In addition, all 21-and-over population estimates are from Statista’s 2019 state figures.

In one of the quickest program roll-outs in the country, Arizona’s adult-use cannabis retail market took off in 2021, despite missing the first 21 days of the year.

Totaling $593.6 million, Arizona’s adult-use sales didn’t quite pass medical cannabis sales ($757.8 million) in 2021, but the month-by-month figures did. December featured $63.8 million in adult-use sales and $53.5 million in medical sales.

The adult-use sales figure for December represented a 95% increase from February (the first full month of adult-use sales), according to data from the Arizona Department of Revenue.

Adult-use sales represented 43.9% of the legal retail market for the year.

California’s adult-use sales figures are only the tip of the iceberg in the world’s largest cannabis market.

While the state’s $5.2 billion in 2021 adult-use taxable sales represent a 17.1% increase over 2020, California’s legal operators have faced myriad challenges, including high taxes, a shortage of retail outlets, falling prices and regulations that many say have kept the illicit market thriving.

RELATED: ‘Surviving is Thriving’ in California’s Cannabis Market

Specifically, California’s 823 licensed brick-and-mortar cannabis retailers as of October 2021 equated to 2.1 dispensaries per 100,000 residents, the fewest among western states with adult-use programs, POLITICO reported.

With the shortage of dispensaries to meet the state’s production, California’s 21-over-over population spent approximately $180 per capita in 2021, lagging behind states like Colorado ($429), Oregon ($339) and Massachusetts ($256).

All the while, nearly $1.3 billion in total tax revenue was generated from the adult-use sales in 2021, which includes excise, cultivation and sales taxes at the state level, according to the California Department of Tax and Fee Administration (CDTFA).

One reason why California’s cultivation tax continued to generate large revenues ($163.2 million) for the state amidst falling prices in 2021 was because it’s a weight-based tax rather than a value-based tax.

Overall, California has sold more than $14 billion in adult-use taxable products since its 2018 launch.

The first state to launch adult-use cannabis sales, Colorado’s established retail market continued to grow with more than $1.82 billion in sales in 2021, representing a 4.35% increase from 2020, according to data from the Colorado Department of Revenue.

Colorado’s adult-use sales represented roughly 82% of the legal market in 2021, with medical sales totaling $404.4 million for the year. Medical cannabis sales represented an 8.6% decrease from 2020.

Since 2014, the state has recorded more than $12.4 billion in combined legal cannabis sales.

Colorado’s $429 per-capita adult-use sales figure for its 21-and-over population was the highest in the nation last year.

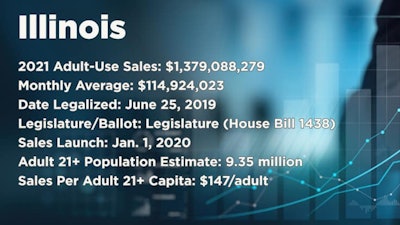

Boasting the third-largest adult-use cannabis retail market in 2021—behind California and Colorado—Illinois recorded nearly $1.38 billion in sales for the year, representing a 106% increase from 2020.

In-state resident sales exceeded $943 million in 2021, or roughly 68.4% of the total sales, according to the Illinois Department of Financial and Professional Regulation (IDFPR).

Out-of-state resident sales accounted for more than $436 million, with Illinois surrounded by neighboring states where commercial sales for adult-use and medical cannabis are not yet available, including: Indiana, Wisconsin, Kentucky and Iowa. On Illinois’ western border, Missouri only has a medical cannabis program.

The state’s 2021 cannabis sales come during an extended legal saga involving the issuance of 185 new dispensary licenses. Illinois ended up conducting a three-part lottery process in July and August for those licenses, 110 of which were for social equity applicants. Even then, IDFPR officials admitted a blunder in their process.

Most recently, an Illinois judge lifted an injunction in March that had previously barred state officials from issuing 60 craft grower licenses.

Nearly four years after Maine voters passed Question 1 in the November 2016 election, the sate launched adult-use cannabis sales in October 2020.

The second-smallest state by population to roll out adult-use retail in the U.S., Maine recorded more than $81.8 million in sales during its first full year in 2021. Only Alaska has a smaller in-state customer base.

But Maine’s retail market was up against a participation rate that only included 10% of municipalities opting in to allow licensed dispensaries to set up shop in their boundaries during the first year of the program—from October 2020 to October 2021—according to data from the state’s Office of Marijuana Policy.

While Maine is a smaller state, a great deal of its economic impact comes from tourism. Even while COVID-19 restrictions took a toll on tourism throughout most of 2020, Maine still attracted 12.1 million visitors whose spending generated nearly $9 billion in economic impact, according to the Maine Office of Tourism’s 2020 Economic Impact and Visitor Tracking report.

In 2021, Maine’s adult-use cannabis sales peaked at $10.1 million August. Among the eight states tracked in this CBT report, Maine was the only one to generate record sales figures for that month.

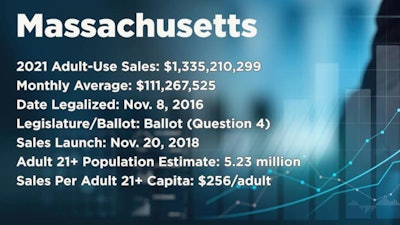

The fourth-largest adult-use cannabis market in the U.S. last year, Massachusetts recorded more than $1.33 billion in sales, according to data from the state’s Cannabis Control Commission (CCC). That figure represents a 26% increase from 2020 sales.

Since launching in November 2018, Massachusetts retailers have sold more than $2.85 billion in adult-use cannabis products, according to CCC data.

Overall, adult-use sales represented roughly 81% of Massachusetts’ legal market in 2021. Medical cannabis retailers recorded nearly $313 million in sales for the year.

With a fairly low tax structure compared to some states, Massachusetts’ adult-use cannabis is subject to a 6.25% sales tax, a 10.75% state excise tax, and up to a 3% tax as a local option for cities and towns.

Meanwhile, Massachusetts’ average price per ounce for cannabis flower remains relatively high. The monthly average cost per ounce of adult-use cannabis remained above $358 throughout 2021, peaking at $380.38 in November, according to CCC data.

With monthly adult-use cannabis sales figures more than doubling from January 2021 to December 2021, Michigan retailers recorded more than $1.31 billion for the year, according to data from the state’s Marijuana Regulator Agency (MRA).

That figure represents a 156.9% increase from 2020 sales figures, which were just taking off following the state’s December 2019 adult-use retail launch.

But the growth has been staggering since. In January 2021, adult-use sales totaled $67.4 million. By December 2021, adult-use sales eclipsed $135 million.

Overall, adult-use sales represented roughly 73.2% of Michigan’s legal market in 2021. Medical cannabis retailers recorded just more than $481 million in sales for the year.

Cannabis flower reigned king among retail products, with adult-use flower sales accounting for $652.2 million in 2021, or roughly 49.7% of the market. Overall, Michigan sold 186,128 pounds of adult-use cannabis flower for the year. Vape cartridges and infused edibles were second and third, respectively.

But those flower sales came at a time of dramatic price decreases. The average adult-use flower retail price dipped from $350.88 per ounce in December 2020 to $184.90 per ounce in December 2021—a $167 decrease in one year, according to MRA data.

In its sixth full year of commercial adult-use sales, Oregon dispensaries recorded nearly $1.1 billion in 2021, representing an 8.3% increase from 2020 sales, according to Oregon Liquor and Cannabis Commission (OLCC) data.

The U.S.’s third-oldest adult-use market—after Colorado and Washington—Oregon had the second-highest per-capita sales for adult-use cannabis at $339 for its 21-and-over population in 2021, trailing only Colorado.

Since OLCC officials began tracking cannabis sales in October 2016, the state’s adult and medical cannabis dispensaries have combined to sell more than $4.4 billion of product.

In 2021, Oregon’s adult-use sales represented roughly 91.6% of the legal market. Medical cannabis sales tallied $99.7 million for the year.

The state’s highest grossing month for adult-use sales ($100.7 million) and medical sales ($10.1 million) was April in 2021.

Representing the largest share of Oregon’s legal market, “usable marijuana” accounted for $647.9 million in 2021 sales, or 54.7% of the combined adult-use and medical retail markets.

Meanwhile, legal retailers sold $296.1 million in cannabis concentrates/extracts, or 24.6% of the combined adult and medical markets, and $131.1 million in cannabis edibles/tinctures, or 11.1% of the market in 2021.

The legal cannabis sales figures came during a time that hemp field inspections in the southern part of the state revealed a staggering number of illicit cannabis operations. More than half of the registered hemp fields tested during the 2021 summer were actually growing THC-rich cannabis, as regulators admitted they lacked the resources to eliminate the still-thriving illicit market.