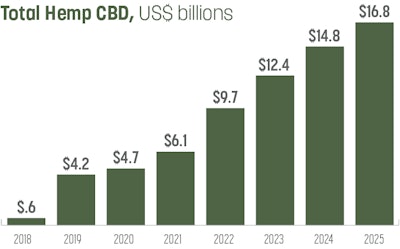

At the start of 2020, the U.S. hemp-derived CBD market was projected to reach $8.1 billion in sales, nearly double 2019 sales of $4.2 billion. With Americans facing high unemployment levels (10.2% in July 2020 compared to 3.5% in February 2020), 2020 retail sales are no longer expected to reach levels anticipated prior to the emergence of the novel coronavirus pandemic. In addition to the economic pressures faced by consumers and temporary store closures, inaction by the Food and Drug Administration (FDA) is constraining growth of the U.S. CBD market.

Price Compression

High unemployment rates and reduced disposable incomes brought on by COVID-19 are helping to accelerate price compression in the U.S. CBD industry. Increased supply has also caused crop prices to drop sharply. According to data from Hemp Benchmarks, the aggregate assessed price for hemp CBD biomass declined by 79% from April 2019 to April 2020, from $38 per pound to $8.10 per pound. Installation of more efficient hemp extraction equipment and expanded manufacturing facilities also have driven production costs down.

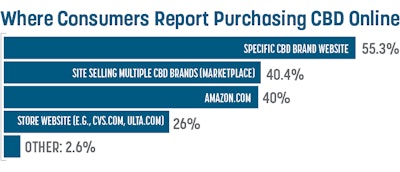

Leading CBD companies including Charlotte’s Web, Global Widget, Green Roads, and Lazarus Naturals reduced prices in the first half of 2020 and reached middle-income consumers (those with household incomes of $40,000 to $75,000). Many companies also expanded their use of online, limited-time price discounts beginning in mid-March as they responded to the stay-at-home orders that temporarily shuttered stores. Nearly half (45%) of CBD consumers and 54% of millennial consumers surveyed by Brightfield Group in June 2020 (among 5,000 people surveyed) have moved their CBD purchases online due to the coronavirus crisis. Price discounting such as “20% off sitewide” or “buy one get one at 50% off” continue to be plentiful as of early August.

Those discounts may have paid off. Compared to 2019, more middle-income consumers are using CBD in 2020 and now account for nearly one-third of CBD consumers. When deciding on a CBD product, price is the second attribute consumers consider, according to Brightfield Group’s “CBD consumer surveys” in March and June 2020 (second only to “desired effect,” or perceived ability to provide results). More specifically, consumers look for products that fit within their budget, but still deliver effective relief. CBD sales volume will continue to rise as new consumers enter the market across a range of product formats, partly thanks to more friendly pricing. However, the ongoing price compression will constrain the market's overall value growth.

Anxiety is the No. 1 ailment consumers report using CBD to treat, with 42% indicating they turn to CBD for relief, according to Brightfield Group’s consumer insights. Depression and insomnia rank second and sixth, respectively. And 39% overall indicated they are using more CBD because of the COVID-19 crisis. This sentiment was even higher among millennials and Gen Zers when examining responses by generation. Over half of millennials (51%) and 48% of Gen Zers have upped their CBD consumption, compared to 40% of Gen Xers and 17% of boomers.

Other Factors

Although hemp cultivation is legal, CBD products remain in regulatory limbo as the FDA does not currently allow CBD products to be marketed as dietary supplements or food additives. In the likely case the FDA creates a regulatory framework for CBD to be marketed as a dietary supplement and used as a food additive, the hemp-derived CBD market is expected to grow to $16.8 billion by 2025.