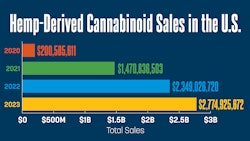

The U.S. hemp-derived cannabinoid market is “conservatively” estimated to be $28.4 billion, according to Whitney Economics’ “2023 National Cannabinoid Report,” making the market size the same as the 2022 craft beer market.

Craft beer retail sales increased 5% in 2022 (the most recently available data), to $28.4 billion, and “account for 24.6% of the $115 billion U.S. beer market (previously $100 billion),” according to the Brewer’s Association.

Whitney Economics’ report used three demand models to provide “low,” “mid” and “high” estimates of the U.S. hemp-derived market size (more on this below); its “high” market estimate—estimating sales of hemp-derived cannabinoids at $35.8 billion—puts the hemp-derived cannabinoid market well ahead of the craft beer market. The report’s “low” estimate of $21.3 billion falls shy of the 2022 craft beer market. (The “mid” estimate is $28.4 billion.) All ranges are considered by Whitney Economics to be conservative, as they don’t include sales from gas stations, grocery stores and dispensaries.

The report, which accounted for sales of all cannabinoids including cannabidiol (CBD) and intoxicating cannabinoids, found that CBD sales comprised roughly 10% of the total market, according to Beau Whitney, who founded the cannabis and hemp data and analytics firm in 2014.

"The $28.4 billion is the total addressable market (or market potential)," Whitney told Cannabis Business Times. "Of the $28.4 billion, $21.3 billion was in states that either allowed the sale of hemp-derived products or allowed them under certain restrictions and $7.1 billion is considered gray or illicit sales. So $21.3 billion of the market is already realized through legal sales."

Market estimates were based on responses to a national survey, conducted in 2023, from 800 hemp cultivators, manufacturers, distributors and retailers in 45 states.

The low estimate was based on “each state’s survey responses,” according to the report, taking into account “average revenue per store (from only the responses), multiplied by the number of stores in the state.”

The mid estimate (or the midpoint forecast) “examined the average sales per store, spread out over multiple states and geographies. Average sales figures were then applied to all stores in a given state,” as explained in the report methodology.

The high estimate demand model outlined in the report “examined the per capita spending for CBD and cannabinoid products. It considered all citizens 18 years and older. The per capita spending was calculated by examining sales in known states, and then dividing the total spends by adult population. This was averaged out over several states. Then, per capita spending was applied to the adult-populations in every state.”