When Lex Corwin founded Nevada City, Calif.-based Stone Road Farms in 2016, almost 100% of the company’s accounts were collect on delivery (COD).

It was a simple model: A retailer would order products, Stone Road would deliver it, the retailer would pay for the products, and then sell them and reorder.

Corwin says roughly 35% of Stone Road’s customers were COD at the start of 2021, and now, only 8% of the company’s customers pay immediately upon receiving products.

It’s one of several major issues in a market that Corwin describes as “inherently broken.”

Still, Stone Road rounded out last year with 50% year-over-year growth from 2021 as the company scales nationally with branded products in more than 400 retail outlets across California, Oklahoma, Massachusetts and Michigan.

The secret to Stone Road’s success, Corwin says, lies in maintaining a lean team—which consists of just Corwin and Chief Operating Officer Sabrina Wheeler—effectively telling the brand story, scaling back the number of SKUs and offering consistently high-quality products.

‘The Industry Is in a Really Bad Place’

Corwin describes the cannabis industry’s current economic conditions—especially those in California—as a “rob-Peter-to-pay-Paul scenario,” where retailers don’t pay brands, so brands can’t pay manufacturers, and then manufacturers can’t pay farmers.

“These are the people who literally grew the damn stuff that’s stocked on every shelf in the state,” he says. “Frankly, it’s not fair, and you are going to see so many people leave the industry, especially smaller, family-owned operators. … And then the consumers are going to be left with the big alcohol and big tobacco suite of brands, where it's 10 holding companies that each have 10 different brands, and you’re going to go into a dispensary and there aren’t going to be any cool, small brands left. They’re going to be completely run out of business. It’s an unfortunate reality, but it’s happening so much faster than people think [and] than consumers even know.”

Corwin says “the industry is in a really bad place” and that Stone Road is “operating in an inherently dysfunctional market.”

So much has changed since Stone Road initially opened its doors, but Corwin points to nonpayment from retailers as one of the core problems in California’s market.

Corwin says retailers who employ these practices are destroying relationships with brands—and fast—but in a crowded market like California, dispensaries seemingly always have new brands to take the place of the ones from brand owners who have severed ties.

“That’s not how most companies are run,” he says. “Have you ever met any other industry where you’re chasing after 20 percent of your open invoices for 120, 150 days? It doesn’t exist because other industries frankly wouldn’t put up with it. [It’s] because the cannabis industry is still so new and still has the legacy of a ‘black’ market that it’s even allowed.”

As an April deadline for excise taxes rapidly approaches, Corwin says that some of the stores owe up to hundreds of thousands of dollars in taxes to the state, which will not be as forgiving as California’s cannabis brands if the bill remains unpaid.

“They’re going to pull your licenses, they’re going to liquidate your assets, and they’re going to completely clear out your bank account to get their money,” he says. “That’s a luxury that many cannabis brands just frankly do not have.”

An All-Natural Product at an Affordable Price Point

Corwin has been growing cannabis since 2009, when he was just 16 years old. He says that while the industry is currently “dysfunctional,” he has learned how to successfully operate his business through working with the right vendors and constantly pivoting to meet the market where it is.

Since it launched nearly seven years ago in California’s medical cannabis industry, Stone Road has been able to earn a prominent place in the market through consistently high-quality products.

The team has been cultivating cannabis on the same property for six years, providing products that consumers actually want to buy, Corwin says.

“There are so many brands that bring products to market that the cannabis industry is either one, not ready for, or two, there’s just not a big enough group of people to support it,” he says. “It’s an unfortunate reality but it’s a reality nonetheless, [that] 80 percent of the market in California is supported by the 20 percent [of consumers who are] ‘super heavy users,’ the people consuming every day, multiple times a day. We see it all the time—it’s the people that know the budtenders’ names and they come in every day or every other day or once every three days. Yeah, they might only be buying an eighth and a few prerolls, but they’re such consistent buyers. They’re the ones who are really keeping us in business because we’re creating really tasty, really fresh, really affordable, really potent product.”

Stone Road doesn’t use artificial terpenes or additives in any of its products and instead opts to “let the product speak for itself,” Corwin says.

RELATED: How Stone Road Farms’ Lex Corwin and Blake Kelley Work: Cannabis Workspace

The company’s biggest issue in past years has been inconsistent batches, where two or three good batches of cannabis were interrupted by a bad batch that didn’t meet Corwin’s standards.

“It went against everything we were trying to do,” he says. “We wouldn’t put out anything we wouldn’t consume ourselves, and we lost sight of that. We were so bogged down in the regulatory craziness of the industry where it’s like, OK, we either put out this product even though we don’t think it’s that great, or we don’t have any product to put out at all. So, we put it out, and it of course backfired where retailers are disappointed, consumers are disappointed, so now, … I personally see, smell [and] smoke every single SKU before it goes to market. And if it doesn’t pass the Lex smell test, we don’t put it out.”

Stone Road has scaled back its product line and the number of SKUs it offers and has gone back to basics, focusing on the company’s strengths.

And with many retailers taking up to 150 days to pay for products—and many more not paying their bills at all—Stone Road has cut the number of retailers it serves by half.

“Scaling back our product line, scaling back the number of SKUs we have in the market and just focusing on the things we do really well—an all-natural product at a really affordable price point—is obviously resonating with the market,” Corwin says.

Stone Road has also brought sales in-house, eliminating third-party sales teams that cost upward of $30,000 per month. The Stone Road team now tells its own brand story to secure a spot on dispensary shelves, as well as manages every other aspect of the business, from finance to marketing, only outsourcing public relations, accounting and legal counsel.

When the team trains budtenders on Stone Road’s products, it shares three core pillars that the retail staff can talk over with consumers.

The first is value.

“We own our supply chain,” Corwin says. “We’ve cut out all the middlemen. We do the cultivation, the manufacturing [and] the packaging, so we can bring a higher quality product than our competitors.”

Stone Road’s second pillar is sustainability. The 57-acre farm in Northern California is completely off grid, and the team only grows cannabis on 10,000 square feet of the property, leaving most of it “completely wild and untamed,” Corwin says. The farm uses solar power, draws water from its own well and makes its own compost teas.

“We don’t use any sprays—we just use ladybugs and predator mites,” Corwin says. “That obviously differentiates us a lot, and it resonates with both the staff at shops and consumers.”

The company’s third pillar is inclusivity.

“When I was starting Stone Road, I never saw myself as a young gay guy represented in any of the marketing,” Corwin says. “You had the bearded Mendocino white farmer, and then you had the heavily tattooed girl by the pool taking a dab in Palm Springs. And I was like, well, I don’t subscribe to any of those marketing campaigns, … so let’s create something that shows the cannabis community as it actually is.”

Stone Road has been so underfunded the past few years that the company has leaned into the community to generate content for its Instagram page.

“We post so [many] user-generated photos and videos on our Instagram that people can see and feel the authenticity because these are people who felt so connected and touched by the brand that they went to our website, found our email, reached out and said, ‘I really want to do this, I’m not going to require a lot of money, just let me create for you guys,’” Corwin says. “It’s just another aspect of the brand [that’s] definitely been a major key to our success.”

Another key to the company’s success: Stone Road has raised its prices despite the downward trending market because the team believes it’s bringing something unique and valuable to consumers.

“I’ve said this before, and I’ll say it again: There’s really not room for white-label brands in California,” Corwin says. “Ultimately, if you don’t control most, if not all, of your supply chain in California, there’s just really no room for you. There are too many good cultivators, there are too many good manufacturers, and there’s just no place for mediocre product, even if they are value priced.”

Giving Up Is Not an Option

Despite the continued challenges, Corwin says he will never give up on California’s market—or bringing the Stone Road brand to other markets across the country.

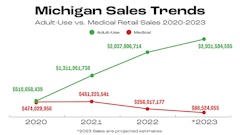

The company is now in the process of expanding the brand to several new markets; after its Michigan launch, the company plans to bring its products to New Mexico and Connecticut, bringing the total number of states it operates in to six.

“We have such a lean operation at this point that we can operate within virtually any environment,” Corwin says. “That’s also just a testament to my team. I have one employee, Sabrina, and we do everything in house. … If you count out-of-state sales, we would’ve done a hair under $5 million last year with two people running the whole thing. It’s ridiculous, but that’s just the way you have to be right now.”

While price compression and other issues are plaguing cannabis markets across the country, Corwin says it’s the worst in California. In smaller markets, he says retailers can’t afford to ruin relationships with their vendors simply because the brand selection is so limited.

“They all talk to each other, … [so] if one retailer isn’t paying a bunch of brands, the other brands aren’t going to service that retailer, not only because they’re afraid of not getting their invoice taken care of, but because it’s a much smaller industry where everyone knows each other more,” he says.

California is the only state where Stone Road has had to initiate legal action to get invoices paid; the company is currently in the process of taking action against roughly 15 retailers who have taken in over $10,000 worth of products from Stone Road without paying for them.

“It’s unacceptable, and we’re not going to take this sitting down,” Corwin says. “We’re going to get our money one way or another.”

If he could get one law passed in California to fix some of the challenges his business is currently facing, Corwin would prohibit operators from implementing net terms for invoices.

“If you want an order, if you want our products, [then] you can buy them and pay for them on delivery,” he says. “We have a number of retailers who do it and they’re very successful and their money management is by far the best, and there’s no reason other stores aren’t able to do this.”

Corwin would also like to see a system where the state denies license renewals for licensees who owe outstanding balances to vendors.

“For us, we’re open and we’re hoping,” he says. “We’re a member of all the big trade groups, and we are putting our money and focus and effort behind basically exposing these bad actors and setting up legal mechanisms where they wouldn’t be allowed to do this.”

In the meantime, despite the turmoil, Corwin expects another year of growth for Stone Road, not only in California, but in its other, newer markets across the country.

“In Massachusetts, we’re absolutely crushing it there,” he says. “We’re about to launch [in] Michigan, so for us, we’re expecting another year of 50-percent-plus growth. We have new SKUs in the pipeline. We have new markets coming up. We’re preparing for federal legalization, and we know where the industry is headed.”

The industry isn’t going anywhere, he says, and Stone Road will continue fighting for a place it the market.

“We’ve had a lot of setbacks in the past few years, but the industry can’t stay down forever,” Corwin says. “It’s a multibillion-dollar industry with millions of customers. So, for us, it’s just positioning ourselves as a reliable, go-to source for high-quality cannabis products that aren’t going to break the bank, and ultimately a marketing and branding scheme that people from all walks of life can really subscribe to."

.png?auto=format%2Ccompress&fit=crop&h=141&q=70&w=250)