Just as the pandemic influenced consumer buying habits, inflation is following suit. But how that plays out in cannabis has yet to be seen. 2022 data on transaction volumes and average baskets showed little movement from last year.

Among this year’s research participants, 38% report “100 or fewer” transactions on average each day per location (see p. 8 for data). Almost three-fourths reported average single-location daily transaction volumes of 250 or fewer.

Average spend per customer, after state and local taxes, also stayed close in line to last year. Just over half of 2022 study participants (51%) reported average baskets between $41 and $80—almost identical to 2021. Less than 1 in 20 average more than $201 per ticket after state and local taxes.

Cash is still king of accepted payment methods for retail cannabis sales transactions. Nine out of 10 participants accept cash. But debit cards—now accepted by 55% of participants—gained 15 percentage points from 2021. “Cannabis-specific cashless payment processing services” gained, too. Now accepted by 25% of participants, these services are up 10 percentage points.

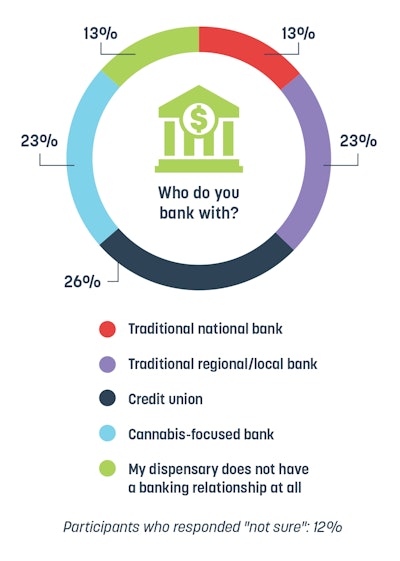

Despite industry financial concerns, banking relationships look brighter. Only 13% of participants indicated “my dispensary does not have a banking relationship at all”—a decrease of 10 percentage points from last year. “Credit union” showed strong, banking 26% of participants. Banking relationships with “cannabis-focused bank,” cited by 23% of study participants, increased 7 percentage points from last year.

Click here to view the 2022 State of the Cannabis Dispensary Industry Report.