The 2021 legislation passed by the Virginia General Assembly spells it out clearly: Adult-use cannabis sales by licensed retailers can begin on Jan. 1, 2024.

That provision of Virginia’s nearly 300-page adult-use cannabis legalization bill—signed by former Democratic Gov. Ralph Northam last April—was codified, meaning it does not require “reenactment,” or a second legislative vote.

But public policy experts who have a boots-on-the-ground presence in the commonwealth aren’t necessarily holding their breath.

“Yes, there is a January 1, 2024, date that’s technically codified, but the language is specific to licensees,” says NORML Development Director JM Pedini. “And so, without licensees, there can be no retail sales.”

The 2021 legislation established a Cannabis Control Authority (CCA), an oversight agency with a five-member board that is responsible for granting, suspending or revoking licenses. Under the law, the board is to award licenses for up to 450 cultivators, 400 retailers, 60 manufacturers and 25 wholesalers. Those license types were not codified in the 2021 law and were instead on the table for reenactment by the 2022 General Assembly.

The Democrats who orchestrated Virginia’s 2021 bill lost control of the House and the governor’s office last November—turning the state’s political structure from blue to purple—and the 2022 General Assembly (notably House Republicans) failed to reenact the legislation.

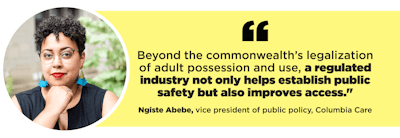

“Half the bill is basically just dead; it didn’t get enacted,” says Ngiste Abebe, vice president of public policy at multistate cannabis operator Columbia Care. “There are folks who’ve talked about, like, ‘They have to start [adult-use] sales in 2024.’ And they don’t actually. If they don’t have any license types that are codified, and regulations aren’t promulgated, then you can’t actually start sales in 2024. You need a lot more than one sentence to get that done.”

A medical cannabis licensee in Virginia, Columbia Care has four dispensaries in the commonwealth—two under its flagship Cannabist brand and another two under gLeaf, following its 2021 acquisition of Green Leaf Medical. The company has plans to open eight more retail locations in the state to support the growing medical program.

In Virginia, a state of roughly 8.6 million people, five medical cannabis licenses were established for five Health Service Areas (HSAs), but only three companies are currently operating in the state: Columbia Care with two licenses; Jushi Holdings with one license for its four Beyond / Hello dispensaries; and Green Thumb Industries with one license for its four Rise dispensaries following its 2021 acquisition of Dharma Pharmaceuticals. (Editor’s note: Green Thumb Industries declined an interview request.)

The Virginia Board of Pharmacy currently lists a vacancy in HSA I, which encompasses the northern region of the state that borders West Virginia, because that provisional license remains tied up in a lawsuit following the failed 2019 merger between Los Angeles-based MedMen Enterprises and Chicago-based PharmaCann Inc.

MedMen did end up acquiring the subsidiary PharmaCann Virginia LLC and its HSA I license as part of a debt settlement package following the failed merger, The News Leader reported in March 2021. However, In June 2021, the Board of Pharmacy denied MedMen’s request for a reinspection extension of PharmaCann Virginia LLC’s Staunton facility (which had missed a deadline to become operational), rescinded the conditional license and denied MedMen’s application for a pharmaceutical processor permit. But the board can’t award the HSA I license to a new entity while PharmaCann Virginia disputes the rescinded permit, which is tied up in the Virginia Court of Appeals after a circuit court ruled in the Board of Pharmacy’s favor earlier this year.

In an additional twist to the HSA I storyline, Chicago-based multistate operator Verano Holdings Corp. expressed interest in entering the commonwealth’s medical market by acquiring PharmaCann Virginia LLC. In a Securities and Exchange Commission filing for Q2 2022, Verano officials disclosed that the company entered into a $5 million definitive agreement on July 7, 2022, to acquire all of the issued and outstanding equity interests in PharmaCann Virginia LLC.

Verano officials declined to comment for this article.

In addition to Columbia Care, Jushi Holdings also has plans to solidify its footprint in the state’s medical cannabis market—with or without the reenactment of adult-use legislation, says Trent Woloveck, Jushi’s chief commercial director. In addition to its dispensaries in Alexandria, Fairfax, Manassas and Sterling, Jushi plans to open Beyond / Hello locations in Arlington and Woodbridge. Jushi’s license in Virginia’s HSA II includes the most populous counties in the state.

“Jushi’s business decisions in Virginia are strictly being made based on the current medical program and us being able to service all of the new patients that are coming into that program,” Woloveck says. “We aren’t making any decisions around slowing down expansion of our grower/processor or opening our six retail locations based on the commercial adult-use program.”

As of April, there were roughly 47,000 program registrants with an estimated 8,000 applicants still awaiting approval when first-year Republican Gov. Glenn Youngkin signed legislation that eliminates the requirement that medical cannabis patients register with the state’s Board of Pharmacy. (Editor’s note: Read more at bit.ly/cbt-va-residency.)

“That has been huge for improving patient access because cards were taking months to get shipped from [the] Board of Pharmacy,” Abebe says. “We’ve seen that rapid expansion in the patient participation process since that was enacted. And we’ve expanded cultivation in preparation for that patient expansion and have been really thriving on that front within the medical program.”

While the state’s medical program, which began commercial sales in October 2020, continues to grow, operators like Jushi and Columbia Care are expanding and building for the future with tens of millions of dollars in infrastructure investments.

Despite focusing primarily on its medical presence for the time being, Woloveck says Jushi officials are confident a commercial adult-use program will be put in place prior to Jan. 1, 2024.

“I believe it’ll be 1/1/24,” he says of an adult-use sales launch. “I feel very confident that, given the current dynamic of what’s unfortunately happening with the illicit market, there’s a huge need from a public safety and a law-and-order perspective to get it under control. The only way to do that is to put a commercial cannabis program in place for adult use.”

Pedini echoed the sentiment that regulation provides public safety.

“Continuing to cede control of Virginia’s [illicit] marijuana market, which is valued at $1.8 billion annually, to untaxed illicit operators does absolutely nothing to achieve a policy goal of public safety,” says Pedini, who also serves as Virginia NORML’s executive director.

But Pedini isn’t so optimistic about the Jan. 1 launch date.

Pedini says state Democrats may have believed there was political gain in including the reenactment clause in the 2021 legislation, but instead, they wound up handcuffing reform in an interim phase of “legalization absent of commodification.”

“People want to focus on the stunning failure by the House [Republicans] in 2022, but let’s not forget 2021 is where the seeds of that failure were sown,” Pedini says. “[Reenactment] was done because there was a belief that there was some political value to be had by dragging it out for another year. There wasn’t. [Democrats] shot themselves in the foot. They shot Virginians in the back.”

Several other states that have legalized adult-use cannabis have experienced similar interims between a bill’s effective date and the roll out of a retail program. Vermont, the first state to legalize adult-use cannabis through the legislative process in 2018, took more than four years before officially launching retail sales this past October.

In Virginia’s case, the General Assembly does not reconvene until January 2023. The earliest industry regulations could take effect would be July 1, 2023—unless House Republicans find an incentive to expedite that process with an emergency clause. But an expedited process would require a supermajority, and those votes don’t exist, Pedini says.

Regardless, should state lawmakers pass new legislation to become effective in July 2023, CCA officials would still have to publish regulations, adopt those regulations, publish licensing application instructions, open an application portal, and then review and award those licenses.

“It’s absurd to think that a law can take effect on July 1, 2023, and then six months later the first sales could begin,” Pedini says. “Could it begin through medical operators? Yeah, absolutely. That’s why state after state after state does that.”

The million-dollar question is where Youngkin stands on the issue from his governorship—an office that the executive could leave before his four-year term expires to pursue a run for the U.S. Senate or even a 2024 presidential bid. (Those signs stem from his recent campaign appearances for GOP gubernatorial candidates as well as Youngkin dancing around a question on whether he’s committed to serving out his term, The Washington Post reported.)

In April, Youngkin proposed an amendment to establish new criminal misdemeanor penalties for people in possession of more than 2 ounces of cannabis. The amendment drew opposition from Senate Democrats, who allowed the legislative session to end without a vote on the amendment, effectively killing the overarching bill that aimed to regulate synthetically derived THC in products sold outside of the state’s regulatory oversight.

Under current Virginia law, adults 21 and older can legally possess up to 1 ounce of cannabis and home cultivate up to four plants per residence, but possessing between 1 ounce and 4 ounces is a civil violation (not a misdemeanor).

Beyond the commonwealth’s legalization of adult possession and use, a regulated industry not only helps establish public safety but also improves access, Abebe says.

“Establishing a market is not just about making businesses profitable. It’s about having access to that supply,” she says. “There are more Americans who grow tomatoes in their backyards than tomatoes grown on commercial farms. But, you know, I’m growing tomatoes in my backyard and I’m still buying ketchup at the grocery store, right?

“I think that that ability to have lots of product options and to buy tomato juice and ketchup and tomato paste and tomato sauce and marinara sauce and frozen pizza; all of those things rely on having tomatoes being available at scale. And for cannabis to have those same things, you need cannabis that’s grown at a scale beyond personal cultivation.”