Packaging creates the first impression consumers have of a product. Brightfield Group surveyed more than 500 medical patients and adult consumers in recreational states about what they want to see in edibles packaging; the results can help make your products more appealing.

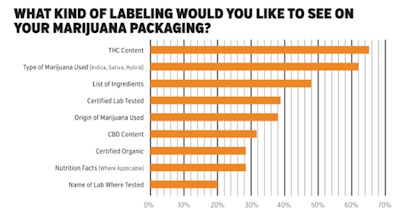

A strong majority of participants in Brightfield’s research indicated they prefer clearly labeled products regarding a number of key characteristics: more than 60 percent of consumers indicated a preference for labels outlining a product’s THC content and strain type (indica, sativa, hybrid), while almost 50 percent expressed a desire for a list of ingredients.

Many respondents also said they would like to see more products labeled with organic certification or nutritional information, reflecting the large number of health-conscious consumers in the market. (Editor’s note: While there are similar industry certifications, no product containing cannabis can be certified “organic” since the FDA, a federal organization, regulates the term’s use.)

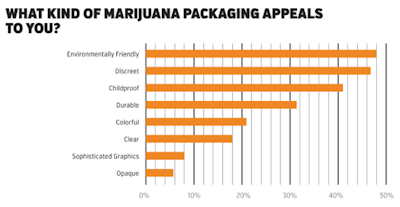

Discreet packaging, which can enable public consumption, was important for more than 45 percent of respondents.

More than 40 percent said they prefer childproof packaging, while 30 percent wanted durable packaging for storage and freshness.

The largest percentage, nearly half of those surveyed, said that environmentally friendly packaging was important.

Cannabis consumers are becoming more sophisticated and are developing loyalty to manufacturers they can trust. Creating a branded and informative package is a component of building that trust.

Bethany Gomez is the director of research for Brightfield Group, a cannabis research and analytics company. She has extensive experience in quantitative and strategic research, specializing in the market research of the consumer goods industry. Prior to joining Brightfield Group, Gomez worked with a leading fast-moving consumer goods (FMCG) market research firm, managing the company's syndicated research of industries such as packaged foods, alcoholic drinks and tobacco in Mexico.

William Honaker is an analyst with Brightfield Group. He holds a Master's degree from UC San Diego's School of Global Policy and Strategy and a Bachelor's degree from San Diego State University. Since 2015, he has been analyzing the distribution and market shares of branded cannabis products across the United States. He has also researched the statistical relationship between recreational cannabis dispensaries and criminal activity in Washington and Colorado.