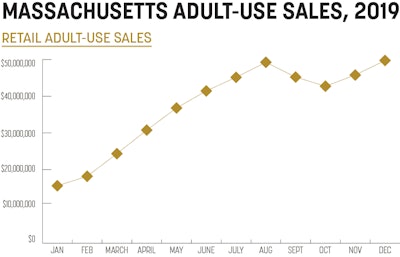

2019 was the first full year of adult-use sales in Massachusetts, the East Coast’s only functioning, regulated recreational cannabis market. By the end of 2019, retailers licensed in the state’s adult-use system grossed more than $445.1 million in sales, and Massachusetts’ Spot Price Index was the highest in the nation, according to data from Cannabis Benchmarks. Strong demand put pressure on a relatively small number of businesses to generate sufficient supply, while a temporary ban on all vape cartridges late in the year provided an interesting glimpse of the impact of such measures.

The sales total generated by Massachusetts adult-use retailers in 2019 is particularly impressive considering the relatively small number of operational storefronts. Only a handful were authorized to sell to general consumers at the start of the year, a number that grew to 33 by the end of 2019.

For context, Colorado’s adult-use market generated more than $303 million in 2014, its first year of sales. In Colorado, 150 shops were licensed to serve recreational consumers in the first month of sales, a number that increased to more than 320 by the end of 2014. (It should be noted that Colorado’s medical cannabis market racked up more than $380 million in sales in 2014; Massachusetts has not released data on medical cannabis sales in 2019 as of press time.)

As sales grew, wholesale flower prices in Massachusetts climbed. Beginning in June, when monthly adult-use sales topped $40 million for the first time, the state’s monthly average Spot Index began an upward trek that would be uninterrupted for the remainder of the year, save for a marginal downturn in December. (Massachusetts’ Spot includes wholesale transactions from both the adult-use and medical markets.)

Twenty-two cultivators had received permission to grow for the state’s adult-use sector by the close of 2019. Massachusetts growers harvested fewer than 260,000 plants in 2019. Monthly harvest totals stabilized at between about 28,500 and 30,500 plants in Q4. Colorado did not collect such data in 2014 so a direct comparison is not possible. However, Colorado growers cut down more than 2.6 million plants in 2018, more than 10 times the number harvested in Massachusetts last year. This illustrates how much cultivation could expand in Massachusetts in the coming years.

Finally, the vape crisis that arose in late summer 2019 prompted Massachusetts officials to ban all vape cartridges beginning in late September. The ban effectively continued into December, with some vape products allowed to be sold beginning Dec. 12. Daily sales data suggests that this impacted revenue, potentially significantly.

In the last few days of September, after the ban went into effect, average daily sales dropped to about $1.4 million, down almost 9% from $1.53 million in the portion of the month prior to the ban. Daily sales in October remained depressed at $1.37 million. November saw an increase to $1.52 million, with a growing number of licensed stores possibly contributing to the boost. In December, daily sales averaged $1.31 million through the 11th, then increased to $1.76 million from the 12th onward after some vape products could be sold again. Holiday shopping almost certainly contributed to sales picking up in the latter half of December, as well.