Canada legalized cannabis edibles for the adult-use market Oct. 17, 2019, exactly one year after the date the country first legalized recreational cannabis consumption. The first approved products went on sale after a 60-day waiting period between late December 2019 and mid-January 2020 in British Columbia, Saskatchewan, Manitoba, Ontario, Alberta and Quebec.

Quebec banned the sale of any edibles of the dessert variety, presumably to eliminate their appeal to under-21 consumers. As of Jan. 8, 2020, the only legal edible product in Quebec is CBD-infused tea bags, although there are hopes of THC-infused drinkable products and cooking oil in the works.

Brands and doses

Many Canadian cannabis consumers—and likely potential consumers—either don’t know or don’t care what brands and/or dosages exist today. In fact, about one-third of those surveyed by Brightfield Group in late 2019 were unsure which brands they purchase, and about half were unsure of what dosage they prefer. For this reason, brand loyalty and purchase consistency across product formats and ratios remain quite limited, and brands have plenty of space to grow and gain traction on these fronts, including through:

- Increased exposure and familiarity: Because budtenders and retail stores are a primary source of information and exposure for a great deal of consumers in a restrictive regulatory environment, many licensed producers (LPs) are driving hard on this element, seeking to educate distributors and vendors, revisiting marketing materials, and more to educate current and potential future consumers about products, quality, safety, etc.

- Creativity: Some LPs are looking to things as simple as font design and package coloring (e.g., dosist, Chowie Wowie) to stand out. They’re also partnering with celebrities or influencers to leverage their personas and social media followings. Others are setting up vertically integrated supply chains that allow brands to promote and highlight their own products within proprietary retail outlets (e.g., “staff picks,” in-store advertising).

Channel Trends

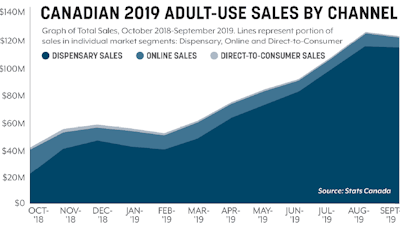

Canadian Cannabis consumers overwhelmingly prefer brick-and-mortar retail to online purchasing; today, less than 10% of adult-use sales are taking place through online channels despite the dearth of retail outlets. As provincial restrictions start to loosen around the country, we can expect to see an even greater shift from online sales to dispensary sales–especially in Ontario and British Columbia, two major population hubs that have historically stymied private retail but are opening up.

Adult-use online sales plummeted from nearly $17 million and from more than 40% of all transactions in October 2018 to less than 6% of total sales by September 2019. We expect online sales to rebound near the norm seen in other markets as additional retail establishments relieve supply pressure, 2.0 products continue to be released and consumers move along the education curve.