South Dakota voters will once again decide on adult-use cannabis legalization this year after state officials approved a legalization measure for the state’s 2022 ballot.

Secretary of State Steve Barnett validated South Dakotans for Better Marijuana Laws’ (SDBML) measure May 25, according to a local Dakota News Now report.

The measure will be titled Initiated Measure 27 and appear on South Dakota’s General Election ballot on Nov. 8, the news outlet reported.

RELATED: Voters in These 9 States Could Decide Cannabis Fate in 2022

SDBML had to gather roughly 17,000 valid signatures to get its measure before voters, and the group submitted those signatures to the Secretary of State’s office May 3.

If approved this fall, the measure would legalize the personal use, possession and cultivation of cannabis for adults 21 and older.

SDBML put forth a similar proposal in 2020 through a constitutional amendment, which voters approved alongside a separate measure to legalize medical cannabis.

The adult-use measure was then challenged in court, where a judge struck it down on the grounds that it violated the single-subject rule in the South Dakota Constitution.

The case then headed to the state’s Supreme Court, which ruled in November 2021 that it would not reinstate the voter-approved initiative.

South Dakota lawmakers then attempted to legalize adult-use cannabis legislatively during this year’s legislative session, but the bill ultimately failed.

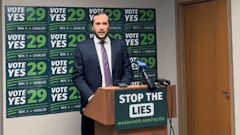

“We did it! We qualified our cannabis legalization initiative for the 2022 ballot,” SDBML Director Matthew Schweich said in a tweet May 25. “Thank you to everyone who made this possible. We are Initiated Measure 27! Yes on 27!"