Top Criteria for New Genetics

For breeders and cultivators, criteria for new genetics transcend current market trends. When it can take years to bring a new cultivar to market, breeders have to trust their tastes as they predict and drive future trends. Cultivators looking for genetics that can differentiate their operation may risk replacing stable, productive varieties with something unknown. Proven production capabilities, based on objective data, matter more than ever before.

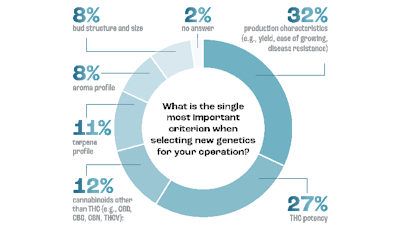

Nearly one-third (32%) of research participants in the 2023 “Breeding & Genetics Market Report” reported that “production characteristics (e.g., yield, ease of growing, disease resistance)” comprise their single most important criterion when selecting new genetics. “THC potency” was the single most important new genetics criterion for 27% of study participants this year.

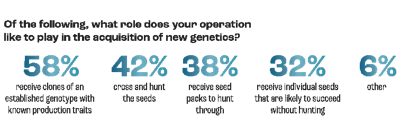

When acquiring or developing new genetics, research participants reported their operations may play multiple roles, with varying degrees of assurance in the results. More than half (58%) like to “receive clones of an established genotype with known production traits”; 42% like to “cross and hunt the seeds”; 38% like to “receive seed packs to hunt through”; and about one-third (32%) like to “receive individual seeds that are likely to succeed without hunting.”

Cannabinoid Priorities in New Genetics

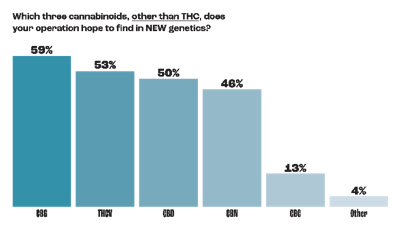

THC still clearly dominates cultivation and consumer trends, but how operations are prioritizing non-THC cannabinoids reflects market shifts. For 12% of research participants, “cannabinoids other than THC (e.g., CBD, CBG, CBN, THCV)” was their operation’s single most important criterion for new genetics.

CBG topped the list of cannabinoids other than THC that operations most hope for in their new genetics. Cited by 59% of 2023 study participants, CBG jumped 27 percentage points from 2022, eclipsing last year’s leader, CBD.

THCV also made big gains in popularity. Last year, 28% of study participants named THCV as one of their top three most-prioritized non-THC cannabinoids; this year, more than half (53%) of research participants indicated they’re targeting THCV as one of their top three non-THC cannabinoid hopes for new genetics—an increase of 25 percentage points over last year.

Half of 2023’s research participants (50%) reported CBD as a top-three new genetics priority for non-THC cannabinoids.

Terpene and Aroma Profile Priorities

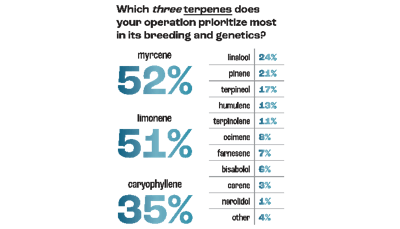

For 11% of 2023’s research participants, “terpene profile” was their single most important new genetics criterion. Terpenes being prioritized for breeding and genetics among participants in this 2023 “Breeding & Genetics Market Report” reflects distinct trends.

“Myrcene” led the list of 2023’s top-three prioritized terpenes, named by 52% of research participants. Last year’s leader—“limonene”—was close behind, cited by 51% of study participants this year. Study data revealed two interesting shifts: 35% of participants named “caryophyllene” a top-three terpene priority, up 12 percentage points from last year. Twenty-one percent of 2023 participants named “pinene,” down 18 percentage points from 2022.

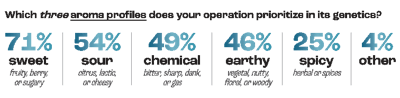

When it comes to aroma profiles, research participants in this 2023 report boosted support for last year’s leader. Nearly three-fourths (71%) of study participants cited “sweet (fruity, berry, or sugary)” as a top-three aroma priority in their genetics, a 16-percentage-point increase for 2022’s “fruity, berry” profile.

“Sour (citrus, lactic, or cheesy),” at 54%, was the second most-cited aroma profile priority for 2023 study participants. Dank lovers won’t be surprised to see “chemical (bitter, sharp, dank or gas)” close behind, cited as a top-three priority by nearly half (49%) of participants.

Refining and Improving Production Genetics

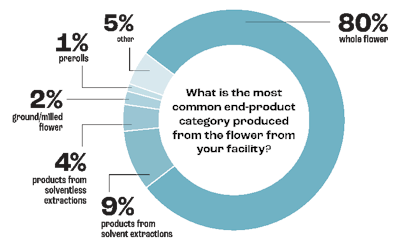

Research participants in the 2023 “Breeding & Genetics Market Report” left no doubt that flower still rules. Eighty percent of study participants reported whole flower as the most common end-product from their flower production. The closest runner-up was “products from solvent extractions,” named by 9%.

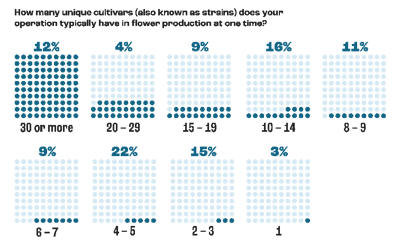

About 4 in 10 growers (39%) typically have five or fewer unique cultivars in flower production at one time—very similar to 2022 study results. (See the chart below.) Only 12% of 2023’s research participants indicated they keep more than 30 unique cultivars in flower production at once.

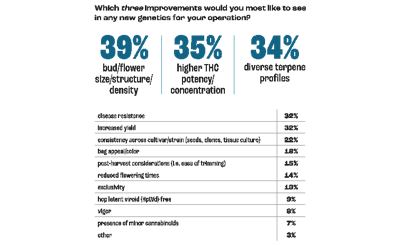

When considering three improvements they’d most like to see in new genetics, 39% of participants noted “bud/flower size/structure/density”—12 percentage points higher than 2022’s “flower structure/density.” (See the chart below.) Next on the improvement wish list was “higher THC potency/concentration,” reported by 35% of participants. “Diverse terpene profiles”—the top improvement targeted in 2022—was called out by 34% of participants this year.

Production-oriented improvements followed close behind, with “increased yields” and “disease resistance” named by 32% of participants. (That’s a 9-percentage-point bump up for disease resistance compared to 2022.)

80% of participants noted that whole flower is the most common end-product category produced from the flower from their facility.

THC Tradeoffs and Predictions

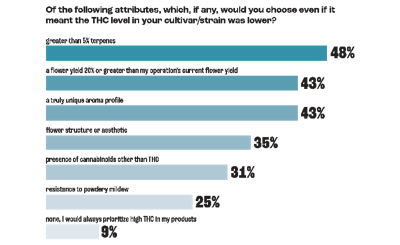

Though current consumer trends are undeniably THC-driven, growers and breeders are looking beyond THC for what comes next. When asked which attributes—if any—they would choose in genetics, even if it meant lower THC levels in a cultivar (“strain”), only 9% of research participants answered “none, I would always prioritize high THC in my products.”

Interestingly, non-THC cannabinoids was not selected by as many growers (31%) as other attributes warranting a THC tradeoff. “Greater than 5% terpenes” was cited by nearly half (48%) of research participants, while 43% noted “a flower yield 20% or greater than my operation’s current flower yield.” The same percentage noted “a truly unique aroma profile” would do the trick for them.

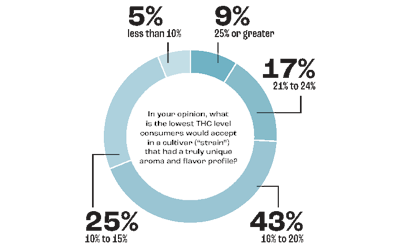

Consumers’ THC crush still has a hold, even with cultivars with truly unique aroma and flavor profiles. More than 4 in 10 research participants (43%) opined that 16% to 20% is the lowest THC level customers would accept, regardless of aroma and flavor attributes. One-fourth (25%) of study participants put the cutoff at 10% to 15% THC.

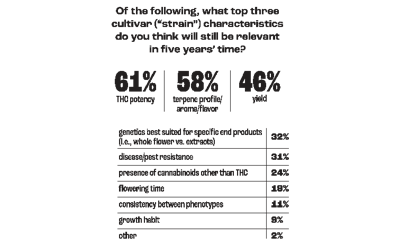

Looking forward, when naming which top three cultivar/strain characteristics they believe will still be relevant five years from now, “THC potency” led the way at 61% of participants. “Terpene profile/aroma/flavor” and “yield” were cited by 58% and 46% of participants, respectively.

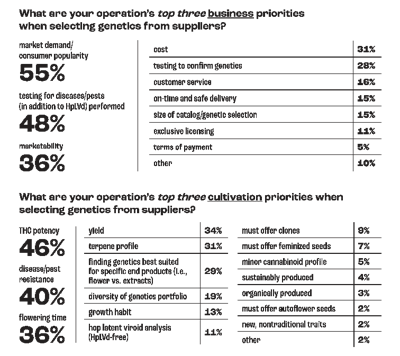

Priorities for Genetics Selection from Suppliers

More than 4 in 5 research participants (82%) in this 2023 “Breeding & Genetics Market Report” work with cannabis genetics suppliers. Of those who work with genetics suppliers, more than two-thirds (68%) reported working with three or fewer genetics suppliers in the past 12 months. About one-fifth (22%) worked with five or more in that period.

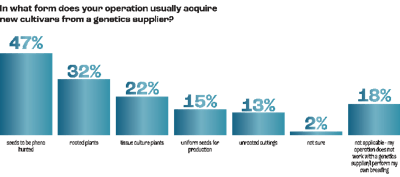

Study participants reported they may acquire new genetics from suppliers in more than one form, with seed leading the way. Almost half of study participants (47%) said they typically acquire new genetics from suppliers as “seeds to be pheno hunted.” But significant shifts appear underway.

Nearly one-third of 2023’s research participants (32%) report they usually acquire new genetics as “rooted plants,” up 11 percentage points from 2022. The big mover, cited by 22% of this year’s research participants, was “tissue culture plants”—a 20-percentage-point increase from last year.

Study results suggest research participants who work with genetics suppliers may have greater confidence in suppliers and genetics than they did a year ago. (See the chart below.) In 2022, nearly half (49%) of study participants cited “testing to confirm genetics” as a top-three business priority when selecting genetics from suppliers. For 2023, that figure dropped 21 percentage points.

For study participants who select genetics from suppliers, 2023’s top business priorities reflect consumer sway. Fifty-five percent cited “market demand/consumer popularity” as a top-three business priority, with more than one-third (36%) citing “marketability.” Nearly half (48%) deemed “testing for diseases/pests (in addition to HpLVd) performed” a top-three business priority for 2023.

When shifting from business to cultivation priorities in selecting genetics from suppliers, “THC potency” headed the list at 46%. Four in 10 study participants (40%) named “disease/pest resistance” as a top-three cultivation priority for supplied genetics. One-third (34%) of 2023 participants cited “yield,” down 17 percentage points from last year.