While Ohio was one of the first U.S. states to reduce penalties for possession of small amounts of cannabis to a minor misdemeanor nearly 50 years ago, if its citizens vote to legalize adult-use cannabis via ballot initiative this November, it will become the 24th state to legalize cannabis for adults 21 and older. After a wildly successful adult-use opening in Missouri and a business-friendly program shaping up in Minnesota, the industry is wondering: Will Ohio be another Midwest state with a triumphant adult-use opening?

Ohio’s Medical Market at a Glance

With nearly $480 million in annual medical cannabis sales in 2022, Ohio is the Midwest’s largest medical market, according to Brightfield Group’s Market Sizing Data. Its landscape is made up of 92 dispensaries, and 37 cultivators provide for the state, collectively licensed to grow up to 617,000 square feet of cannabis in total. For a state with nearly 12 million people, it will need a serious ramp-up of grow space if it expects to meet demand smoothly.

Ohio could look to Missouri as a guide. Three months into its adult-use launch, Missouri had licensed more than 1.6 million square feet of grow space to serve its 6 million residents, allowing it to avoid extreme drops in supply and meet demand at a price that’s kept consumers in the market.

Cannabis consumers continue to enter Ohio’s medical market. As of June 2023, Ohio had more than 176,000 active patients—about 28,000 more than the year prior. However, retention is another matter; there are more than 377,000 people who have registered for the program since its launch. Legislators in favor of adult-use see Ohio as falling behind other states. The state is very aware of consumers driving to neighboring adult-use states like Michigan, and lawmakers in favor of the program want cannabis dollars brought back to Ohio.

Ohio’s Cannabis Consumers

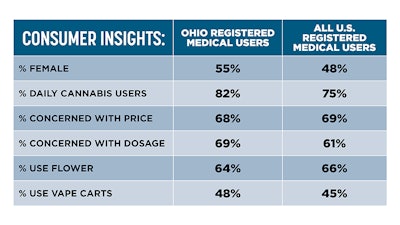

Ohio’s medical patients skew female (55%), a majority of patients consume cannabis every day (82%), and flower is the most used product type (64%), according to Brighfield’s U.S. Cannabis Consumer Insights from Q2 2023. Ohio’s medical program dictates that cannabis flower must be vaporized. And, there is a higher prevalence of disposable vape and vape cartridge use in the state when compared with other medical states, including Florida.

Ohio consumers are slightly less price-conscious than those in other states—but 68% still say price is a top product attribute. However, when compared to the general population of cannabis consumers, the dosage of a product is as important to Ohioans, with 69% listing it as a top cannabis product consideration. Anxiety, depression and joint pain are the three most common medical conditions Ohioans report they treat with cannabis.

Brands on Shelf

Brightfield Group’s research into U.S. product brands shows the landscape in Ohio includes a mix of local and multistate operators. Acreage, Green Thumb Industries, Cresco Labs, Ascend, Columbia Care, AYR and Verano are present in the state. However, at the top of both consumer awareness and dispensary distribution are local operators Buckeye Relief, Butterfly Effect, and Klutch Cannabis.

The existing brands with strong awareness and sales will be well suited to compete as new dispensaries expand the market. As of writing this article, House Bill 168 is setting the initial framework for adult-use cannabis. This bill sets a maximum of no more than one dispensary license per 60,000 residents, or about 196 licenses statewide, with the ability to consider adding more after January 2027. In contrast, markets that meet consumer demand land close to 1 dispensary per 10,000 residents, and, should Ohio move forward with this rollout, the state could eventually work up to that.

Ohio could look to Michigan and Illinois for lessons on creating a regulatory framework that grows a market. In Illinois, the regulatory hurdles have been too great for the cash-strapped license holders, hundreds of whom have failed to begin operations. In Michigan, unlimited licensing and exceedingly lower barriers to entry, while contributing to price compression, have created the second biggest cannabis market in the U.S. In 2023, the Michigan program had some of the highest sales months in the program’s history.

With a large population, strong operators and the right regulatory path forward, adult-use sales could double the size of Ohio’s cannabis market within the first year of implementation. But first, we’ll find out this November if citizens and legislators are ready for recreational cannabis in the Buckeye State.