Canada continues to face its multiyear cannabis supply-and-demand imbalance. Following a brief supply shortage when it first rolled out its federally legal adult-use program in October 2018, unpackaged and packaged products were in such surplus that they were eventually destroyed by the third full year of the program.

In 2020, Health Canada, the federal agency that oversees the country’s cannabis producers, reported that as of April 2020, licensed producers (LPs) held in excess of 600,000 kilograms (600 million grams) of unpackaged dried cannabis and an additional 46,413 kilograms (46 million grams) of packaged flower. (This was not counting what was being held in stock by distributors and retailers.) And in 2021, Health Canada data showed that “more than 425 million grams of unpackaged dried cannabis were destroyed between January and December 2021,” the Financial Post reported. “That’s 26 percent of the total dried cannabis produced.”

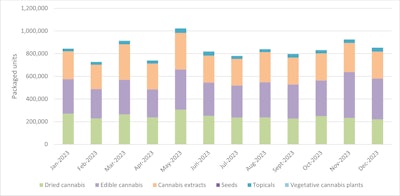

Jumping ahead to the present, most product categories’ available inventory are exceeding retail sales by a ratio of more than 3-to-1, according to fourth-quarter 2023 data released May 14 by Health Canada. Seed supply exceeds unit sales by 2,280%.

The data shows that the ratios of total packaged inventory to retail sales, for federal license holders, distributors and retailers, by product type are:

- Dried cannabis: 3.4 to 1

- Edibles: 3.6 to 1

- Extracts: 3.7 to 1

- Seeds: 22.8 to 1

- Topicals: 6.4 to 1

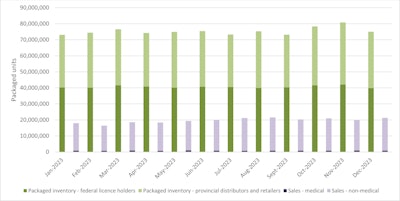

Diving into what this looks like on a monthly basis, in December 2023, 21.3 million packaged units (medical and nonmedical) were sold of 75 million packaged inventory units, leaving unsold inventory of 53.7 million units. In June 2023, packaged inventory units of 75.4 million exceeded packaged units sold (just over 20 million) by 55.4 million; and in December 2022, nearly 20 million packaged units were sold of nearly 76 million packaged inventory units, leaving a surplus of more than 56 million packaged units.

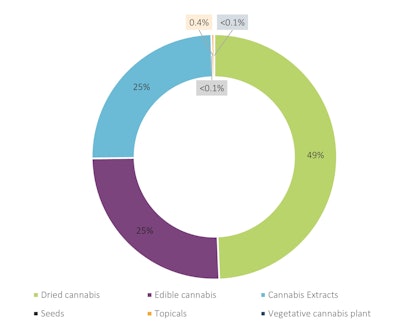

Dried cannabis flower captured the lion’s share of unit sales in Q4 2023, comprising nearly half the market (49%). Edibles and extracts tied for second in unit sales market share, each comprising 25%.

However, when looking at sales to registered medical patients, edibles and extracts each comprised a slightly larger percentage than dried cannabis flower.

In December 2023, for example, 220,774 units of dried cannabis flower were sold in the medical market, compared to 359,643 units of edible cannabis and 237,272 units of cannabis extracts.

How Much Square Footage Is licensed?

According to Health Canada’s report, the total licensed area for indoor and outdoor growing in Q4 2023 is more than 7.9 million square meters, or 85.5 million square feet:

- Indoor growing area: 1.5 million square meters (16 million square feet)

- Outdoor growing area: 6.5 million square meters (70 million square feet)

The woes plaguing the Canadian market aside, this is a 1,644% increase over October 2018, when adult-use sales launched. At that time, combined indoor and outdoor growing area totaled 452,896 square meters (4.9 million square feet). (Prior to October 2019, indoor and outdoor growing area was combined.)

Outdoor growing area at its peak, in December 2021, totaled 7.1 million square meters (76.7 million square feet).

Indoor growing area reached its peak in May 2020 with 2.2 million square meters (23.9 million square feet).