Scaling a business to nationwide success is challenging under any circumstances. But when that business operates in an industry that is rapidly shifting from minimal regulation to hyper regulation—with divergent state-to-state requirements, intense regulatory oversight and negative public perceptions about its products—success demands a unique skill set. Fortunately for Cresco Labs, it’s a skill set that co-founder and CEO Charlie Bachtell brought with him from the post-2008 housing crisis and resulting hyper-regulated mortgage industry. And it’s what has led the seed-to-sale cannabis company from its Chicago roots to having a presence in nine U.S. states—and counting.

When Illinois’ Compassionate Use of Medical Cannabis Pilot Program Act became law on Aug. 1, 2013, Bachtell was executive vice president and general counsel for residential mortgage company Guaranteed Rate. Joe Caltabiano, now Cresco’s president, was a standout in loan origination on Guaranteed Rate’s sales side.

While other companies failed following the housing collapse, Guaranteed Rate became a leader in the mortgage space, expanding from a few hundred to several thousand employees, licensed and operational in all 50 states with 150-plus brick-and-mortar offices. By engaging, embracing and excelling at regulation, the company thrived in the new era of hyper-regulated mortgage banking. “[On the surface], the [mortgage] industry was not similar to cannabis,” Bachtell says. “But in reality, it was almost like a foreshadowing of what the cannabis industry was about to become.”

Within 72 hours of the Illinois medical marijuana law’s signing—and Caltabiano’s semi-casual suggestion that the pair “sell weed”—Bachtell had written a 25-page white paper/business plan. Nearly six years later, the document still serves as the foundation for Cresco’s business model.

Today, the company operates in highly regulated states—Illinois, Pennsylvania, Ohio, Nevada, Arizona, California, New York, Massachusetts, and Maryland—with 13 production facilities, 12 retail locations and significant expansion plans for 2019. For starters, on March 18, 2019, Cresco announced its entry into the Florida market through the signing of a letter agreement to acquire VidaCann Ltd., one of the largest vertically integrated medical cannabis providers in the Sunshine State. One week later, the company announced it had been pre-approved by Michigan to move ahead with its cultivation and processing license process in that state.

Envisioning Cannabis on Every Shelf

Achieving Cresco’s current national reach happened fairly quickly, but deliberately. When Bachtell dove into his initial analysis of the cannabis industry, two things were immediately apparent: The destiny of the cannabis industry was hyper-regulation and the days of budtenders weighing out bulk cannabis on retail counters would pass.

From his vantage point, cannabis was a consumer packaged good (CPG), whether the industry realized it or not. It seemed obvious to Bachtell that—just like common foods, beverages and personal care items found in every American home—child-proof, tamper-evident, straight-from-the-manufacturer, consumer-ready packaging was the industry’s future.

“All cannabis needed was somebody to come in and help normalize it and professionalize it. Everything else was already there,” Bachtell says. “That was something we knew we could offer to the industry because of what we had just gone through in the mortgage banking space.”

Caltabiano, a childhood leukemia survivor, was already interested in the industry’s potential. Active in philanthropic activities and his own long-term cancer follow-up, he’d witnessed medical opinions shift from considering cannabis as snake oil toward viewing cannabis as a positive influence on cancer protocols and quality of life. He felt that Illinois’ medical marijuana law “made a lot more sense” than some less-regulated state programs. “It was set up in a way for people who could operate in compliance- and regulatory-based environments to excel. It spoke to us in such a unique way,” he says.

Cresco entered the Illinois market in cultivation, extraction and distribution, choosing not to stretch themselves too thin by expanding into retail at the same time. Cultivation launched in November 2015; the first sales came in January 2016. Despite Cresco’s success in the Illinois market, the state’s stringent program restricted patient counts and made out-of-state expansion attractive.

Successful Cresco applications in new, highly regulated Pennsylvania and Ohio markets followed in 2017. (Cresco was the first cultivation/manufacturing company to bring products to market and the first company to open retail stores in both states, in early 2018 and 2019, respectively.) January 2018 marked the company’s move into retail in Pennsylvania and Illinois. Then came merger and acquisition (M&A) transactions in existing cannabis markets, including California, Nevada and Arizona. With those moves, Cresco’s seed-to-sale expansion picked up speed.

“We refined our skills in a very difficult environment, which was Illinois,” Caltabiano says. “We put our framework together, we sharpened our tools, went into another market, did it intelligently, and then were able to really scale post-Pennsylvania.” Cresco’s choice of markets reflects its preference for strict regulatory environments that play to its skill sets.

“We like vertical integration, but first and foremost, we like creating consistent products for the benefit of consumers and making sure those are as widely available as possible, way outside of just the retail establishments we own,” Bachtell says. “Our priority is to get them onto every shelf, not just our own.”

Creating a House of CPG Brands

Bachtell says his experience watching other companies fail in the mortgage banking industry while Guaranteed Rate thrived also helped shape some of Cresco’s corporate values. One of those core principles—”Know Your Audience”—guides the company’s CPG approach to building brands.

Preparing for entry into the Illinois medical market, the Cresco team identified two distinct audiences: the consumer familiar with cannabis who was seeking non-clinical solutions with a wellness approach and, as Bachtell describes it, “the 70-year-old grandmother who never tried it before in her life, but her oncologist told her it will help with the nausea from chemo.”

It was clear that a single brand wouldn’t directly address either patient group. “You’ve got these two totally divergent audiences that are basically coming into the same store to effectively buy the same product, but those two audiences want it to look and feel totally different,” Bachtell explains.

From that realization, the five brands that comprise Cresco’s House of Brands were born:

- Cresco – “everyday” flower, extracts and vape pens that pair sativa, hybrid and indica offerings with color-coded “Rise,” “Refresh” and “Rest” packaging

- Reserve by Cresco – premium products featuring proprietary genetics that target more sophisticated cannasseurs

- Remedi – CBD-forward, non-combustible products in pharma-inspired forms such as capsules, salves and transdermal patches

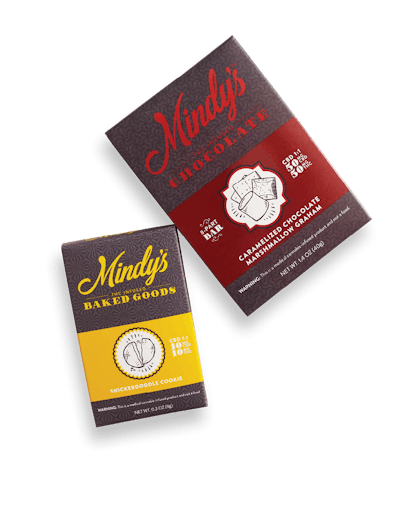

- Mindy’s Artisanal Edibles – decadent desserts infused with flavorless distillate, created by James Beard Foundation award-winning chef Mindy Segal

- Mindy’s Kitchen – hard candies, sour gummies and fruity chews

In late February, Cresco announced a new hemp-based CBD wellness subsidiary, Well Beings. Early plans call for a Well Beings line plus hemp-based CBD versions of some house brands, all designed to accelerate nationwide recognition of Cresco brands and advance Cresco products into the CPG marketplace.

“The Farm Bill and CBD gave us, the consumer products branded company, an incredible opportunity to now be able to get our brands, our portfolio, into all 50 states and, most importantly, outside of the licensed dispensary channel,” Bachtell explains. “It gave us that opportunity today.”

Building Awareness and Attracting Top Talent

From its beginnings in the Illinois market, Cresco’s marketing strategy has focused on educational and awareness campaigns, with an eye toward consumers new to cannabis.

“For the most part, up until that point, cannabis was being done by cannabis people, for cannabis people, in [parts of the country] that had a culture that embraced cannabis a lot more than Illinois,” Bachtell explains. “You needed to demystify the situation. You needed to give your customer base a baseline level of education and knowledge so they would feel comfortable wanting to participate.”

Caltabiano echoes the value of that approach. “Consumers don’t want to be told what to do. The world today wants to be educated, and they have this thirst for knowledge,” he says.

To that end, the company launched a 2015 million-dollar advertising campaign to educate Illinois residents and potential patients about the new program. By focusing on consumer education and awareness, the campaign circumvented the state’s ban on cannabis product advertising and set the stage for Cresco’s marketing approach across states.

This is very unique industry that has the opportunity to create more win-win-win scenarios than anything I’ve ever seen. ... There’s no limit to where this industry could go. – Charlie Bachtell, CEO, Cresco Labs

“We believe strongly that the best form of communicating your message is through an education platform more than a direct [traditional] marketing platform,” Caltabiano says.

In recent months, Cresco steadily added top marketing talent from outside the cannabis industry, with résumés that ring with names like Nike, PepsiCo, Molson Coors, Pfizer and Walgreens, just to name a few. How these additions will affect Cresco’s marketing efforts as the company’s footprint grows is yet to be revealed.

“Charlie and I pride ourselves on building a best-in-class team through individuals who’ve done this before in different mediums. We really try not to reinvent anything in cannabis,” Caltabiano explains. “We have this opportunity to grab people who’ve been in [other] industries and build on this baseline to make a company that’s going to be a mainstay consumable product for a very long period of time.

“When we set out to explore this journey, there were law firms who wouldn’t work with us. There were people hesitant to engage in the business,” he shares. “Now to see this blossoming of the industry, where you’re able to draw talent from various industries … where you’re seeing this exodus from other industries into the cannabis industry is an incredibly exciting thing.”

Scaling Cultivation to Meet CPG Goals

The journey, it would seem, is just beginning. Cresco’s current cultivation footprint—spread across indoor, greenhouse and seasonal open-field production—totals approximately 357,000 square feet; the company’s 2019 year-end cultivation projections show more than triple that amount.

Achieving and maintaining CPG success demands product reliability, consistency and unwavering availability to patients, consumers and wholesale customers. Responsibility for finding the sweet spot where CPG-level production and Cresco quality intersect falls to Jason Nelson, Cresco’s senior vice president of production.

People who’ve been working in this space should feel good about where we’re going. Obviously, there’s going to be a mountain of challenges in any new emerging industry. – Jason Nelson, SVP-Production, Cresco Labs

Nelson brings his own unique skill set to the team, blending academics with hands-on cannabis expertise. An undergraduate agronomy degree and several years in the early Southern California cannabis market were followed with a master’s degree in floriculture and horticulture, personally and surreptitiously tailored to support large-scale cannabis greenhouse production and nutrition. Several years in cultivation with one of Denver’s largest vertically integrated operations during the state’s transition from medical to recreational came next.

Having had a front-row seat to Colorado’s subsequent price compression, Nelson remains acutely aware of the necessity of sustainable production models, while still supporting the product variety that customers demand.

In late February, Cresco announced a new hemp-based CBD wellness subsidiary, Well Beings.

At any one time, Nelson has 20 to 30 cultivars in production per market. Cultivars vary from market to market, depending on the production site, the market’s needs and its consumer preferences.

“In a given market, it has to be roughly 20 to 30 to match all the patient needs. As far as sativa, hybrid and indica, we typically have four to five each of those, plus two to three CBD cultivars. We also have our Reserve genetics, which tend to flow between five and seven strains, depending on the market,” he explains.

Venture inside Cresco production facilities and you’ll find plants growing in a peat-based soilless substrate with custom-mixed liquid nutrition—all fed and watered with the same solution, at the same time, on the same intervals. Nelson credits his academic research with enabling him to find and maintain essential balance across multiple facilities.

“The key is to have a production method that allows for success across all those cultivars without having to manage cultivars on a table-by-table or space-by-space basis. For revenue forecasting and all the things that allow a company like us to have success, you have to be able to grow all those cultivars as consistently as possible, with the highest quality possible, at the largest scale. That’s where the challenge really starts to come into play,” Nelson says.

To meet that challenge, Nelson relies on soluble nutrients, with some liquids added, for a custom nutrient solution mixed in house to his specifications. “It’s really very difficult to scale effectively and sustainably on a pre-dissolved or liquid nutrient regiment that locks in specific nutrient ratios,” he explains.

When we set out to explore this journey, there were law firms who wouldn’t work with us. – Joe Caltabiano, President, Cresco Labs

A second essential to Nelson’s system is a substrate that allows sativas and indicas to remain on the same schedule despite natural, size-related differences in moisture-consumption rates. “You need to develop a scalable substrate that allows sufficient moisture to be applied to sativas to not let them flag or dry out and, by extension, keeps indicas comfortable as well,” he says.

Cultivar selection also plays a role. “Commercial production is a gauntlet. … Genetics are entering a new phase where it’s large-scale commercial production. That’s a very intense scenario for the plant itself,” Nelson says. “There’s a lot of breeders out there who aren’t selecting for stabilized characteristics. … If you’re not selecting for those characteristics, it’s going to be difficult to get those genetics to play well at acres upon acres at a time.”

Nelson points out that economies of scale inherently affect quality. “At Cresco, we put a high precedence on quality, with a more consistent supply and larger volume. I think that’s where we have the most success—finding a production model and being able to establish and refine that production model to allow high quality and scalability.”

Looking Toward the Next Milestones

Cresco’s momentum seems to be building, beyond its increasing national footprint. The company closed a $100-million round of private funding in October 2018. Then a reverse takeover of a Canadian company opened the door for Cresco’s December 2018 debut on the Canadian Securities Exchange (symbol “CL”). On March 6, Cresco announced shares had been approved to trade on Over-The-Counter (OTC) Markets under the symbol “CRLBF.” (Because cannabis remains illegal under U.S. federal law, U.S. cannabis companies are not allowed to trade on U.S. stock exchanges such as the New York Stock Exchange (NYSE).)

Bachtell notes key milestones in the company’s history, from its substantial market share in Illinois to its first-to-market status in Pennsylvania and Ohio, as examples of the company’s ability to “execute” in new cannabis markets.

There’s a lot of breeders out there who aren’t selecting for stabilized characteristics. ...If you’re not selecting for those characteristics, it’s going to be difficult to get those genetics to play well at acres upon acres at a time. – Jason Nelson, SVP-Production, Cresco Labs

“The next thing for us will be when we show everybody how we’re going to execute in existing markets that we didn’t help start,” he says. “I think you’ll start to see some good things from us in these prior existing markets, like in Arizona and California.”

Cresco’s team expects to face increasing regulation and complexity, heightened competition and rising consumer expectations, but Bachtell, Caltabiano and Nelson all exude optimism, confidence and gratitude at where they are now and what lies ahead.

“When we first looked at this thing when the law passed in Illinois, I knew within 24 hours that it was the most fascinating thing I had ever seen, and that hasn’t stopped,” Bachtell says. “This is a very unique industry that has the opportunity to create more win-win-win scenarios than anything I’ve ever seen. ... There’s no limit to where this industry could go.”