CBD is infused in everything from sparkling water to vape pens and bug spray. As interest grows and dollars flow into the market—which is projected to have reached $591 million in 2018 and skyrocket with legalization—the question on everyone’s lips is: What’s the next big thing?

Cannabis market research firm Brightfield Group, which has focused a great deal of research on the U.S. CBD market, has seen various indicators among manufacturers, consumers and retailers that the following products will be the hottest CBD trends in 2019.

Drinks

Drinks are a hot product in general, with soda alternatives like LaCroix, Bubly sparkling water and a number of infused beverages (Bai Antioxidant Infusions, KeVita Sparkling Probiotic Drink, etc.) swooping in to gain market share from declining sugary soda sales.

CBD-infused beverages are a natural fit to compete in the popular beverage market. Not only is CBD widely recognized for its wellness benefits such as anxiety reduction, sleep aid and pain management—CBD beverages can also take the form of water, sparkling water, tea, coffee, energy shots, beer, wine and more. In turn, this multiplies the number of dosage options and available target markets. A number of hemp-CBD product manufacturers are headed in this direction, aiming to compete with, or be acquired by, large corporations who have their eyes on the CBD space and who are ready to pounce come commercial hemp legalization.

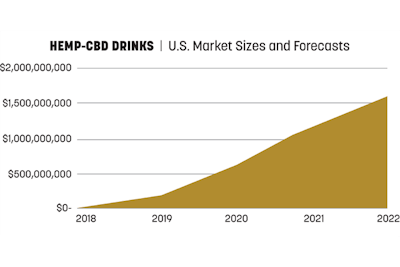

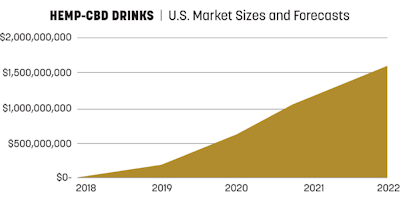

For these reasons, drinks are expected to be a huge CBD growth area, projected to jump from a $12 million market in 2018 to a $200 million-plus market in 2019 with a compound annual growth rate (CAGR) of 242 percent through 2022.

Pet Products

Only a handful of pet CBD-focused brands (e.g., Pet Releaf) have gained traction in the market thus far, along with some larger CBD brands with existing pet lines in their portfolios (e.g., Charlotte’s Web Holdings). But CBD pet products are beginning to pique the interest of an increasing number of pet owners around the country who have seen or heard about its positive effects on furry family members. A number of additional major CBD manufacturers are beginning to take notice and develop their own lines of pet products, such as Mary’s Nutritionals (Whole Pet) and Isodiol (PawCeuticals). Direct sellers (aka affiliate programs) have also seen great growth in pet product sales.

The pet CBD market has an expected 2018 to 2022 CAGR of 195 percent, outpacing the general CBD market’s CAGR of 147 percent for the same period.

Topicals

Another area where consumers and manufacturers are focusing more attention is topicals—especially when it comes to specialized formulas such as those tailored to the beauty, skincare or sports medicine industries. Given topicals’ rapid-release formulas and reported efficacy against inflammation, pain and various skin conditions, and their ability to be formulated into an endless number of varieties and products for various consumer segments, these products have excellent long-term sales potential.

Beauty and skincare topicals are expected to have a whopping five-year CAGR of 214 percent.