Such eye-opening predictions aside, and despite the fact that California legalized medical marijuana 20 years ago, the industry, really, is in its infancy. Even California is facing a regulated market for the first time, and growers in The Golden State will be adapting and learning like everyone else.

The industry also still faces major challenges with the Federal Government. So, while growers are operating fully legal businesses in their respective states, the Fed’s illegal label on the plant causes many to continue to look over their shoulders, remain in the shadows and even use aliases when discussing their businesses in public or with the press.

Those challenges, combined with a lack of focus on cannabis producers, have left data wanting on this industry segment — the roots, so to speak, of the market.

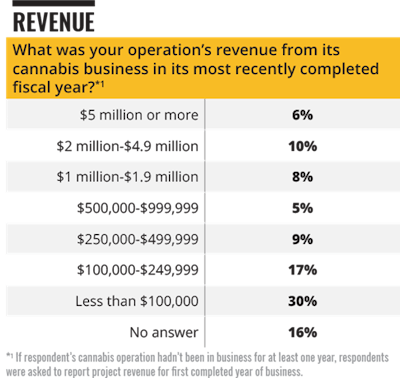

Cannabis Business Times set out to remedy that by conducting research on cannabis cultivators, examining important trends, their facility choices and size, plans for growth, revenue generation, energy spending and more.

In this special “State of the Industry” report, we present to you the results of this important research project, managed by Readex Research, an independent third party and leader in market research. Here’s what we found.

Click here to read the full State of the Industry Report.