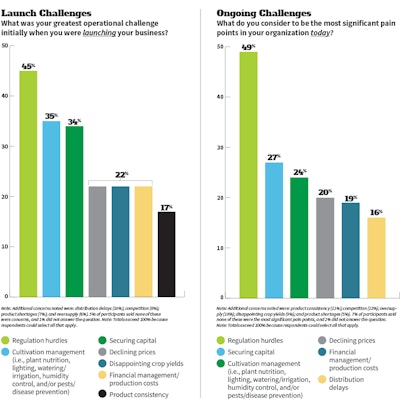

Top Operational Hurdles: Regulations, Cultivation Management

When cultivators launch operations, they often grapple with complex regulations, environmental factors and financial challenges. Growers participating in Cannabis Business Times’ “State of the Cannabis Nutrients Market” study indicated that these issues were significant challenges during their start-up phase. Given the number of factors involved in running a successful growing operation, it’s no surprise that cultivators also often struggle with effective cultivation management, which includes plant nutrition—a critical process that can determine crop yields, quality and, ultimately, profitability. In fact, 35% of research participants ranked “cultivation management” as their greatest operational challenge during the launch phase, second only to “regulation hurdles.” Other notable challenges included “securing capital,” “declining prices” and “disappointing crop yields.” The top three challenges remain unchanged for cultivators when comparing hurdles during the launch phase to what these businesses struggle with today.

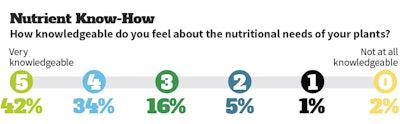

Nutrient Knowledge and Strategies

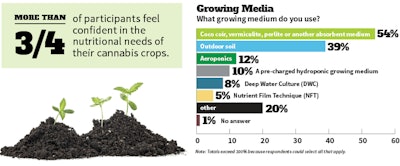

In the two years since CBT’s first nutrient report, also conducted in partnership with Emerald Harvest, study participants reported being slightly more knowledgeable about plant nutrition, as 42% indicated they feel “very knowledgeable” about it compared with 36% in 2017. Overall, more than three-fourths of participants rated their knowledge as 4 or 5 on a scale of “not at all knowledgeable” (0) to “very knowledgeable” (5) in the nutritional needs of their plants, which has not changed since CBT last conducted research of nutrient use among cannabis cultivators.

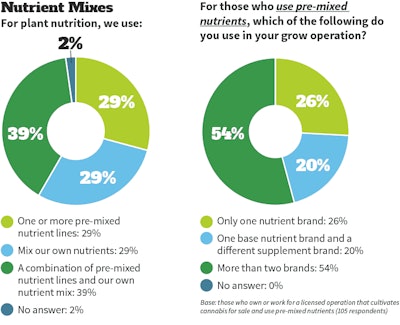

Despite cultivators’ confidence, their approaches to nutrient programs are not consistent. For example, responses to whether cultivators use pre-mixed nutrient lines (29%), mix their own nutrients (29%) or do some combination of the two (39%) were fragmented. For those who do use pre-mixed nutrients, a majority (54%) said they use more than two nutrient brands.

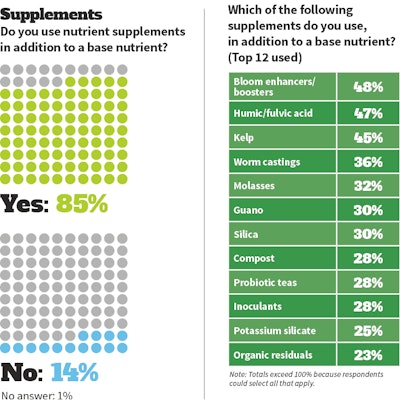

Cultivators use a wide range of supplements, in addition to base nutrients, and the top 12 supplements used are included below. The most popular choices included “bloom enhancers/boosters” (48%), “humic/fulvic acid” (47%) and “kelp” (45%).

Performance Expectations, Reasons for Buying Evolving

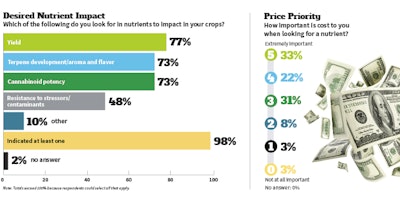

The number of cultivators seeking nutrients that can impact cannabinoid potency has increased dramatically since the last study in 2017; this year, 73% indicated it was among the top three factors they considered, compared with less than 10% two years ago. Other key priorities cited by this year’s participants include “yield” (77%) and “terpene development/aroma and flavor” (73%).

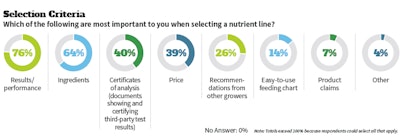

The selection criteria cultivators use to choose nutrient lines has also changed since the last report. A plurality of respondents relied on “recommendations from other growers” (45%) in 2017. This year, 26% used those endorsements as a guide. The majority (76%) indicated “results/performance” was of top importance when determining what to feed their plants. When looking at other highly ranked options, it seems growers value information and transparency from nutrient manufacturers, as “ingredients” (64%) and “certificates of analysis” (40%) ranked as the second- and third-most selected choices. Price remains important for cultivators—55% of research participants noted cost as 4 or 5 on a scale of “not at all important” (0) to “extremely important” (5) when looking for a nutrient. But when compared with other factors, 39% said price is among the most important when selecting a nutrient line.

Growing Medium: The Foundation

More than half (54%) of cultivators who participated in the nutrient study indicated they use “coco coir, vermiculite, perlite or another absorbent medium” as a growing medium, while 39% said they use “outdoor soil.”

Science and Nutrition

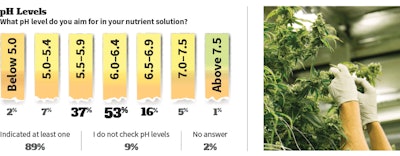

In this year’s study, slightly more respondents indicated they measure nutrient pH (89%) compared to the 2017 report (85%). Most respondents (90%) aim for nutrient pH levels between 5.5 and 6.4, with the majority (53%) targeting the 6.0-6.4 range.