In the U.S., products with the highest THC content have been so sought-after by consumers that lawsuits around and allegations of THC potency inflation of flower and concentrates have been widely reported. High-THC products not only would warrant higher price tags, but some in the industry even noted that some retailers do not purchase products containing less than 20% THC.

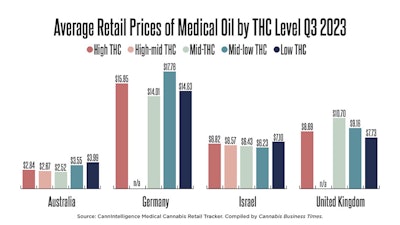

But in Australia, Germany, Israel and the U.K., products with low, mid-low and/or mid-THC potencies draw the highest prices.

In Australia, low-THC medical oil products (those with less than 5% THC) are the most expensive, according to data from CannIntelligence Medical Cannabis Retail Tracker for Q3 2023. The average retail price ($3.99(USD)/mL) for low-THC oil products is $1.15 higher than the average price ($2.84/mL) for high-THC oil products (those with 20% or greater THC). Oil products containing mid-low THC (5% to 10% THC) also command a higher average retail price ($3.55/mL) than those with high THC.

In Israel, the products garnering the highest average retail price, according to CannIntelligence data, are also those with low THC ($7.10/mL), though the price gap between low- and high-THC products is narrower at $0.28/mL.

In Germany, the highest average retail prices ($17.76/mL) are for medical oil products that contain mid-low THC. That price is $1.81/mL higher than the average retail price for high-THC medical oil products ($15.95/mL).

And in the U.K., mid-THC medical oil products (those with 10% to 15% THC) top the price chart, with an average retail price of $10.70/mL—more than $2 higher than high-THC products. (Editor’s note: As of press time, CBT could not find a data source that tracks comparable prices by THC/mL content in the U.S.)

Which Country Has the Highest Average Retail Prices?

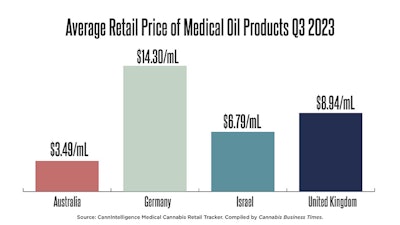

When comparing Australia, Germany, Israel and the U.K., Germany’s average retail price of medical oil products in Q3 2023 ($14.30/mL) was more than double that of Australia and Israel and nearly 40% more than the U.K. Australia had the lowest average retail price for medical oil products at $3.49/mL.

“I would say Germany is a unique market because pharmacies are allowed a 100 percent upcharge on unprocessed flowers of German origin and 90 percent for processed flowers of German origin,” Jonathan Darnell, market analyst at CannIntelligence, told Cannabis Business Times.

“German-origin flower prices were set by BFARM [the Federal Institute for Drugs and Medical Devices] and were cheap around 4.30EUR/gram originally for pharmacies. This price was increased to 5.80EUR/gram by BFARM effective July 1, 2023. Imported cannabis into Germany is not facing a price ceiling technically (although there is a maximum reimbursement for pharmacies to receive from those buying with insurance), and due to growing demand and lack of domestic production (and lack of profit from domestic cannabis for pharmacies), medical cannabis imports are necessary for the German market to satisfy demand,” Darnell said. “This allows for importers to sell to pharmacies at a higher price than BFARM. Add this with the pharmacy surcharge and we get expensive retail prices.”

Israel's case is different, according to Darnell. “Israel’s domestic production capabilities are significantly higher than Germany's and can exceed demand,” he said. “In 2019, the Health Ministry allowed imports into Israel to offset local firms that stopped providing medical cannabis (in response and anger to newer regulation that would cut profits). With a capable domestic market and now a booming import market, true competition is the culprit for low prices in Israel. Too many firms fighting for too few patients.”

In 2022, Israel became the largest importer of medical cannabis, according to “The Israeli Cannabis Report” published Jan. 31 by Prohibition Partners.

The Jerusalem Post reported earlier this month that the 2019 decision to allow imports “pushed local growers and producers to desperation.”

“Every industry goes through upheavals in its infancy, and Israel's medical cannabis industry is no different. It has gone through non-stop upheavals in the past four years, but the most significant of them all was the regulator's [sic] decision in late 2019 to allow medical cannabis to be imported into Israel,” according to The Jerusalem Post article.

Earlier this year, however, Israel’s Ministry of Health updated the Medical Indications Procedure (Procedure 106) designed, according to the Ministry of Health, to “help increase the medical autonomy of the specialist physicians” (patients will no longer be required to have exhausted other medical options first, and physicians can use their own discretion), “while also improving availability and reducing bureaucracy for patients who require medical cannabis,” particularly those suffering from pain and post-traumatic stress disorder (PTSD), and those “patients on the autism spectrum.”

The recent Prohibition Partners’ report also suggests recent changes will “reduce regulatory burdens on medical cannabis operators, initiate growth in research and development, boost the country’s export potential and harmonise production to EU-GMP standards,” which will result in “a transformation in Israel’s medical cannabis environment.”

U.S. Flower Product Prices Are the Lowest

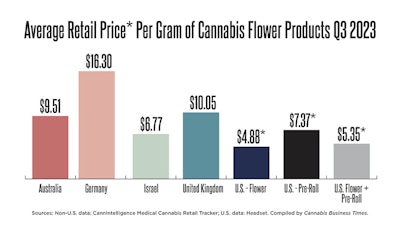

When looking at how U.S. flower product compared with those of the four countries noted above, the U.S. comes in at the bottom of the price scale. Its flower products—flower and preroll combined (and not exclusive to the medical market)—sell for an average retail price of $5.35/g, according to data provided to CBT by Headset. The next lowest average retail price is in Israel, at $6.77/g.

When U.S. flower is broken out separately, that number is even lower at $4.88/g. Prerolls in the U.S., however, sell for nearly $2.50/g more than U.S. flower, based on the average retail price, and if one looks at the pre-roll category alone, the U.S. would rank third in pricing behind Germany, the U.K. and Australia, in that order.

As was reported happening in Israel, U.S. growers have been “pushed to desperation” with severe price compression in state markets, overtaxation, and overregulation and affiliated costs. Perhaps Israel will see its predicted transformation … and who knows, maybe the U.S. will follow.