By 2027, the cannabis market will likely look very different than it does today.

That may not be a huge surprise, as people working in and examining the industry know that a lot can happen and change in the still emerging space in three years. Cannabis market analytics and research firm BDSA, which tracks sales and consumer insights data from 14 state-legal cannabis programs in the U.S., recently announced its top takeaways from 2023 and what it forecasts for the industry’s future.

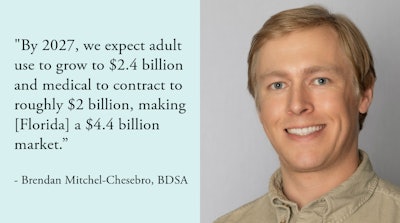

Cannabis Business Times recently checked in with BDSA industry analyst Brendan Mitchel-Chesebro, who shared the company’s most compelling findings, what surprised him the most, and what factors drove BDSA’s biggest and boldest predictions. Here are 13 top takeaways that Mitchel-Chesebro noted from 2023 and what to watch in 2024–and beyond.

1. Midwest and East Coast adult-use states take shape, and will soon be sales leaders as Western markets stagnate.

“I'd say one of the biggest takeaways is the rise of the Midwest and Northeastern markets. So, we saw Connecticut, Missouri and Maryland all launch adult-use sales. We saw Ohio legalize adult-use sales. And these are really big opportunities, not just because they’re markets that have relatively high populations and high consumer participation, but also especially when you’re looking at a place like Ohio, there’s a huge opportunity for growth just from cross border shopping. I mean, they’re right next to Indiana. Obviously being next to Michigan, with its really low prices, cuts into that a little bit, but there are a lot of opportunities for growth from people who are in either limited-access states like Indiana or states with higher retail prices. We saw in Illinois out-of-state sales, which they publish, dip really significantly once Missouri launched sales. So, we do know that consumers are willing to travel to specific states for price shopping.

“Western markets, California, Colorado, they're really stagnating. Most of them are really saturated as far as the number of brands, the number of SKUs that are on shelves. There's issues there in California about not having enough retail availability in some areas that's sort of hampering the growth and hampering the legal market's ability to take away sales from the unregulated channel. But compared to those markets like California, Colorado, these Midwest and East Coast markets represent a huge opportunity.”

2. Ohio will become a top six market by 2027.

“We think Ohio is going to be a top six contributor to growth by 2027.”

3. Michigan will hit $3 billion in 2023, growth will slow to $3.9 billion by 2027.

“Michigan's still a really strong performing market, especially when you take into account the price compression that they've seen; they've seen sharper price compression than almost any other state we track. It's close to a third if we're looking over the past two years. So, with Ohio going adult use and how that might impact the Michigan market, we're seeing something similar with Minnesota, as well. Minnesota has already had really wide availability of these hemp-derived cannabinoid products and Michigan, part of the market strength is that they are next to Ohio, they are next to Minnesota, these limited-retail availability markets. So as those markets come online and prices hopefully come down to the point where people aren't going to be driven across state lines to shop in Michigan, we do expect that to have an effect on the Michigan market and sort of tamper down sales growth a little bit.

"But there's still a lot of really cool things happening in Michigan. They have a really dynamic brand landscape, and when we're looking at it, it's not just all the big MSOs (multistate operators) moved into Michigan that are doing great sales. There are some MSOs, but there's also a lot of brands that are homegrown and are Michigan only. There's a lot of brands that have sort of held that as part of their brand identity, and consumers identify with that. I think that speaks to the strength of the Michigan market. I do expect there to be a lot of success stories out of Michigan, even as we see the sales growth from cross border traffic sort of slow once Minnesota progresses and Ohio gets closer to launching adult use sales.”

4. Competition from gray market sales will continue, especially in newly legalized adult-use states.

“We’ve seen a number of markets [sprout] even before adult-use sales officially launch.

There's a whole gray market that springs up, and we can't speak to the size of it, but we saw this in New York right after legalization launched. All these retailers were everywhere. We've seen this in Virginia as well, not as many storefront retailers, but a whole lot of delivery services. New Jersey [also has] a lot of delivery services sort of serving this gray area where consumers know cannabis is legal, but some of them may not know exactly what the licensing plan is or the path to the legal market was, and they just say, ‘Oh, legal cannabis delivered to my door.’ There's a demand for that. And we do think that that's something that may crop up in Ohio now that we have adult use passed.”

5. Among top sales drivers in the U.S., THC potency is and will continue to be No. 1.

“We do see really consistently that high THC percentage is a top driver of consumer product choice. The three top product choice drivers when we're looking across all U.S. markets are high THC content, number two is taste or flavor, and number three is low price. So, 29% of consumers said that low price is one of their top product choice drivers. We do think that especially in markets where, after adult use launches, we pretty much universally see a spike in average retail price just because of that demand. And we think a lot of these consumers that are really price conscious are going to be driven toward shake/trim/lite. (More on this below).

"It is a little bit surprising [that price isn’t No. 1], but a thing worth keeping in mind is that we see from our data that the bulk of the cannabis sales, we hear about new consumers all the time, consumers who want maybe low-THC edibles, they want less potent products, products that are more approachable. But the consumer segment that does consistently drive the biggest share of cannabis sales is the experienced consumers and the high frequency consumers. So, a lot of these people do want high-potency products. They are willing to prioritize high potency and taste and flavor when they're at retail.”

6. Top products could shift in areas with form factor restrictions.

“Vapes, flowers, extracts, edibles, those are sort of stabilized across most markets. The markets where we do expect to see shifts at that top line are ones where there's currently restrictions on form factors allowed. So, for example, Pennsylvania only allows very specific edible types. They allow some products that would be classified as beverages, like little infused shots. They allow pills. They allow very limited product form factors. And because of that, we see edibles make up a really small share of Pennsylvania. Once adult use launches, we do expect that to change, and we do expect edibles making up a bigger share and probably taking share away from flower. So those are the markets where we expect to see top line changes, and that's just due to regulatory restraints that brands are currently dealing with.”

7. Growth of disposable vapes will continue.

“One that we see really consistently across most markets is the rise of disposable vapes. This was a big piece of our predictions piece. Disposable vapes have increased their share. I think that a piece of this is due to one, the innovation aspect of it. We see more disposable vapes have form factors that would appeal to a broader segment of consumers. So, it's not just consumers who think convenience first and convenience only. We see more disposable vapes that are rosin vapes. We see more disposable vapes that are live resin vapes, and those appeal to more experienced consumers, maybe the cannaisseurs who like to prioritize things like taste and flavor, who look for things that have those premium form factors, like rosin inputs.

Also, on the innovation side, we've seen these disposable products become more reliable, and there's more interesting form factors available. There are brands that put out fun shapes of disposable vapes that's shaped like the state of California, or it's shaped like a weed leaf that's appealing to some consumers. We've also seen things like dual chamber vapes, so it's a full gram vape that's half a gram of one strain, half a gram of the other. So that might appeal to some consumers who want an indica and a sativa, or they want the strain that they know from that brand that they really like the flavor of, but they want to try something else as well. So, the innovation is one thing that's really driving this increase.

8. Biggest surprise from 2023: The growth of shake/trim/lite.

“It’s a category that’s been around forever. A lot of people just wrote it off as like, ‘Oh, if you just have garbage pot, that’s what you throw it into.’ But we’ve seen pretty significant growth in a few different markets, Illinois and Pennsylvania, specifically within this shake/trim/lite segment.

"I think that we’re going to see states that launch adult-use sales with a relatively limited amount of brands and limited cultivation capacity see an increase in shake/trim/lite. I think back to Illinois— Illinois had a lot of product shortages in the first quarter that they had adult-use sales, and it led to stores almost being completely out of flower in some cases. So, in markets like Ohio, once they launch and they have that huge increased demand from their internal consumer base and also from states like Indiana, maybe some Pennsylvania patients going over to Ohio to buy cheaper cannabis. If that's how the pricing dynamic works out, we do expect shake/trim/lite to see a boost in these new emerging markets that launched adult-use sales and have really high demand.

"I do think that price consciousness plays into it a fair amount.”

9. Popularity of prerolls (especially infused) will continue.

“We do think that this is a trend that's going to continue as far as convenience being a driver, but with infused, it's sort of convenience, but it's also the potency aspect. One aspect that's driven this rise of infused prerolls, aside from potency, is just the price compression we've seen over the past two years. Most markets have seen between 20% and 35% price compression over the past two years. We're talking Q3 2021 to Q3 2023. So that means that a lot of these preroll products that might've been cost prohibitive or seemed cost prohibitive for consumers who look for potency but are a little bit price conscious—because sometimes they're opposing interests—but a lot of consumers do hold both of them at the same time. These preroll products have become a lot more affordable, and it's sort of made it less price cost prohibitive for the consumers. But the preroll products still offer the premiumization benefits to the brands.

"If we're just going from Q3 2022 to Q3 2023, infused prerolls’ dollar share of the total preroll category grew by roughly 18%. That pricing point that I mentioned, infused preroll products as a whole have an equivalent average retail price that's about 90% higher than the non-infused category. So even though we've seen a big dip in retail prices, they still hold that premiumization factor for retailers.

"There’s been a resurgence of traditional hash and other solventless products in the preroll category. That's also a premiumization draw compared to the extract category as a whole. Solventless products do hold higher retail prices. So, I think that some of the people who are going for those products are the more taste and flavor oriented, more experienced cannaisseur-type consumers.”

10. Opportunities for hemp-derived products exist, despite risks.

“Unfortunately, we aren't able to track the [market share of] the whole hemp-derived product channel just because it's so many different retail channels that we're talking about. For a long time, it was just smoke shops, convenience stores and e-commerce. Now we're seeing some of the biggest beverage and alcohol distributors lean into distributing hemp-derived beverage products. We're seeing them in liquor stores. I think it's only a matter of time before we start seeing in them regional chains and statewide chains. We can talk about the opportunity then the risks. I think that that's a good way to look at it because I don't think it's purely a risk for cannabis companies because one, most of it is centered in the edibles space. From what I've seen, and I don't have super hard data on this, but just judging on what is available in stores and what these big non-cannabis distributors or distributors are handling, it is very edible focused.

"And two, we've already seen some cannabis brands really lean into this space. It's an opportunity for these brands that are maybe seeing sales stagnate, maybe having a really hard time making the margins that they need to in the cannabis channel to expand out into the hemp-derived cannabinoid channel.

"Also, the broader consumer base is huge. This isn't our data, but I thought it was really interesting. There was a recent University of Michigan study that said that one-fifth of Americans report using hemp-derived cannabinoid products. (Editor’s Note: 21% of participants in the study noted using CBD in the past year.) So that's a really big opportunity, especially as I would suspect that there's some people who would be more hesitant to consume cannabis who might be convinced to consume something that is federally legal, like a hemp-derived product.

"Touching on the risks, yes, consumer safety is one concern. These products, they're not subject to the same scrutiny of the legal cannabis channel. And that sort of speaks to the reputability, the reputation of legal cannabis, the fact that they are subject to so much testing and so much scrutiny day in, day out. A lot of these hemp-derived companies may not be subject to the same scrutiny, but as it becomes more mainstream, I think that there's going to be a lot more beverage industry players who are involved in it, and they're going to bring those manufacturing processes and that level of accountability into it.

"If we start seeing a lot of brands really taking off with hemp-derived vape products and those becoming really popular, I think it would present a greater risk to the larger cannabis channel. But that's a thing we'll have to wait and see on.”

11. Relatedly, beverages only make up a small percentage of sales now, which means opportunities exist for companies willing to formulate and sell them.

“Beverages are about 1% of total cannabis sales across most of the markets that we track. So, it's not a huge category, and there's some logistical troubles to dealing with beverages. If you're a cannabis dispensary, they take up a lot of space. They're heavy, so more costs from a distribution perspective, you need to have refrigeration.

That's a lot of space at retail. These are a lot of problems that retailers don't necessarily want to deal with. So being able to launch a brand, if you're an existing cannabis brand, in the hemp-derived space is a huge growth opportunity because of that.”

12. New York will establish a legal market by 2025 and emerge as a top market by 2027.

“We were really hopeful that in 2023, New York would be able to address retail availability and illicit competition and be effective at both. Retail availability did pick up quite a bit in the first half of the year, but we saw the addition of new retail retailers slow down in the first part of Q4. We do expect that to pick up in 2024, but it's going to take a while for that to really show an effect. As far as sales on the illicit competition front, they've had a few different strategies to tackle that. The problem being centered in New York City, they've done the regular things of fines or trying to go after landlords, but we really only saw the first illicit retailers being closed in the fall.

"It's going to take a sustained effort on that front, and we're probably not going to see a really concerted or really a really noticeable difference until 2025 when we're talking about just the amount of illicit retailers that are in New York. There's a couple of historical examples we can speak to on that. Los Angeles is a big one. Los Angeles was slow to launch licensed retailers after California legalized. And because of that, a lot of these illicit market retailers sort of became entrenched, and the city was doing everything it could to sort of crack down on them. But they'd raid an illicit retailer, maybe arrest somebody, and then that same operation would be operating again two days later just down the block.

"There's an aspect of whack-a-mole that they have to play with this. I don't think you can solve this problem just through interdiction and enforcement alone. You really have to tackle it by getting that legal retailer count up and getting cultivation up enough so that it brings down prices and takes away the incentive to actually shop at these illicit retailers. And obviously with cultivation, cultivation cycles are roughly nine months. Some good news is that the MSOs that are in the medical market will be able to enter the adult use market. So that additional capacity as well as the additional brand identity that these multi-state brands have, I think it'll play a role in sort of shifting sales over to the legal market.”

13. Florida will be second-largest cannabis market by 2027.

“There have been massive investments by all the firms that are active in the Florida market. It's a limited-license market, but they've been able to get their retailer count up to the point where retail availability isn't that much of an issue anywhere in the state. The biggest drivers of the size of the market in any state is population, consumer penetration—with the amount of retirees and older folks that we have in Florida, a lot of them are looking for solutions for things like pain management, being able to sleep better. And I think that that's been a big driver of the growth of medical cannabis in Florida speaking to when we think adult-use sales will launch. So, our current forecast has adult-use sales launching in 2025. For 2025, we do expect adult use to bring in $870 million to Florida with medical sales bringing in $2.8 billion. And then by 2027, we expect adult use to grow to $2.4 billion and medical to contract to roughly $2 billion, making it a $4.4 billion market.”

Editor's note: This conversation was edited for length, style and clarity.