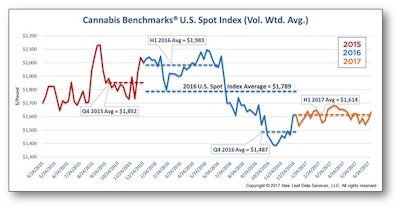

National wholesale cannabis prices have been fairly flat for the last few months, if not slightly increasing, but the market is anticipating a sharp price decline in the coming months as outdoor crops are harvested, according to Jonathan Rubin, CEO of New Leaf Data Services.

Cannabis Benchmarks, a division of New Leaf Data Services, provides financial, business and industry data for the North American cannabis markets. According to its research, pricing has not been as volatile as it has been in the prior two years.

“That said, the volatility typically happens in the second half of the year because of the harvest,” Rubin said. “[There is a] sharp price decline in … the late September, really October/November timeframe when all of the outdoor harvest hits the market, dried and cured, and drives prices down.”

Rubin said when outdoor growers harvest, they generally sell product quickly in October and November to pay expenses, and then hold on to the remainder of their harvest to release product here and there as prices increase.

“Right as the harvest is happening and after the harvest, they’re less focused on optimizing dollars per pound than they are just getting some cash in to cover expenses,” Rubin said. “Once they cover those expenses, January through July, that’s when they start focusing more on … [releasing the] outdoor harvest into the market at a more measured pace that’s going to maximize revenue.”

Two Years of Trends, and a Dip

Pricing trends are still following patterns of previous years, even with additional cultivators coming online, according to Rubin. However, yields could be higher this year due to droughts and fires which affected crops in 2015.

“All indications are the prices are going to continue to decline for the remainder of the year,” Rubin said, although “they typically swing up the second half of December as you hit the holiday demand and the New Year demand.”

Rubin said demand is on an upward slope with more markets opening up to both medical and recreational cannabis and more consumers consuming marijuana, while supply can be a little more complex.

“The more dynamic side is the supply side because in the short term, supply is relatively fixed, and when you see increases in supply or decreases in supply, it tends to be a little shock to the system,” Rubin said.

Hold ups with laboratory testing, or flower being destroyed or quarantined for failing pesticide or microbial tests can also cause prices to hike even when supply is high.

“The demand side is solid and growing, but it doesn’t grow in fits and starts. … It’s a constantly upward slope,” he said.

Despite the flux of supply and demand, Rubin anticipates prices will keep dropping.

“With more production capacity coming online, and with more sophisticated growing operations and better supply chain management, overall, we’re anticipating that prices will continue to decline,” he said.

In individual markets, however, Rubin says price movement could be significantly different, especially in smaller, highly regulated medical markets.

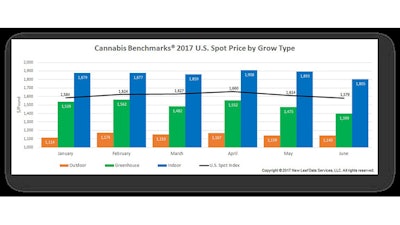

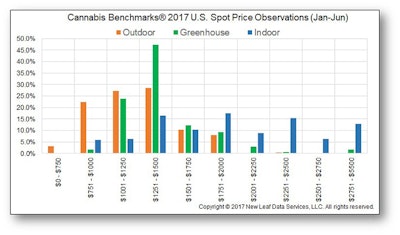

“You’re going to continue to see a patchwork of high prices and low prices around the country, but typically, the more mature, larger markets [and] the more outdoor growing you have, the lower the average cost of production is going to be,” Rubin said. “Sun-grown is the cheapest, greenhouse has been the middle, and indoor growing is going to be the most expensive.”

Rubin says in a market like Connecticut where only indoor growing is allowed, the price will remain steadily higher, as wholesale prices rarely drop below the marginal cost of production.

“Since highly controlled markets like Illinois and Connecticut only have indoor grow operations, you’re never going to see the price decline to the point of a market like Colorado, Oregon, Washington [or] California where they have outdoor growing [and] where the cost of production could be just a few hundred dollars a pound.”

California is the largest market, Rubin says, and has the most impact on the overall average national price. The state’s prices have been fairly steady, according to Cannabis Benchmarks’ weekly Premium Report published Sept. 15. Indoor and greenhouse rates have been slightly declining, but outdoor prices have recovered from a year-to-date low price, per the report.

Other regional trends noted in the report show Oregon’s prices are increasing in the weeks prior to the outdoor harvest, while prices in Nevada and Michigan are on a downturn, with Nevada seeing its lowest prices since before adult-use sales began July 1. Prices in Colorado and Washington appear to be the most stable, according to the report.

Cannabis Benchmarks allows people to monitor weekly price changes and stay up-to-date on wholesale pricing trends through its Premium Weekly Reports and Annual Review. Additional information and insights can be found on the company's website.

Images courtesy of Cannabis Benchmarks