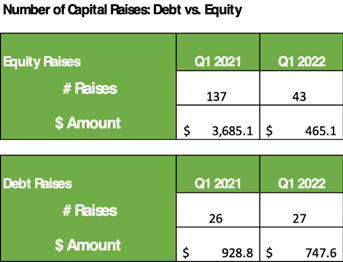

For Q1 2022, there were 70 capital raises totaling $1.2 billion. Compare that with Q1 2021, which saw 163 capital raise transactions totaling $4.6 billion. That’s a decline in transactions of 57% and a decline in total capital raised by ~74%.

So, what’s happening here?

To be fair, Q1 2022 followed a strong first quarter when the number of capital raise transactions and total invested capital reached historic levels.

Nonetheless, the quarter reflected a sharp falloff in investor interest in the cannabis sector due to:

1) any legislative progress re cannabis legalization;

2) declines in the market valuation of public cannabis companies, which made equity issuances dilutive and expensive;

3) and the general decline in overall market sentiment. The S&P 500 declined more than 5% during the first quarter and has continued its decline since. Cannabis stocks are not immune from overall market trends, and given their more speculative nature versus larger more established companies the case could be made that cannabis stocks are inclined to fall more than the market at large. Further the appetite for M&A transactions and other kinds of financings tends to be diminished during times of market turmoil. Nobody likes doing deals amid uncertainty.

Shift in Capital Allocation by Industry Sector

investments by category in cannabis industry

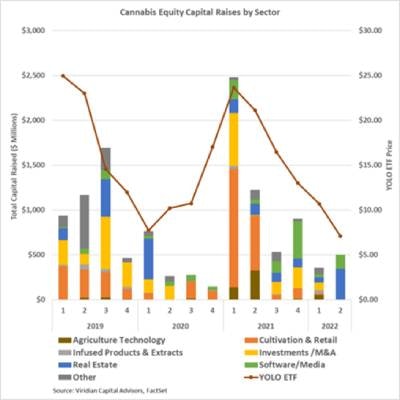

investments by category in cannabis industryCannabis transactions (capital raises and M&A) are allocated into one of 12 industry sectors to track the flow of deals by sector. For the last year, there has been a rotation of invested capital into different cannabis industry sectors. The chart below and the accompanying narrative detail this sector rotation.

Cultivation & Retail, historically the most significant sector for equity financing, accounts for only $14 million (1.6%) of equity raised YTD in 2022, compared to $1.9 billion (52%) in 2021. This declining trend is likely to continue for several reasons:

- The MSOs have been able to use equity in acquisitions, one of their primary needs for new capital.

- The Tier 1 MSOs have strong cash positions and are expected to be free cash-flow positive in 2022 and 2023, eliminating any pressing need to issue equity in a down market.

- Greater availability and better pricing of debt is a further restraining factor.

Investments/M&A, which is chiefly composed of SPAC IPOs, has also fallen deeply out of favor as an industry sector for capital inflow. This category made up only 9.9% of 2022 YTD raises, compared to 16.1 % in 2021, and is likely to represent a lower percentage in future periods due to increased SEC scrutiny and poor performance of de-SPAC’d stocks.

The Real Estate sector, which is composed of cannabis lenders and sale-leaseback providers, has been a beneficiary of the sector rotation in 2022. Riding the trend toward greater use of debt capital, this sector has accounted for 47.3% of 2022 equity issuance YTD, compared to only 7.6% for the comparable period in 2021. Given our expectations that meaningful legalization will remain elusive and stock prices will have difficulty rebounding in the overall market downturn, we think this sector will continue to benefit.

Software/Media companies have also taken a bigger piece of the financing pie, accounting for 22% of YTD raises vs. 7.1% in the previous year. This trend is likely to continue as MSOs look to improve the efficiency and compliance of newly built and acquired operations.

Agriculture Technology is down YTD, a resurgence in demand as MSOs build out operations in newly opened adult rec states.

Debt Increases as a Percentage of Total Capital Raised

For all of 2021, debt financings reached their highest percentage level since our tracking began, reaching 44% of total dollars raised in 2021, up from 38% in 2020. Debt capital raised increased to $5.62 billion in 2021 from $1.65 billion in 2020. Seven of the largest 10 capital raises of the year were debt transactions.

This trend is likely to continue in the current environment as cannabis companies remain hungry for growth capital, but cautious about issuing equity because of low public market values.

M&A Activity

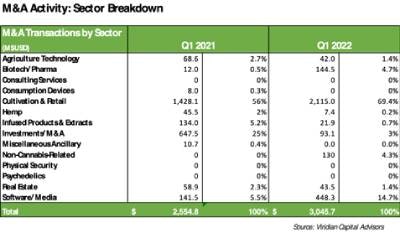

There were 319 M&A transactions in 2021, the highest number since 2018 and up 235.8% from the 95 M&A transactions recorded in 2020. The total transaction value of $25.2 billion in 2021 was up nearly 573% from 2020.

For the first quarter of 2022 there were a total of 58 M&A transactions, down 21.6% vs. the first quarter of 2021. Despite this decline, M&A activity held up much better than it had in previous cannabis stock price swoons. And against the backdrop of a 73.9% decline in capital raises by cannabis companies in the second quarter of 2022, the pace of M&A activity remains robust.

M&A activity is primed to remain strong as the industry at-large is still top-heavy in licensed operators—and cannabis companies in general. Consolidation is needed in the current state of the market and is a healthy dynamic for the industry.

Change in M&A by Industry Sector

Since 2015, companies in the Cultivation & Retail sector have been the dominant acquirers as they consolidate within markets and expand to new states. This trend continued into Q1 2022. However, two sectors that saw a real uptick in M&A activity in Q1 2022 were Biotech/Pharma and Software/Media.

The Biotech/Pharma sector comprised 4.7% of all M&A deals in the first quarter of 2022, vs. only 0.5% in the first quarter of 2021. This reflects the emergence of the psychedelics sector, which is on a faster FDA drug development and clinical trials pathway than medical cannabis.

The Software/Media sector comprised 14.7% of all M&A deals in Q1 2022, vs. 5.5% on Q1 2021. This reflects the demand for more sophisticated ERP, inventory management, POS and other enterprise systems to better manage operations as cannabis companies scale.

Sale-Leasebacks

The sale-leaseback story in the cannabis sector to date has been a cap rate compression story largely due to long-term confidence of legalization at the federal level—despite little immediate progress—as well as growing strength of credits in the space. Sector cap rates—which are the implied multiple of the operating income of the underlying property—have declined from as high as 17% over the last couple years to a 11-15% range today.

These rates, while high relative to the overall sale-leaseback universe, still provide for attractive financing levels for cannabis operators due to sector-specific capital constraints. However, the volatile interest rate environment in Q1 leading into Q2 provides a wrinkle in this narrative.

In the traditional sale-leaseback universe, the cap rate environment in Q4 2021 and into early Q1 2022 was one of the strongest seen across the board. The increasing pool of investors, combined with the low interest rate environment made for very attractive sell-side dynamics with compressed cap rates and outsized valuations.

We began to see a different story in the tail end of the first quarter.

Despite cannabis industry-specific compression, and credits which are growing stronger by the month as smaller entities move through their first grow cycles, the interest rate environment began to provide unfavorable headwinds. The 10-year treasury climbed ~70bps throughout the quarter and since has risen ~50bps since the end o the quarter, impacting sale-leaseback investors’ cost of capital.

Over $50 million of cannabis sale-leaseback transactions were priced in the first quarter of 2022, spanning Massachusetts, New Jersey and Pennsylvania.

Specialized players such as cannabis real estate investment trusts (REITs) have filled the financing need in the space thus far, and we have not yet seen traditional sale-leaseback investors grow comfortable with the sector. This year will be a very interesting time period as we see the narratives of increasing interest rates and an inflationary environment go up against positive drivers of growing multi-national operators and increasing legalization initiatives.

Scott Greiper is the present and founder of Viridian Capital Advisors a financial and strategic advisory firm to cannabis enterprises.

David Rosenberg, CFA is a principal of SLB Capital Advisors, which advises businesses and private equity investors on a wide range of sale leaseback transactions.