Edibles: The Future of California’s Cannabis Market

by Patrick Hayden

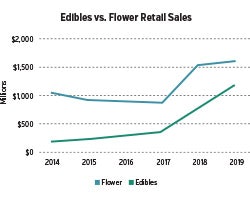

To give a sense of how fast the state’s edibles market is growing, consider that the retail edibles category is currently about 26 percent of the overall flower retail category. However, by 2019, that percentage will rise to almost 75 percent. That’s a tremendous increase in the amount of cannabis that will be used as input into edibles manufacturing.

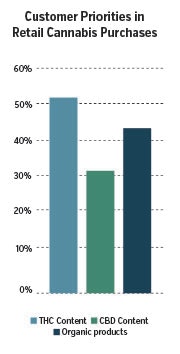

To capture this increased market, cultivators and processors will need to understand the changing dynamics among consumers and, subsequently, the cannabis supply chain. First, edibles consumers are a picky bunch. They have high expectations for their edibles, and they’re willing to pay to get it. Based on a recent survey conducted by cannabis market research firm Brightfield Group, more than a third of California edibles consumers are willing to pay significantly more for their preferred THC content, CBD content and organic products.

This trend in consumer preference will only grow as more consumers enter the market and expect the same choice and customization they have in other consumer goods.

This is an important patient group for dispensaries and manufacturers, too. Nearly half of patients medicate on a daily basis, and it is the frequent users that drive the majority of sales volume and, thus, revenue. Also, California edibles patients are wealthier than others. Nearly one in four has a household income of over $100,000. So, this wealthier, discerning consumer base will challenge the market to work harder to cater to their demands.

So, now is the time for companies to act to capture this market. The industry is still fragmented, and regulations continue to slow consolidation, but the market is maturing quickly. The companies that align their businesses with these changing dynamics will be the ones that are still successful four years from now.

Patrick Hayden is president of the Brightfield Group (BrightfieldGroup.com), a cannabis market research firm that helps businesses make smarter business and investment decisions through data analysis and forecasting.

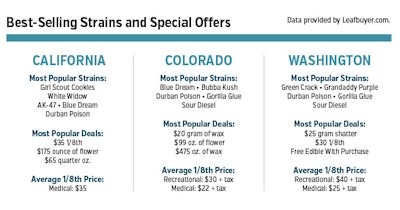

Leafbuyer: Cannabis Deals for Consumers

“We have more than 250,000 cannabis users who use our network every month,” Breen says. Users click on a deal, print it out and bring it to the retailer offering the deal. The sales data provided is based on the company’s analysis of which deals and strains are most popular among users, and what prices are being offered by retailers. Approximately 200 retailers use the platform, he adds, to showcase special offers.

Leafbuyer also provides information on various strains on dispensary menus, such as whether they are sativas, indicas or hybrids, and the THC, CBD and CBN content. The company is looking to partner with testing companies, too, to incorporate testing data into retailers’ menus.