Farmers and entrepreneurs in the United States may be asking themselves whether an investment in cultivating hemp is worthwhile, especially when given the option of growing its higher-THC counterpart, marijuana. While nothing is “black and white” in the cannabis arena, Brightfield Group has outlined some pros and cons of endeavoring to grow hemp in today’s market.

Pros

The hemp market is lucrative:

Brightfield Group researchers project sales of hemp-derived cannabidiol (CBD) products to hit $1 billion by 2020.

Today, hemp cultivation is arguably less risky than marijuana cultivation.

Since passage of the 2014 Farm Bill, which defined industrial hemp as distinct from marijuana and authorized domestic hemp cultivation in select contexts, industry regulation has been loosened to some extent, and hemp has been subjected to less federal intervention than marijuana.

- However, there is a lawsuit taking place between the hemp industry and Drug Enforcement Administration (DEA). The DEA currently stands firm that all cannabis derivatives, including hemp, fall within the Controlled Substances Act’s definition of marijuana, a notion currently being challenged by the Hemp Industries Association (HIA), which has filed a motion to hold the DEA in contempt for the agency’s efforts to regulate hemp products against court orders.

Despite the legal gray area, hemp is being afforded leniency that marijuana is not.

- Unlike marijuana, hemp is currently sold across state lines, enabling farmers and investors to expand their markets. Although the federal Farm Bill was designed to permit “research” or “pilot” programs, in practice, many states have been liberal in their interpretations of the law and licensing practices. For example, Kentucky created an industrial hemp research program and a commercial licensing program to allow hemp cultivation for any legal purpose.

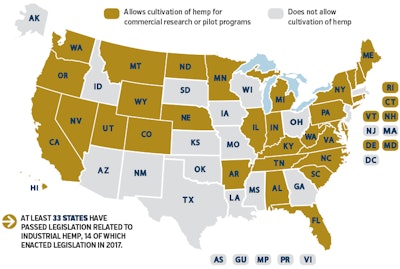

- Hemp cultivation is not restricted to cannabis-legal states, only those that have adopted laws to allow for hemp cultivation, a great advantage given that—per Brightfield Group research—demand for hemp-derived CBD is highest in states where marijuana is illicit or only medically legal.

Cons

Given the ongoing court battle, hemp stands on tenuous legal ground.

The Farm Bill came with relatively strict caveats that influence the industry’s operations:

- Industrial hemp must be cultivated for research conducted under an agricultural pilot program or other agricultural or academic research; and

- Industrial hemp cultivation must be allowed under the laws of the state in which the research occurs, and grow sites must be certified by and registered with their state, according to the National Conference of State Legislatures. Thus, commercial sales have been taking place under the Bill, though legality and regulatory conditions vary greatly by state.

Federal law has permitted the importation of various hemp-based products (containing no THC) from abroad for many years.

As a result, unlike in the marijuana market, U.S. hemp farmers are forced to compete with established international importers.

For those thinking about entering the difficult-to-navigate hemp market, the above considerations are important to keep in mind.