The marijuana marketplace is experiencing historic growth, with sales booming across nearly all categories. But growth among the many categories of cannabis, including flower, edibles, concentrates and topicals, is not uniform.

An interesting place to examine slow-downs in growth is edibles. The category remains the third-most-popular sales category across the three states, capturing 13 percent of the cannabis market during April of this year, according to cannabis market research group BDS Analytics. And sales between Colorado and Washington for April (recreational dispensaries in Oregon could not sell edibles during April of last year) rose 17 percent over April last year.

What may sound like great growth is unremarkable in the cannabis space, especially given the edibles category’s size relative to larger categories like flower and concentrates. Edibles sales in Colorado rose 9 percent in April compared to the previous April. Between April 2015 and April 2016, however, edibles sales rose by 77 percent. And we can’t blame this year’s declining sales in the medical channel (down 4 percent) for the brakes on growth—growth was 13 percent in the busy adult-use channel in the Centennial State—meaning we are seeing a significant slow-down in growth for edibles.

The same slow-down holds true in Washington, although it is less pronounced. Edibles grew by 47 percent in April this year, compared to the previous April. However, edibles growth in Washington was 71 percent between April 2015 and April 2016, so again we see a significant decline in growth. Meanwhile, concentrates sales in Washington rose by 85 percent in April compared to a year earlier, and the concentrates market is larger than edibles in Washington (ditto for Colorado and Oregon), second only to flower.

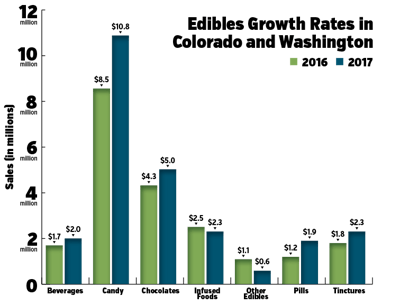

Within the edibles marketplace, we encounter a wide range of products, from baklava to mints. In terms of growth, the biggest movement is toward candy, rather than chocolates, beverages, infused foods (like cookies) and other subcategories. In Washington and Colorado during April, the candy category grew by 28 percent, compared to growth of 16 percent for chocolate, the next largest edibles category. Much of candy’s growth is led by gummies, which vaulted up by 40 percent in April compared to April last year. Meanwhile, the No. 2 edibles category, chocolate bars (capturing 13 percent of the edibles market, compared to 24 percent for gummies), fell by 0.3 percent in April this year.

Sales trends within the states vary. For example, during April, the No. 1 edibles product in both Colorado and Oregon was gummies, but in Washington it was chocolate pieces. In Washington, gummies are—in fact—behind several categories.

As we see, all broad categories of cannabis products are continuing to perform with gusto so far this year—especially concentrates. Growth in the edibles category is slowing down, compared to growth in its main competitors for market share. But the cannabis marketplace is nothing if not fluid. It is unlikely the breakdowns in growth a year from now will mirror this year’s numbers.