Consider this: The broad edibles category grew by 37 percent during the months of January through October of 2017 (compared to the same period in 2016) in Colorado, Washington and Oregon-the states with the most established recreational cannabis programs. But high-CBD edibles expanded by 101 percent during that time period. In concentrates, growth reached 168 percent for high-CBD products, compared to 47 percent for the broader concentrates category. Topicals growth last year hit 44.5 percent, but inched to 53 percent for high-CBD topicals. Growth among high-CBD tinctures last year was also strong-up 86 percent compared to 57-percent growth for all tinctures.

CBD (also known as cannabidiol, a non-psychoactive compound found in marijuana) often represents a minor slice of the marketplace pie. In the candy market (i.e., gummies, taffy, etc.) high-CBD products account for just under 12 percent of the combined $142 million in sales for Colorado, Washington and Oregon between January and October in 2017. But in the tinctures market, CBD is a player: It accounts for about 60 percent of the $34 million tinctures market in those states during the same period.

The massage business, apparently, is high on CBD, too. Among topicals, CBD-rich massage oils are far and away the growth leader, with sales expanding by 250 percent for most of last year. But the market for high-CBD massage oils is fairly small, just $519,500 during the period.

Vape pens have been a prominent growth story for several years, and when we consider high-CBD vapes, the story becomes even more compelling. High-CBD vape sales expanded by 203 percent during the period, compared to 93 percent for vapes overall.

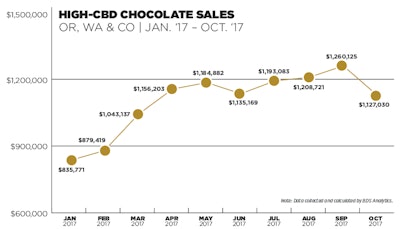

In edibles, however, we find the most impressive CBD boom from those three markets. Chocolate sales in general expanded by 47 percent last year, with sales of $65.8 million. But high-CBD chocolates took off, seeing 217 percent growth with roughly $11 million in total sales. High-CBD candy grew by 169.5 percent last year, compared to 51 percent for candy in general.

Gummies are the biggest-selling type of edible in the cannabis marketplace. For January through October last year, sales hit $91.2 million, and growth rose to 98 percent. But the high-CBD gummies market led growth during 2017; while sales represented a small slice of the gummies pie-$5.6 million out of that $91.2 million market-growth sky rocketed to 1,556 percent.

Clearly, consumers are turning to high-CBD products, brands are responding, and the trend continues to rise.