Do You Know Your Plant Nutrition?

Despite the serious implications that optimal (or sub-optimal) nutrition can have on cannabis crops, the lack of academic research to substantiate or refute commercial cultivators’ nutrient practices, as well as the number of nutrient options and combinations available today—just 2% of cultivators who participated in CBT’s research said they are “not knowledgeable” about the nutritional needs of their crops.

Most cultivators said they are either “very knowledgeable” (36%) or “knowledgeable” (44%). Eighteen percent said they are “somewhat knowledgeable.”

What Do You Expect From Nutrients?

When it comes to what cultivators expect of their nutrient strategies, two traits reigned supreme. Nearly two-thirds (64%) of cultivators who participated in CBT’s research said yield size and terpene development were what they look for nutrients to impact most significantly.

Less than 10% said cannabinoid potency, and 7% said resistance to stressors. Twenty percent said “other,” and of those, 63% commented that yield, terpene development, potency and resistance to stressors were all equally important in regard to what they expect their nutrient programs to impact most. The overall health of the plant was noted by a number of respondents as the overall goal and priority—everything else is considered secondary.

Nutrients: Premixed or Proprietary

One area that stands out as a commonality among cultivators is the use of premixed nutrients. More than three-fourths of research respondents said premixed nutrient lines are part of their nutrient strategy: 37% use one or more premixed nutrient lines, and 39% use a combination of premixed nutrient lines and a proprietary “homemade” mixture.

When it comes to using premixed nutrient lines, the largest number of cultivators (44%) said they use more than two brands in their gardens. (As we learned from many participants’ comments—some combine brands, some use different brands for various growth stages, and others compare brand performance—until they find their holy grail of nutrients.) Twelve percent said they use one brand for a base nutrient and one brand for supplements. On the other hand, 19% said they use just one brand of premixed nutrient solutions.

Nutrient Selection Priorities

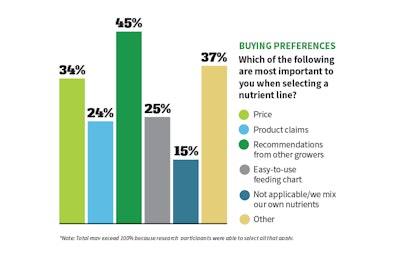

When shopping for nutrient lines, what are cultivators’ top motivators for buying? The largest number of respondents is driven by faith in their peers’ input—45% of research participants said that recommendations from other growers is a top priority when selecting a nutrient line.

Thirty-four percent said price was one of the most important factors in selecting a nutrient product line.

A sizable number (37%) of growers noted other top priorities for product selection. About a quarter of those said that whether or not a nutrient line or product is organic is among their top priorities, if not their No. 1 priority. Others prioritized source information and analysis of ingredients. Some said they want certificates of analysis (documents showing and certifying third-party test results). Another top response among those selecting “other” factors that are most important to them in selecting a nutrient line was results/performance.

Sam Thoman, chief of business development at Strawberry Fields in Pueblo, Colo., explained that comparison testing is a primary motivator in the company’s nutrient line selection. “We will always compare the current nutrient line we’re utilizing in a side-by-side test study with the nutrient line we are testing,” Thoman said. “If the nutrient line we are testing does a better job in production than the one we are using, and the price is comparable, then we will make a switch [to] the new nutrient line.”

Austin Sims, assistant operations manager for Colorado-based Americanna, agreed. “Price and proof,” he said. “I’ll give something a head-to-head [comparison] with what we currently do, [and] if it’s better, we scale up until we eventually switch.”

Supplemental Strategies

Many, if not most growers have their own techniques that they believe to be the best. That sentiment may stem, at least in part, from the fact that what works in one grow environment may not work in another. And what works for one cultivar may not work for another. However, another area where the clear majority of cultivators seems to be in agreement is in the use of nutrient supplements. More than three-fourths of growers who participated in CBT’s research said they use a nutritional supplement in addition to a base nutrient.

Some research participants noted that they use all organic amendments. Others said they use a relatively straightforward calcium-magnesium supplement strategy. Other supplements growers noted include:

- compost

- worm castings

- bokashi and other ferments

- rock dusts

- organic residuals

- molasses

- sweeteners (in final phase)

- ammonium sulfate

- iron

- silica

- inoculants

- bloom enhancers

- kelp

- probiotic teas

- guano

- frass (insect excrements or debris)

- humic/fulvic acid

- calcium chloride

- potassium silicate

- algae water added “to a 20-20-20 mix”

- zinc

The key to nutrient-supplement application for some is adding the right supplements at the appropriate growth stage or health status. This is where careful tending of crops and even individual plants comes into play.

“We use seasonal/weather/plant-stage-specific nutrients, root drenches, teas, foliar sprays, which have some basics, but [we] vary [nutrient application] if there is ever a deficiency,” commented one research participant who wished not to be named.

“It’s kind of trial and error,” commented another cultivator who wished to remain anonymous. “You have an idea of what works, but the plant will show you what it needs if you pay attention. Sometimes adjustments need to be made.”

Measuring pH and PPM

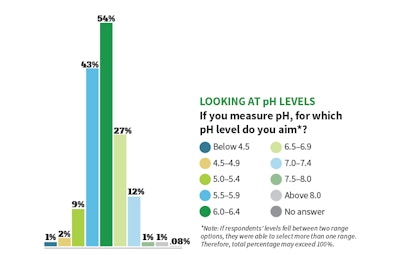

When it comes to measuring media’s acidity, most growers seem aligned: Eighty-five percent of research participants said they measure pH.

Measuring pH is more than just a good idea, suggested Mark June-Wells, Ph.D., principal owner of Sativum Consulting Group, a consulting company specializing in cultivation, supercritical CO2 extraction, product development and analytical testing. “Plant nutrition is dependent on the availability of nutrients in your growth media or hydroponic solution. The relative concentration of hydrogen ions (aka pH) can determine what interactions are occurring ...,” he said.

“For example ... the essential metal iron decreases in solubility by 1,000-fold for each pH-unit increase—becoming, for all intents and purposes, unavailable above a pH of 8.0 standard units (SU),” added June-Wells.

“Another example ... is a plant’s preference for specific ionic species of phosphorus. Plant’s roots show a preference for the dihydrogen phosphate ion compared to other acidic phosphorus species; dihydrogen phosphate is the principal species with the pH range of 2.1 and 7.2. ... [This shows] it is necessary to balance ... pH to ensure all nutrients are available to your plants,” he stressed.

As for optimum pH levels, respondents indicated that they aim for anywhere from below 4.5 to above 8.0. However, the largest percentage of cultivators aim for a pH level between 5.5 and 6.9.

This range is in line with what experts suggest. “Most researchers agree that media/solution pH should be maintained between 5.5 and 7.0 to ensure the widest spectrum of nutrients are in solution for the plant to access,” June-Wells said.

Testing pH range is important, but testing frequency is as well, he said. “Media pH should be tested weekly ... while hydroponic solution should be tested [daily]—because plant metabolism and other microorganisms can shift the pH of the less-buffered hydroponic solution—to minimize nutrient issues.”

When it comes to checking individual nutrient concentration in parts per million (ppm), cultivators are split: Slightly more than half (53%) measure ppm, while nearly half (47%) do not.

Off the Charts

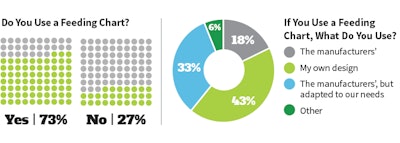

When it comes to getting help with nutrient usage, a tool cultivators frequently turn to is the feeding chart. Nearly three-fourths of research participants said they use a feeding chart to help them stay on schedule and on target with nutrient application.

While more than half (51%) of respondents said they use the manufacturer’s feeding charts, 33 percent of respondents adapt the manufacturer’s chart to their specific needs. Forty-three percent use a feeding chart of their own design.